Understanding HMRC Mileage Rates and How Expense Hub Can Simplify Your Claims

HMRC Mileage Rates: Your Ticket to Tax-Free Travel (and Less Paperwork)

Picture this: it’s Monday. You’re behind the wheel, coffee in one hand, steering wheel in the other (okay, hopefully not literally), with your mind juggling client meetings, emails, and—of course—how on earth you’re supposed to handle another mileage claim. If you’re a UK business owner, freelancer, or employee who ever drives their own “pride and joy” for work, HMRC mileage rates should be as familiar to you as your favourite service station on the M1.

But what are HMRC mileage rates, really? In plain English, they’re the official government-approved figures that say, “Hey, we get it—it costs you to drive for business. Here’s what you can claim back, tax-free.” The magic numbers for 2025/2026 are as stubbornly stable as marmite on toast: 45p per mile for the first 10,000 miles, 25p per mile after that for cars and vans, 24p per mile for motorcycles, and a cheeky 20p for bicycles (for those bravely pedalling through the British drizzle). Check the exact figures if you wish, but you won’t find a plot twist there (https://www.driversnote.co.uk/blog/hmrc-mileage-rates-2025, https://anna.money/blog/guides/hmrc-mileage-rates-and-allowances-in-the-uk/).

Why does this matter? Because not getting mileage right is like letting the taxman borrow your car—with your wallet in the glovebox.

Now, let’s crank up the engine on what really matters: there’s finally a way to automate, simplify, and de-stress your claims. Enter Expense Hub. While the name might sound like a dry accounting tool, it’s really a turbocharger for your business travel admin. It keeps up with HMRC’s rules (even when they don’t change), tracks every journey, and transforms what used to be stacks of faded fuel receipts into shiny, compliant claims—no sweatbands required.

What’s This Mileage Allowance Thing My Accountant Keeps Yelling About?

Let’s clear up a common confusion. Mileage rates and mileage allowance sound like two toppings on the same accounting pizza, but here’s the Melton Mowbray difference:

- HMRC mileage rates = the rates per mile you can claim.

- Mileage allowance = what you actually get paid back, tax-free, by your business—or, if you’re a solo act, what you can claim from the taxman.

Think of the HMRC mileage allowance as your personal VAT-free fuel top-up from HMRC for “using your own wheels” for business purposes. The catch? You can only claim for business miles—not that trip to pick up a cheeky Friday night takeaway.

It’s a hard line. That meeting with a client across town? Claims-worthy. Driving your aunt’s cat to the vet? Sorry, Fluffy. Not a business asset. https://anna.money/blog/guides/hmrc-mileage-rates-and-allowances-in-the-uk/

This is where Expense Hub comes off the bench like an all-star substitute. Its app doesn’t just track miles—it tags them. Business or personal? It splits them before you blink. Forget scribbled mileage logs or post-it notes stuck to your dashboard as your “system.” Expense Hub ensures every claim is squeaky clean, with the receipts to match.

Want a crash course on cleaning up your entire approach to business claims? Head over to Mastering Business Expense Reporting. Thank us later.

HMRC Mileage Rates: The Unchanging (But Critical) Numbers You Need

Let’s get down to brass tacks. Numbers. Here are the straight-from-the-source rates for 2025/2026:

| Vehicle Type | First 10,000 Miles | Over 10,000 Miles |

|---|---|---|

| Cars & Vans | 45p | 25p |

| Motorcycles | 24p | 24p |

| Bicycles | 20p | 20p |

(Source: https://www.driversnote.co.uk/blog/hmrc-mileage-rates-2025, https://www.rydoo.com/compliance/united-kingdom/uk-mileage/)

Notice anything? That’s right—these rates haven’t budged in twelve years. Let’s do some quick napkin math and a dash of economic cynicism. If petrol, insurance, and maintenance have all skyrocketed, why are you still getting 45p? Short answer: that’s what HMRC has decided is “enough.”

This stability is a double-edged sword:

- Pro: Budgeting is straightforward. You know what’s coming. No gambling on next year’s numbers.

