You know the thrill—you’ve just booked the trip, your mind’s already wandering to cobblestone streets, exotic dishes, and sunsets that could make poets cry. But here’s the gut punch: if your finances aren’t planned right, that dream vacation can quickly turn into a financial hangover.

Traveling isn’t just about tossing clothes in a bag and hopping on a plane. It’s about travel budgeting that matches your wanderlust. And trust me, skipping this step is like running a marathon without shoes—you’ll regret it halfway through. A dream vacation without a budget is nothing more than a wish (Antoine de Saint-Exupery nailed it).

But don’t worry—I’m not here to kill your wanderlust. I’m here to make sure you can actually afford it. With a smart approach to managing travel expenses efficiently and mastering travel cost management, your adventures can be both breathtaking and bank-account-friendly.

In this guide, we’ll unpack the reality of current travel spending trends, the role of inflation in travel spending, and even how demographics shape travel habits. The goal? You come home rich in stories, not broke in savings.

So, fasten your seatbelt. Let’s dive into travel planning the right way—where your budget is your passport to freedom, not your ball and chain.

Understanding Current Travel Spending Trends

Travel spending isn’t random—it’s a pattern, a rhythm, a mirror of human behavior mixed with market realities. One season, it’s family trips and festive cheer; another, it’s executives chasing quarterly goals across continents. To manage travel costs well, you need to see the trends clearly.

Let’s break down what’s shaping current travel spending trends—from holiday season travel expenditure to the rising costs of airfares, lodging, meals, and rental cars, plus what it all means for your personal and business travel budgeting.

Holiday Season Travel Expenditure

The holidays aren’t just about lights, food, and family—they’re also a financial storm waiting to happen. Every December, wallets open wide as millions set out on their dream vacations. Numbers don’t lie: in the U.S. alone, half of all travelers plan to spend an average of $1,946.50 on flights and hotels during the holiday season. That’s not pocket change—it’s a major financial commitment.

For individuals, this highlights the need for travel budgeting habits that go beyond “hope for the best.” For businesses, it means factoring in seasonal spikes when setting corporate travel budgeting strategies.

Rising Costs and Demand

Here’s the kicker: travel expenses rose 22% in 2023 compared to 2022. Costs are climbing—but so is demand. Travelers haven’t slowed down; they’ve leaned in. This tug-of-war between rising prices and unshaken wanderlust is one of the most defining travel expense trends of our time.

If you’re a family traveler, this means your next trip may cost more than you expect. If you’re a finance manager, it means business trip expenses need sharper oversight. Either way, ignoring this trend is like ignoring a warning light on your dashboard.

Projected Business Travel Spending

Let’s talk scale. By the end of 2023, global business travel spending is projected to hit $1.4 trillion. That’s trillion—with a “T.” It underscores how indispensable business travel remains, not just for sales calls or conferences but as fuel for global growth and collaboration.

For finance leaders, this means building airtight systems for managing business travel expenses and ensuring compliance. For employees, it’s a reminder that company-paid trips are big business—so they come with big responsibility.

Average Trip Cost

The average trip cost has jumped significantly. In 2023, travelers shelled out $6,587 per trip—nearly $1,000 more than in 2022. That’s a serious uptick.

For individuals, this means rethinking travel budgeting habits to avoid coming home with more debt than memories. For businesses, it means tighter approval workflows and better corporate travel budgeting to control rising costs.

Increased Costs of Airfares, Lodging, Meals, and Rental Cars

Let’s get specific: prices for airfares, lodging, meals, and rental cars have climbed by roughly 16% overall. Since these categories make up the lion’s share of any travel bill, the hike feels unavoidable.

This is where both individuals and companies can get strategic. Think smarter bookings, loyalty programs, negotiated vendor contracts, and leveraging expense management tools to track and curb overspending.

The Bottom Line

Travel remains irresistible—whether it’s the lure of a holiday getaway or the necessity of a business trip. But understanding travel spending trends is non-negotiable if you want to travel smarter, not poorer.

