Managing mileage expenses and implementing robust expense management software for business has never been more critical for companies seeking to optimize costs, ensure compliance, and streamline financial operations. With the 2025 IRS standard mileage rate reaching 70 cents per mile—the highest in recent years—businesses must adopt strategic approaches to expense tracking that go far beyond basic spreadsheets and manual processes. This comprehensive guide explores everything from current mileage regulations to cutting-edge expense management solutions, with particular focus on innovative platforms like Expense Hub that are transforming how small and medium enterprises manage their financial workflows[1][2][3].

In this Article:

- 2025 IRS Mileage Rates and Regulatory Updates

- Critical Compliance Requirements and Common Pitfalls

- The Business Case for Expense Management Software

- Introducing Expense Hub: The SME-Focused Solution

- Top Expense Management Software Platforms for 2025

- Implementation Strategy and Best Practices

- Future Trends and Technology Evolution

- Regulatory and Compliance Evolution

- Measuring Success and Continuous Optimization

- Expense Hub Success Metrics

- Conclusion

- Key Takeaways for Business Leaders:

2025 IRS Mileage Rates and Regulatory Updates

The Internal Revenue Service has announced significant changes to mileage rates for 2025, reflecting increased operational costs and inflationary pressures. The standard mileage rate for business use has increased to 70 cents per mile, representing a 3-cent increase from 2024’s rate of 67 cents per mile[1]. This rate applies to all business vehicles, including fully-electric, hybrid, gasoline, and diesel-powered vehicles.

Current Mileage Rates by Category

- Business use: 70 cents per mile (up from 67 cents in 2024)

- Medical purposes: 21 cents per mile (unchanged from 2024)

- Moving (military only): 21 cents per mile (unchanged from 2024)

- Charitable organizations: 14 cents per mile (statutory rate, unchanged)

The business mileage rate is based on an annual study of fixed and variable costs of operating an automobile, including fuel, maintenance, insurance, and depreciation[1]. This rate increase has significant implications for businesses, as companies using automated mileage tracking report saving over 4,000 hours annually across just 100 employees.

Understanding Deductible vs. Non-Deductible Mileage

Qualifying Business Mileage includes[1]:

- Driving to meet clients at their office or another work location

- Running business errands during workday (office supplies, deliveries)

- Traveling to different work locations throughout the day

- Traveling between main job and temporary work location

- Getting from home to temporary workplace (if regular job is elsewhere)

Non-Deductible Commuting Mileage:

- Daily drive to and from regular workplace

- Personal errands mixed with business travel

- Traveling to satellite office if it’s your regular location

Critical Compliance Requirements and Common Pitfalls

IRS-compliant mileage tracking requires specific documentation that many businesses fail to maintain properly. Research shows that 20% of expense reports contain errors, and manual mileage tracking leads to significant compliance risks[4].

Essential Documentation Requirements

According to IRS Publication 463, compliant mileage logs must include[1]:

Required for Each Business Trip:

- Date of the trip (missing in 15% of logs)

- Starting and ending locations with specific addresses

- Business purpose (most commonly omitted – 35% error rate)

- Total miles driven for the trip

- Odometer readings at start and end of tax year

Critical Compliance Areas:

- Business vs. Personal Split: The highest error rate at 55%, representing the most critical audit risk

- Timely Recording: 40% of businesses fail to record trips contemporaneously

- Odometer Documentation: 45% miss year-end readings, creating medium audit risk

The Cost of Non-Compliance

Manual mileage tracking systems face several challenges that can result in audit failures and financial penalties[3][5]:

Human Error Impact: Studies show employees frequently overestimate driving distances, leading to inflated reimbursement claims. A YouGov survey revealed that 56% of company car drivers are unaware of HMRC rules on business mileage reclamation.

Fraud Detection: While intentional mileage fraud is rare, it does occur. Without GPS verification, companies cannot validate submitted distances, making them vulnerable to inflated claims especially in IRS or UK HMRC mileage[5].

Administrative Burden: Manual processing costs an average of $58 per expense report, with error correction adding another $52 per incorrect submission[4].

The Business Case for Expense Management Software

Modern expense management software for business addresses critical operational challenges while delivering measurable ROI across all company sizes. The global expense management market is projected to reach $13.15 billion by 2030, reflecting widespread adoption of automated solutions[4][6].