- Con: If you’re covering rising costs, you might feel like you’re running a charity (for HMRC).

But break these rates, and you’ll be playing Monopoly—with the taxman. Claim above these rates, and HMRC will want a slice in taxes.

Ever tried to keep up with these rules on your own? Let’s face it: you have better things to do (like running your actual business). Enter—again—Expense Hub. Its job is to always know the latest numbers, update your system, and guard you from claiming too much or too little. All you do is log your trip—and never Google “HMRC mileage updates” at 2 am again.

Want to cross-check for yourself? Visit the https://www.gov.uk/government/publications/rates-and-allowances-travel-mileage-and-fuel-allowances and let Expense Hub take care of the rest.

Economic Reality Check: What HMRC’s Rates Mean in 2025

Let’s roll up our sleeves. Are these rates fair? That depends on your point of view.

- For companies: Predictability is gold. You avoid sudden spikes in claims.

- For employees: If your fuel receipt nearly brings you to tears, this static allowance might feel underwhelming.

- For the “do-it-all” small business owner: Every penny helps, but paperwork and compliance burn more time and brain cells than the 45p/mile covers.

So, is there a hack? Yes. Knowing the rules, tracking everything to the letter—and making the process as painless as possible. See where we’re going with this?

Calculating Your Claim: Napkin Math Meets Digital Simplicity

Let’s get practical (and maybe a little cheeky).

How do you calculate your mileage claim without staring at a spreadsheet until your eyes cross? At its heart, the formula is as British as pie:

Claim = (First 10,000 business miles × 45p) + (Additional miles × 25p)

Sounds simple, right? Until you realise HMRC expects:

- Precise journey descriptions,

- Clear date and purpose,

- Route information,

- Oh, and zero crossover between business and personal trips.

Imagine you drove 12,000 business miles last tax year:

- First 10,000 miles: 10,000 × 45p = £4,500

- Remaining 2,000 miles: 2,000 × 25p = £500

- Total claimable: £5,000

Sounds easy. But what if you misclassify 500 personal miles? Suddenly, you’re over-claimed, and HMRC is side-eyeing your accounts.

How Expense Hub Turns Mileage Math Into a Cakewalk

Expense Hub’s built-in mileage claim calculator (think: a hyper-competent digital PA crossed with a satnav) takes your route, applies the right HMRC rates, and automatically separates business from personal miles (with supporting trip details just a click away). No more double-checking formulas, no more “hang on, was that trip for work or that weekend cycling club?”

Not only does it keep HMRC happy, but it keeps you happy by turning hours of admin into a few clicks. That equals more time for billable work—or, heck, just more time for lunch.

Curious about other ways to sharpen your expense game? Check out our Advanced Features for Expense Management.

The Real Story: Getting the MAX from Your HMRC Mileage (And Keeping the Tax Man Grinning)

Understanding the Reimbursement Gauntlet

Youcould try to wing it. Maybe even “estimate” the odd journey. But HMRC’s rules are clear—document everything, or risk the dreaded audit.

Here’s how it really works:

- Document every business journey. That’s every. Single. One.

- Keep a log: Dates, journey start/end, purpose, and miles.

- Store the log. For at least six years. (“HMRC never forgets,” as your accountant would say.)

- File the claim. On time, through payroll or your self-assessment tax return.

Mess up, and it could cost you more than you saved by “eye-balling” your miles.

Cutting Out Hassle with Expense Hub

Expense Hub works like a backstage pass for your mileage claims. Its tools:

- Automate log entries. Each trip, instantly recorded.

- Attach maps and supporting docs. Directly to trips—so no more lost paperwork.

- Submit claims. Direct to payroll or export for your accountant—neat, fast, painless.

Hundreds of hours saved. Zero missed claims. No sleepless nights over surprise HMRC letters.

If you’re interested in a deep dive on smarter, faster business reimbursements, don’t miss our advice on Streamlining Reimbursement Processes.