For individuals, it’s about protecting your wallet. For businesses, it’s about turning insight into strategic travel and expense policies. Either way, the message is the same: don’t just go with the flow. Plan with eyes wide open, and let the numbers guide your next adventure.

Travel Budgeting Habits and Predictions

When it comes to travel, people don’t just pack bags—they pack budgets. Whether it’s a week at the beach, a quick business trip, or saving up for that dream adventure, travel budgeting habits reveal how travelers balance wanderlust with wallet realities. Let’s unpack the numbers shaping both today’s costs and tomorrow’s predictions.

Domestic Vacation Costs

Think “staycation” and you might picture saving money—but that’s not always the case. In 2023, the average domestic vacation cost clocks in at $283 per person per day, which adds up to about $1,584 for a week-long getaway. That’s a significant investment for a “local” escape. The message is clear: travelers are prioritizing quality experiences over cheap ones, stretching their budgets to make even nearby trips memorable.

Travel Plans for 2025

Here’s a trend worth watching: 91% of travelers plan to stay domestic in 2025. But it’s not about playing it safe—it’s about playing it bigger. Nearly 40% of travelers say they’ll travel more in 2025 than they did in 2024. That’s not just wanderlust—it’s a signal that local exploration is booming and shaping the future of travel.

Average Business Trip Costs

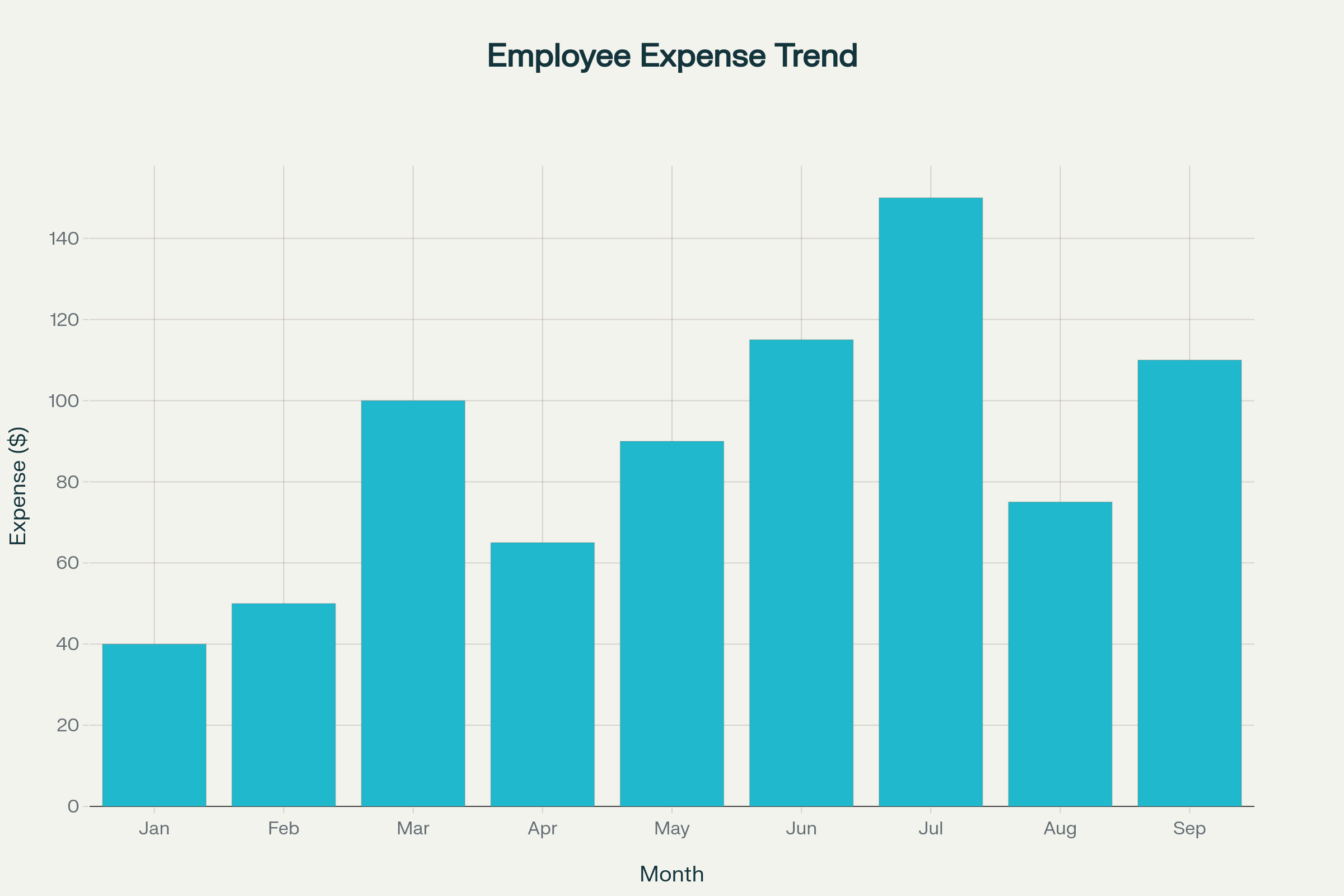

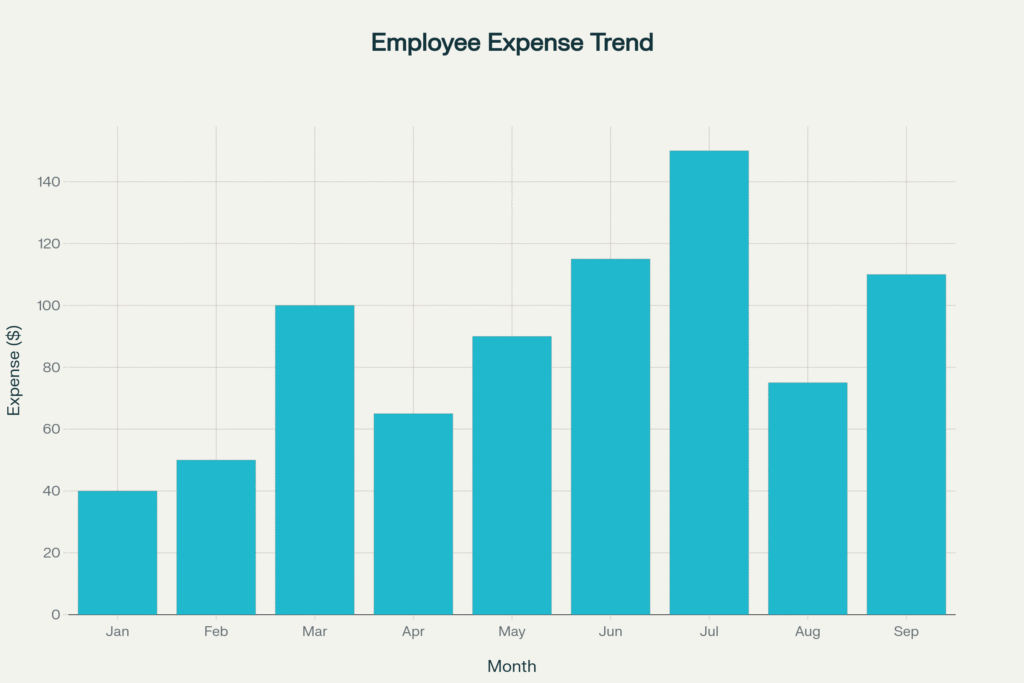

As we shift gears to the professional landscape, the conversation on travel budgeting habits would not be complete without touching on business trips’ expenses. To explore this in greater detail, consider insights shared in this section about Efficient Travel Planning.