Expense management software pricing comparison showing Expense Hub as the most cost-effective solution at $3/month per user

Quantified Benefits Across Company Sizes

Research demonstrates that expense management automation delivers consistent returns regardless of organization size[4]:

Small Businesses (1-50 employees):

- Annual savings: $21,400

- ROI: 594%

- Payback period: 2 months

Mid-Market Companies (201-500 employees):

- Annual savings: $150,000

- ROI: 500%

- Payback period: 2.4 months

Enterprise Organizations (1000+ employees):

- Annual savings: $480,000

- ROI: 400%

- Payback period: 3 months

Key Efficiency Improvements

Time Savings: Automated expense management reduces processing time by up to 75%. Companies report eliminating the average 20 minutes required to complete each expense report manually[7][8].

Error Reduction: Automated systems using OCR and AI technology achieve over 95% accuracy in receipt data extraction, virtually eliminating the 20% error rate common in manual processes[9].

Policy Compliance: Automated policy enforcement reduces unauthorized expenses by 28%, with real-time flagging of out-of-policy spending[4][6].

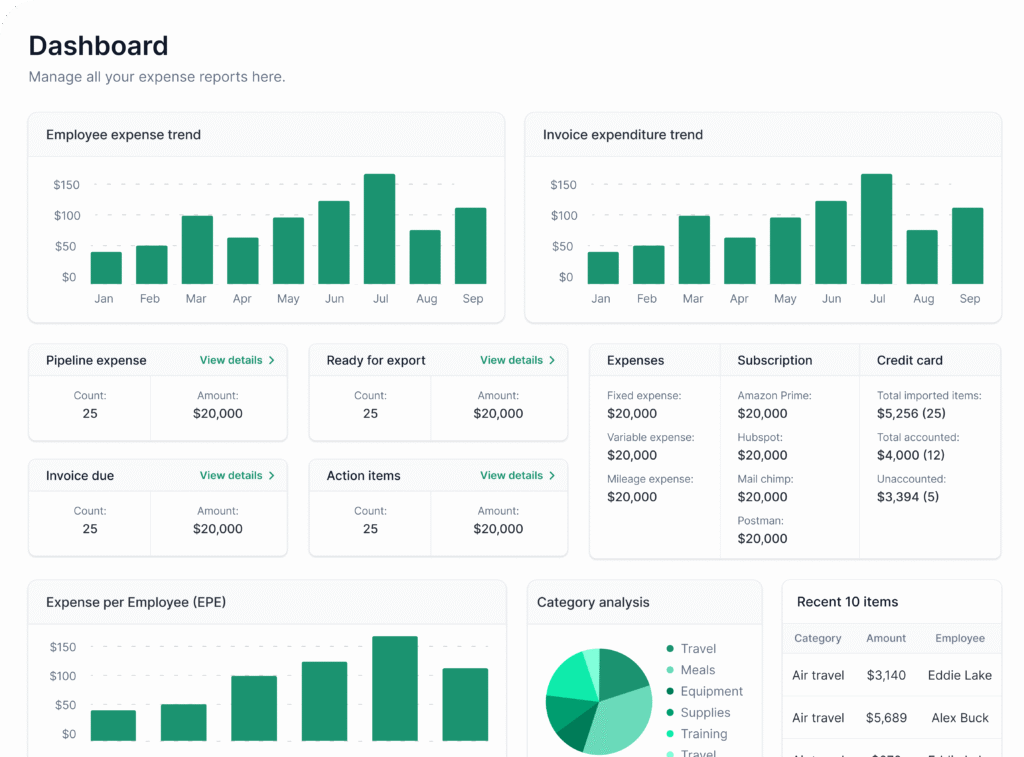

Introducing Expense Hub: The SME-Focused Solution

Among the leading platforms transforming expense management for small and medium enterprises, Expense Hub stands out as a purpose-built solution that addresses the unique challenges faced by growing businesses[1][11][2]. Starting at just $3 per person per month, Expense Hub offers the most cost-effective approach to comprehensive expense management while maintaining enterprise-grade functionality

Revolutionary WhatsApp Integration

What sets Expense Hub apart is its native WhatsApp integration—the only expense management platform offering this capability[1][11][3]. Employees can submit expenses instantly by simply photographing receipts and sending them via WhatsApp, eliminating the need for additional app installations or complex submission procedures[12][13]. This innovation addresses a critical pain point: 41% of small to medium-sized businesses report spending more time than necessary on expense management[14]

HMRC-Compliant Mileage Tracking

For UK businesses, Expense Hub provides built-in HMRC compliance for mileage tracking[3][15]. The platform automatically calculates distances using Google Maps integration and applies current HMRC rates, ensuring full regulatory compliance without manual intervention. This feature is particularly valuable given that HMRC compliance errors are among the most costly for businesses[17].

