Understanding Expense Management Software: A Guide for UK Businesses

Estimated reading time: 12 minutes

Key Takeaways

- Expense management software streamlines financial workflows, enforces compliance, and improves real-time visibility.

- Expense Hub offers automated receipt capture, strong policy enforcement, and deep integrations for UK businesses.

- Choosing the right software depends on your company size, industry, and need for scalability, usability, and compliance features.

- Cloud-based solutions are preferred by most UK firms due to accessibility, speed, and integration benefits.

Table of Contents

The Importance of Effective Expense Management

Why Managing Expenses Is Crucial for UK Businesses

Expense management is at the heart of sustainable business growth.

Without strategic oversight, expense-related errors and inefficiencies can result in financial leakage, non-compliance with HMRC standards, and operational delays. Switching to digital solutions reduces human error and ensures regulatory alignment.

Explore more insights in our guide on Mastering Expense Management: A Finance Manager’s Guide.

How Expense Hub Solves Expense Management Headaches

- *Full automation* of tracking and policy checks.

- Real-time dashboards to detect anomalies early.

- Built-in policy enforcement for audit-readiness.

Learn more in our post on Understanding Compliance in Expense Management.

Overview of Expense Management Software Features

Real-Time Expense Tracking: Always Know Where Your Money’s Going

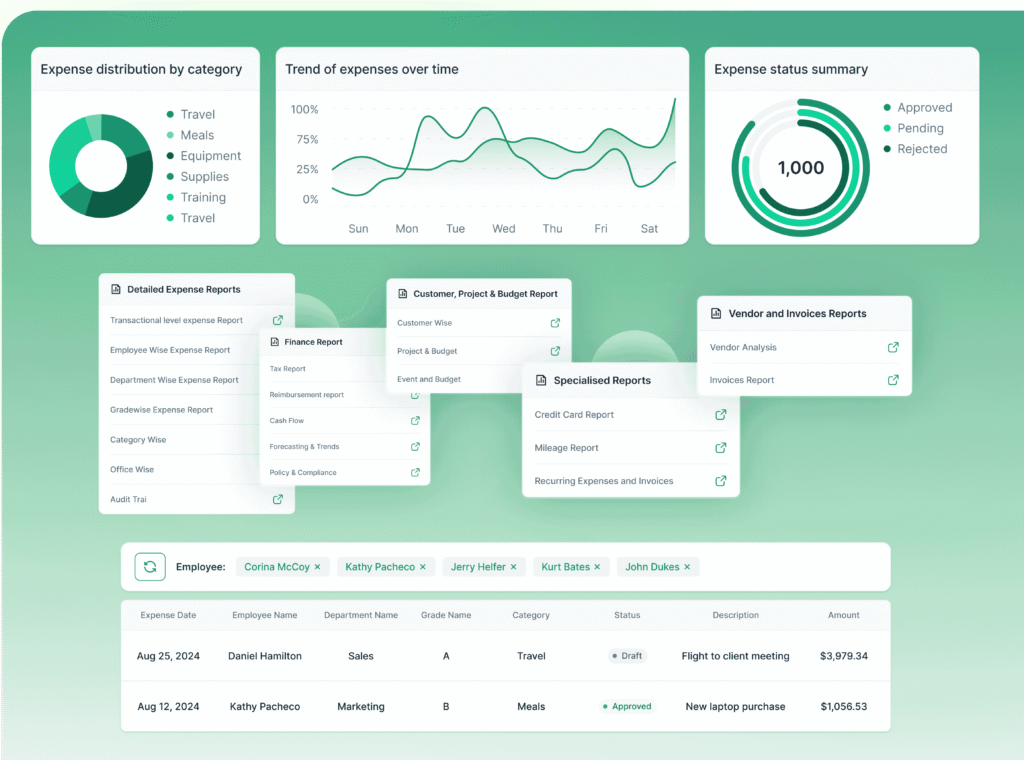

Modern platforms like Expense Hub help businesses move from reactive to proactive management. With real-time analytics, finance professionals can respond instantly to unexpected spending.