Anticipated Spending Changes

With the enthusiasm for travel palpable, it’s no surprise that 26% of leisure travelers are getting ready to break the bank in 2023, planning to spend more than they did in 2022. The draw of new adventures and experiences seems to be outweighing economic prudence, reinforcing the saying that travel is indeed the only thing you buy that makes you richer.

Major Trip Savings

Lastly, an intriguing 66% of travelers are diligently squirreling away for that major trip they’ve been dreaming of in 2023. The idea of a grand adventure seems to be particularly appealing, with a remarkable 54% of these folks planning their trip 3-6 months in advance.

Travel Cost Management: Efficient Strategies for Smart Spending

Travel cost management is more than just setting a budget; it involves smart planning, tracking, and adjusting your expenses to optimize every dollar spent. Whether you’re budgeting for international travel or domestic getaways, applying structured travel expense tracking and daily travel expense tracking can revolutionize your experience.

Adjusting Daily Spending for Efficient Travel Planning

Making smart decisions with your money while on vacation can significantly enhance your travel experience. One effective way to handle your finances a dime at a time is by setting daily spending limits. It’s not just about budget control anymore; it’s an exciting game of resourcefulness and thrift. By monitoring and adjusting your daily expenses, you can enjoy a journey that is not financially draining, and instead, more enriching and fulfilling.

Financial conversations may sound dull or intimidating in a vacation setting, but trust us, they play a vital role in your travel satisfaction. Ever encountered the famous quote, “Travel is the only thing you buy that makes you richer?” Imagine making your travel experience not just mentally richer but also economically sound. Sounds fantastic, doesn’t it?

How to Start Spending Smart on Your Travels

Start with a General Budget: Before you embark on your adventure, decide on how much you’re willing to spend overall. This estimate should include transportation, accommodation, food, attractions, souvenirs, and unexpected expenses.

Break Down Your Budget into Daily Limits: Once you have your overall budget, it’s time to divide it up by your travel days. This will give you a basic figure to aim for every day.

Track Your Expenses: Keep an eye on your daily spending. There are countless travel budgeting apps available today that can make this task super easy and tech-savvy. Every penny counts!

Adjust According to Your Plan: Some days, you may plan to go to an expensive restaurant or visit a pricey attraction. On such occasions, balance your budget by spending less on other days.

Evaluate and Adjust: At the end of each day, review your expenditure. Did you overspend or underspend? Make the necessary adjustments for the next day. Your daily budget isn’t set in stone!

These are arguably the same principles underlying the interplay of budget control and performance in the corporate context, where judicious resource allocation can amplify the value achieved not just at an organizational level but in our case, at a personal level too.

In essence, setting daily spending limits lets you enjoy your vacation without financial stress. It morphs the ‘daily survival struggle’ into a rewarding challenge, leveling up your overall travel experience. Plus, the practice of budgeting and tracking expenditures hones your financial management skills, which as per this insightful article on Budget Control and Performance, is a key aspect of personal as well as corporate success.

To all the fellow globetrotters out there, it’s time to spice up your travel routine with these financial skills. Let’s turn every trip into a journey towards financial wisdom and make your travel memories not just fun-filled but also budget-friendly! Here’s to smarter spending!

The Impact of Inflation and Demographics on Travel Spending

Imagine a world where you can enjoy traveling, meet new people, indulge in exotic cuisines, thrive on an adrenaline rush from daring adventures, and capture breathtaking photos for your gram, all within your budget. Are you wondering how that’s possible given the impact of inflation on the economy? Well, it’s time to buckle up. This section unravels the intricate dynamics of inflation, demographics, and their effect on travel spending trends.

Increasing Travel Budgets

Inflation, a broad economic phenomenon, typically brings about a surge in the general price levels of goods and services. One of the sectors impacted by inflation significantly is the travel industry. But don’t let this dampen your spirits. Rather, see it as an opportunity.