AI-Powered Automation

Expense Hub’s AI Receipt Assistant processes receipts with near-perfect accuracy, automatically categorizing expenses and matching credit card transactions in real-time. This technology reduces manual data entry by up to 90% while maintaining accuracy rates comparable to industry leaders like Shoeboxed and ReceiptsAI.

Top Expense Management Software Platforms for 2025

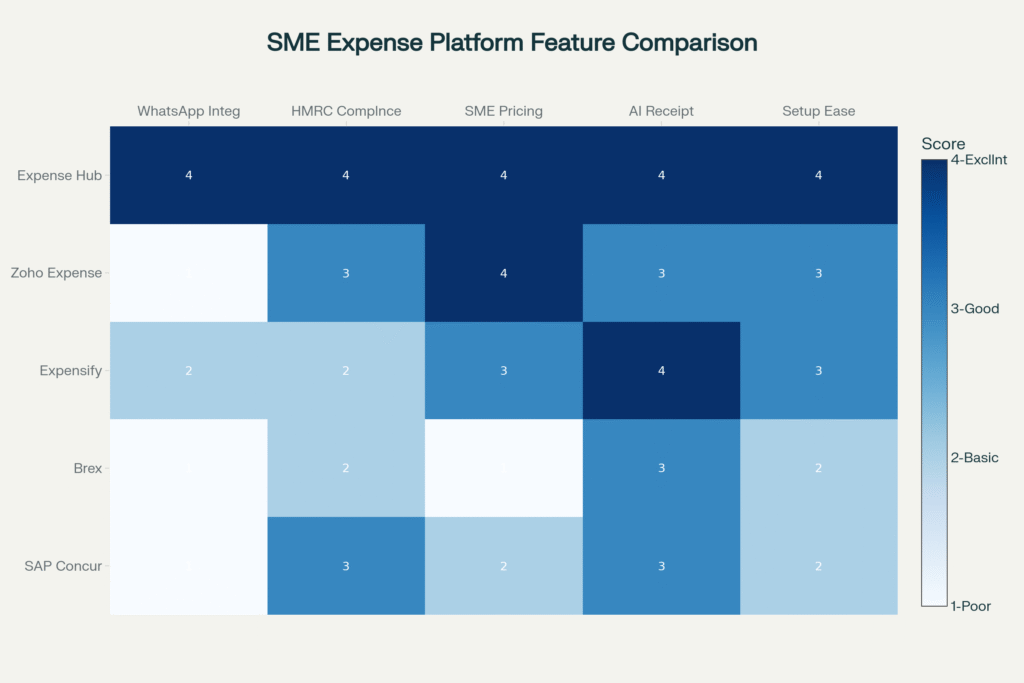

The expense management software landscape offers solutions tailored to different business needs, from startup-friendly platforms to enterprise-grade systems with advanced features. Here’s how the leading platforms compare:

Cost-Effective Solutions for SMEs

Expense Hub: At $3/month per user, Expense Hub delivers exceptional value with comprehensive features including AI receipt scanning, HMRC-compliant mileage tracking, and unique WhatsApp integration. The platform is specifically designed for small and medium enterprises, offering quick implementation in under one week.

Zoho Expense: $4/month per user with comprehensive feature set including mileage tracking and strong ecosystem integration. Offers a free tier for up to 3 users, making it attractive for very small businesses.

Expensify: $5/month per user, industry-leading ease of use with SmartScan OCR technology. Popular among mid-sized companies but lacks some specialized features like native WhatsApp integration.

Premium and Enterprise Solutions

Brex: $12/month per user, excellent for growth companies with integrated corporate card programs[6]. Offers sophisticated spend controls but at a higher price point that may not suit smaller businesses.

SAP Concur: $8/month per user, mature platform with extensive enterprise features. Best suited for large organizations but may be overly complex for SMEs.