Dive deeper into expense tracking in our article Need for Speed: How to Track and Analyze Expenses Faster.

Automated Receipt Capture: End Paperwork Woes

Snap, sync, and submit. Receipt data is digitised instantly using OCR technology within the Expense Hub mobile app.

This mirrors trends reported by Emburse and others. Explore further tools in our guide on Maximize Efficiency with the Best Expense Tracking Tools 2025.

Compliance and Policy Enforcement: Stop Rule Breaking at the Source

Set mile limits, restrict categories, and flag duplicates—automatically.

Explore more in our article on Improve Expense, Finance Process & Reporting.

Enhancing Fraud Detection and Audit Trails

Audit logs and fraud detection algorithms surface anomalies for internal investigation. Learn more from our resource on what small businesses can and can’t claim in 2025.

Types of Expense Management Solutions

Web-Based (Cloud) vs. On-Premise Expense Solutions

Web-Based Expense Management Systems

Cloud platforms like Expense Hub dominate today’s UK market, offering flexibility and scalability backed by industry leaders like Rydoo and Asanify.

On-Premise Expense Systems

Suited for firms with niche security requirements, but often lack agility. For most, the cloud is both practical and future-ready. See more in The Role of Automation in the Modern Financial Analyst Toolkit.

Corporate vs. Small Business Expense Management Tools

Corporate Expense Management Software

Designed to handle high volumes, analytics, and global cost centers.

Small Business Expense Management Software

Expense Hub’s adaptive, user-first platform empowers growing firms. See the breakdown in Expense Software for Small Businesses.

Choosing the Right Expense Management Software

Integration with Existing Systems: The Heartbeat of Digital Finance

Platforms that sync with Xero, QuickBooks, and Sage ensure real-time data flow and accurate reporting. Read more at Xero vs Sage vs QuickBooks 2025.

Ease of Use and Training Needs: Empowering All Employees

Simplicity = adoption. Employees and managers alike need intuitive tools with support that scales.

Training and Onboarding Support

From live sessions to dedicated help desks, Expense Hub gets teams online quickly and painlessly.

Scalability and Futureproofing: Invest Once, Grow Forever

Expense Hub’s modular design supports evolving business needs without reimplementation nightmares.

Benefits of Implementing an Expense Management System

Cost Savings and Efficiency Gains

Manual tasks and error-prone processes are replaced with accurate, fast, and compliant workflows. See reviews from Rydoo and Emburse.

Improved Accuracy and Real-Time Financial Reporting

Expense Hub delivers granular insights through visual dashboards and contextual filtering. For deeper analysis guidance, visit Advanced Financial Reporting Techniques & Insights.

Enhanced Employee Satisfaction

Mobile-first platforms turn expense submission into a few taps—not a dreaded task. More on this in our guide to mileage and business expense software.

Strengthened Compliance and Risk Management

Stay ahead of audits and tax changes with platforms built to enforce policy at scale.

Conclusion

For UK organisations of all sizes, expense management software is no longer optional—it’s how resilient, efficient firms stay ahead. With tools like Expense Hub, your business gains the speed, accuracy, and control to drive sustainable financial growth.

Ready to transform your expense process? Discover Expense Hub and take control of company spend today.

FAQ

What is expense management software?

It’s a digital solution that automates how companies submit, approve, monitor, and analyse business spending—reducing errors and enforcing compliance.

Is Expense Hub suitable for small businesses?

Yes, its modular design and affordable pricing make it ideal for startups and SMEs looking for ease of use and scalability.

Does Expense Hub integrate with accounting tools?

Absolutely. It connects seamlessly with platforms like QuickBooks, Xero, and Sage to ensure real-time reconciliation.

How does expense software help with compliance?

It automates policy checks, flags suspicious submissions, and maintains a tamper-proof audit trail.

Is cloud or on-premise better for UK businesses?

Cloud-based solutions offer greater flexibility, accessibility, and lower maintenance—making them the preferred choice in the UK market.