According to a recent report, travel managers are foreseeing an average increase of around 9% in travel budgets in the second half of 2023. This implication of this forecast is twofold. It signifies that organizations are becoming adaptive and adopting newer strategies to tackle inflation. On the flip side, it also indicates that travelers need to plan meticulously and inject financial flexibility into their travel budgets.

If managing this increased budget seems like a daunting task, count on efficient methods to streamline business travel expenses. This tactic ensures that you monitor your spending judiciously and enjoy your travels without any financial stress.

Domestic Business Travel Bookings

Despite the rise in prices, the spirit of travel has remained undeterred. This resilience is evident in the strong recovery signs shown by domestic business travel bookings, which stood at a healthy 76% in November 2023. This indicates the industry’s emergence from the sluggish period and provides optimism for both travelers and industry stakeholders about the industry’s robust recovery.

Millennials’ Impact on Travel Spending

Millennials are no longer just setting the trends for avocado toast or flexitarian diets; they’re influencing significant trends in the travel industry too. Millennials are leading the way in planned travel spending increases, making them a lucrative market segment for the travel industry. These digital natives are shaking up the industry, prioritizing experiences over stuff, seeking sustainable travel options, and using technology to plan their trips smarter.

Understanding and capitalizing on the changing travel behaviors of this demographic segment can prove game-changing for businesses in the travel industry. It’s not just about adapting to inflation but about adopting strategies that align with the preferences of emerging dominant market segments.

In light of the above insights, it’s clear that while inflation and changing demographics are indeed presenting challenges to the travel industry, these challenges are also opening up fresh avenues for transformation and growth. Travel lovers, businesses, and industry stakeholders — it’s time to embrace the changes, adapt, innovate, and set sail into a dynamic, evolving era of travel!

Conclusion

Navigating the intricacies of efficient travel planning in light of fluctuating financial dynamics and spending habits is indeed an art form. But remember, staying abreast of trends and making smart, informed decisions can indisputably ease the process.

Key aspects such as understanding current travel spending trends, effective budgeting habits, adjusting daily spending, and acknowledging the impact of inflation and demographics can substantially optimize your travel expenses. Not only does this create room for a smoother journey, but it also encourages responsible personal finance management and robust financial planning.

Moreover, staying connected to a reliable source of financial advice and industry trends is paramount. Whether you’re a seasoned professional embarking on a business trip or a finance student planning a vacation, ensure that you continuously equip yourself with the latest finance insights.

To stay updated on various industry insights and helpful tips, consider regularly checking Ayyeah, your trusted finance blog. From travel expense management to broader topics like corporate finance strategies, finance career growth tips, and accounting tips, Ayyeah offers an array of resources to handle the complexities of the finance world with ease.

So embark on your next journey with confidence, all while keeping your finances in check. After all, efficient travel planning doesn’t necessarily mean cutting down on experiences. Instead, it’s about smart spending and making the most out of every dollar.

Happy and safe travels!

Frequently Asked Questions

What are some tips for managing travel expenses efficiently?

Some tips for managing travel expenses efficiently include creating a budget, researching and comparing prices, booking in advance, using travel rewards programs, keeping track of expenses, and using expense management apps.

How can I create a travel budget?

To create a travel budget, determine your total trip cost, including transportation, accommodation, meals, activities, and miscellaneous expenses. Allocate a specific amount for each category and stick to it. Be sure to leave room for unexpected expenses as well.

What are some ways to save money on transportation while traveling?

To save money on transportation, consider booking flights or train tickets in advance, being flexible with travel dates, using public transportation instead of taxis, and considering alternative modes of transportation like buses or car-sharing services.

Are there any tools or apps to help manage travel expenses?

Yes, there are several tools and apps available to help manage travel expenses. Some popular options include Expensify, TripIt, Mint, Splitwise, and Trail Wallet. These apps allow you to track expenses, create budgets, and generate expense reports.

How can I track expenses while traveling?

To track expenses while traveling, keep all receipts and record them in a notebook or use expense tracking apps. Categorize expenses by different cost categories and review your spending regularly to stay within your budget.