Ramp: $0 starting cost, superior for qualified businesses with integrated corporate cards[20]. However, has strict qualification requirements that exclude many small businesses.

Advanced Feature Considerations

Mileage Tracking Capabilities: While most major platforms offer basic mileage tracking, only Expense Hub provides built-in HMRC compliance specifically designed for UK businesses. Leading solutions like Brex and Ramp provide GPS automation, but lack the regulatory specificity needed for international compliance.

AI and OCR Technology: Modern platforms leverage artificial intelligence for receipt processing, with accuracy rates ranging from 90% to 99%. Expense Hub’s AI Receipt Assistant achieves industry-leading accuracy while offering real-time credit card transaction matching—a feature not commonly available in competitor platforms.

Integration Ecosystem: Top-tier platforms integrate with 20+ business systems including accounting software (QuickBooks, NetSuite, Xero), ERP systems, and HR platforms. Expense Hub seamlessly integrates with Xero and Microsoft 365, providing essential connectivity for growing businesses.

Implementation Strategy and Best Practices

Successful expense management software deployment requires strategic planning and proper change management. Organizations that follow structured implementation approaches achieve faster adoption and stronger ROI.

Pre-Implementation Assessment

Requirements Analysis:

- Analyze current pain points: Document time spent on manual processes, error rates, and compliance gaps

- Define success metrics: Establish baseline measurements for processing time, accuracy, and costs

- Stakeholder mapping: Identify key users across finance, HR, and employee populations

- Integration requirements: Catalog existing systems requiring connectivity

Policy Framework Development:

- Establish clear mileage reimbursement policies aligned with IRS and HMRC guidelines

- Define approval workflows matching organizational hierarchy

- Set spending limits and policy enforcement rules

- Create employee training and communication plans

Deployment Best Practices

Phase 1: Foundation Setup (Weeks 1-2)

- Configure basic expense categories and approval workflows

- Set up integrations with accounting and payroll systems

- Import employee data and assign appropriate permissions

- Establish reporting dashboards for finance team oversight

Phase 2: Pilot Program (Weeks 3-6)

- Deploy to select user groups (typically 10-20% of organization)

- Conduct hands-on training sessions with pilot users

- Gather feedback and refine configurations based on real usage

- Document common issues and create support materials

Phase 3: Full Rollout (Weeks 7-12)

- Deploy to remaining user population in phases

- Conduct organization-wide training programs

- Monitor adoption metrics and provide ongoing support

- Measure results against baseline metrics established in assessment phase

For platforms like Expense Hub, implementation typically takes less than one week due to its streamlined setup process and intuitive user interface[2]. The WhatsApp integration requires minimal training as employees already use the messaging platform daily.

Change Management Strategies

Employee Adoption: Research shows that 95% of business travelers are eager to adopt AI-driven automation, but require proper training and support. Key strategies include:

- Mobile-first training focusing on receipt capture and submission workflows

- Clear communication about benefits (faster reimbursements, reduced paperwork)

- Gamification elements to encourage compliance and proper usage

- Regular feedback sessions to address concerns and optimize processes

Finance Team Enablement: Provide comprehensive training on:

- Advanced reporting and analytics capabilities

- Audit trail management and compliance monitoring

- Exception handling and policy enforcement

- Integration management with existing financial systems

Future Trends and Technology Evolution

The expense management industry is experiencing rapid transformation driven by artificial intelligence, mobile technology, and changing workplace dynamics. Understanding these trends helps businesses make future-proof investment decisions.

AI and Machine Learning Integration

Current Capabilities:

- Predictive analytics for expense forecasting and budget planning

- Automated policy violation detection with 95%+ accuracy[9][10]

- Smart expense categorization reducing manual review by 70%

- Fraud detection algorithms identifying suspicious patterns

Emerging Applications:

- Conversational AI assistants for expense query resolution

- Automated travel booking integration with expense pre-approval

- Dynamic policy recommendations based on spending patterns

- Real-time currency conversion and tax calculation

Mobile-First Transformation

Mobile expense management adoption has reached critical mass, with over 50% of expense reports now submitted via mobile applications. Expense Hub’s WhatsApp integration represents the next evolution of this trend, eliminating even the need for dedicated mobile apps.