Car, Bike, or Beast: HMRC Company Mileage Rates for All Types (And How Expense Hub Handles Each)

Think HMRC mileage rates are just for those in company Ford Fiestas? Think again. The government, in all their wisdom, recognises the broad church of company transport.

| Vehicle Type | Mileage Rate Logic | Business Impact |

|---|---|---|

| Cars & Vans | 45p/mile up to 10,000; 25p after | Covers average running costs, affects travel budgets |

| Motorcycles | 24p/mile flat | Lower costs, handy for two-wheeled warriors |

| Bicycles | 20p/mile flat | Promotes green travel, minimal business cost |

(https://www.rydoo.com/compliance/united-kingdom/uk-mileage/)

If you’re running a company fleet, simply choosing more motorcycles or incentivising cycling could mean significant savings. (And more high-fives from the eco crowd.)

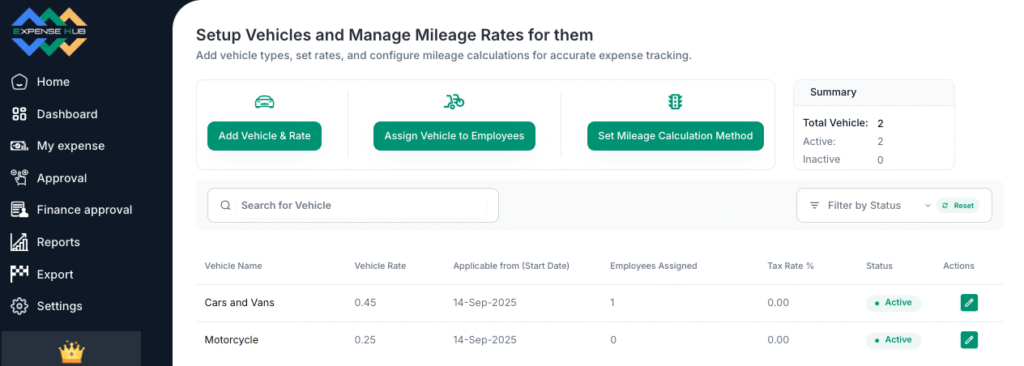

Expense Hub Customization: One Platform, All Vehicles

Expense Hub doesn’t treat you like a statistic. Are you all about hybrid cars, or do you have a team of pedal-powered engineers? With a few clicks, you can:

- Set rates for each vehicle type,

- Apply company-specific tweaks,

- Pull accurate reports—filterable by team, office, or even that one staff member who insists on commuting via e-scooter.

This is serious flexibility. No one-size-fits-all nonsense—just compliant, accurate, real-world mileage claims, all handled automatically.

Stay Compliant, Spend Less Time on Admin: Why Expense Hub Makes Sense for Mileage Claims

Let’s wrap with a reality check. Understanding HMRC mileage rates isn’t a ‘nice to have’—it’s business-critical. Each penny scrimped (or over-claimed) could mean easier growth, less hassle at year-end, and more energy spent building your business, not building spreadsheets.

Here’s what you really get by mastering mileage rates with Expense Hub:

- Utter compliance with the current (unchanging) HMRC mileage rates.

- No more admin black-holes—every trip logged, categorised, and ready to claim.

- Real-time rate updates, so you never miss an allowance change—even if HMRC finally remembers to update them.

- Flexible vehicle support, tailored to your business.

And if you want to impress your accountant, Expense Hub even makes exporting reports a two-click marvel.

Ready to Take Control of Your Mileage Claims—and Get Hours of Your Life Back?

Enough with shoeboxes full of coffee-stained receipts. Enough with “did you really drive from London to Edinburgh for a meeting, Graham?” Enough with guessing what you’re entitled to claim.

It’s time to match your business drive—with the right tool for the job. Expense Hub is the solution designed to take the sting (and boredom) out of mileage admin—for everyone who works as hard as their car does.

Want to make this tax year the easiest one yet?

Explore Expense Hub, and leave the mileage math to us.

(Now, about that coffee refill…)