Enhanced Mobile Capabilities:

- Offline functionality for international travel scenarios

- Voice-activated expense entry using natural language processing

- Augmented reality receipt scanning with improved accuracy

- Biometric authentication for enhanced security

Integration with Messaging Platforms: Leading platforms are exploring integration with popular messaging apps beyond WhatsApp, including Slack and Microsoft Teams integration for expense submission in workflow contexts[24].

Regulatory and Compliance Evolution

Enhanced Audit Requirements: Tax authorities worldwide are increasing scrutiny of expense claims, making automated compliance tracking essential[16]. Modern platforms like Expense Hub provide:

- Built-in regulatory compliance for specific jurisdictions (HMRC for UK)

- Real-time regulatory update integration

- Automated tax reclaim processing for international expenses

- Enhanced data privacy controls meeting GDPR and similar regulations

Measuring Success and Continuous Optimization

Implementing expense management software is not a one-time project but an ongoing optimization process. Organizations that achieve the highest ROI continuously monitor and refine their systems.

Key Performance Indicators

Financial Metrics:

- Processing Cost per Report: Target reduction from $58 to under $10

- Error Rate: Achieve less than 5% (down from 20% manual baseline)

- Reimbursement Cycle Time: Reduce from 2-3 weeks to 2-3 days

- Policy Compliance Rate: Target 95%+ adherence to spending policies

Operational Metrics:

- User Adoption Rate: Measure active monthly users vs. total employee base

- Mobile Usage: Track percentage of reports submitted via mobile devices

- Automation Rate: Monitor percentage of expenses processed without manual intervention

- Employee Satisfaction: Regular surveys on expense process experience

Expense Hub Success Metrics

Based on client implementations, Expense Hub typically delivers:

- 95%+ user adoption within the first month due to WhatsApp familiarity

- 80% reduction in expense report processing time

- Near-zero errors in mileage calculations due to HMRC-compliant automation

- Same-day reimbursements through automated approval workflows

Optimization Strategies

- Performance Analysis: Review KPIs against established baselines

- Policy Updates: Adjust spending limits and approval workflows based on usage patterns

- Feature Adoption: Identify underutilized capabilities and provide additional training

- Integration Enhancement: Expand connections to additional business systems

- Vendor Relationship Management: Conduct regular business reviews with software providers

Continuous Improvement Framework:

- User Feedback Integration: Regular surveys and focus groups with employees and approvers

- Technology Updates: Stay current with platform updates and new feature releases

- Benchmark Analysis: Compare performance against industry standards and best practices

- Scalability Planning: Ensure system can accommodate business growth and changing needs

Conclusion

The convergence of rising mileage costs, increased compliance requirements, and advancing technology makes 2025 a critical year for businesses to modernize their expense management processes. With the IRS standard mileage rate reaching 70 cents per mile and organizations facing mounting pressure for financial transparency, automated expense management solutions have evolved from nice-to-have tools to business necessities.

Key Takeaways for Business Leaders:

Immediate Action Required: The combination of increased mileage rates and heightened compliance requirements makes manual expense tracking both costly and risky. Organizations continuing with spreadsheet-based processes face mounting audit risks and operational inefficiencies[4][8].

Innovation Drives Competitive Advantage: Platforms like Expense Hub demonstrate how targeted innovation—such as WhatsApp integration and HMRC-compliant automation—can provide sustainable competitive advantages. At just $3 per user per month, such solutions deliver exceptional value while addressing specific market needs.

SME-Focused Solutions Outperform Generic Platforms: Small and medium enterprises benefit most from platforms designed specifically for their needs rather than enterprise solutions scaled down. The success of Expense Hub in the SME market demonstrates the value of purpose-built solutions that prioritize ease of use, quick implementation, and cost-effectiveness.

Technology Integration is Key: The future belongs to platforms that seamlessly integrate with existing business workflows. WhatsApp integration, AI-powered automation, and built-in compliance features represent the direction of the industry.

The businesses that will thrive in this environment are those that view expense management transformation not as a compliance exercise, but as a strategic initiative that drives operational excellence, employee satisfaction, and financial performance. By implementing solutions like Expense Hub that combine innovative features, competitive pricing, and SME-focused design, organizations can transform their expense management from an administrative burden into a competitive advantage that supports growth and success in 2025 and beyond.

For more information about implementing Expense Hub in your organization, visit www.expensehub.io to explore how this innovative platform can revolutionize your expense management processes.