In business finance, standing still isn’t safe—it’s sliding backward. The world has moved past clunky spreadsheets and quarterly reviews that feel like a post-mortem. Today, money moves faster, decisions need to be sharper, and your financial reporting can’t just keep up—it has to stay ahead.

Think of it like driving a car. Would you trust your journey to a dusty road map printed three months ago? Or do you want a GPS that updates in real time, warns you of traffic, and gives you the best route forward? That’s what modern financial reporting does—it turns your finances into a live dashboard instead of a lagging history book.

This guide isn’t about boring you with theory. It’s about showing you how to future-proof your finance function. You’ll see how to:

- ditch static reports for interactive dashboards,

- use tools that actually cut the busywork (instead of adding more),

- and leverage scenario planning so you’re ready for what’s next—not scrambling for what just happened.

The truth is, finance isn’t a back-office chore anymore. Done right, it’s your company’s growth engine. And by the time you’re finished with this, you’ll have practical, real-world strategies to turn reporting from “just numbers” into the kind of insights that drive bold decisions, smarter growth, and a business that thrives—not just survives.

The Evolution of Financial Reporting: From Basic Statements to Strategic Intelligence

Last year, Anita, a seasoned CFO at a mid-sized tech company, found herself drowning in spreadsheets. Revenue was growing, but cash flow was slipping through the cracks, and her board kept pressing for better margins. Late one night, frustrated after yet another reconciliation meeting, she stumbled upon a simple shift: instead of reacting to numbers at the end of the month, she began tracking financial KPIs in real time. Within a quarter, not only had she restored cash flow discipline, but she’d also uncovered growth opportunities hiding in plain sight.

Anita’s turning point is not rare—it’s a lesson every finance leader in 2025 must embrace. Strategic financial management is no longer about “keeping score.” It’s about proactively using data, tech, and sharper KPIs to drive performance before issues snowball.

Financial statement analysis used to be the accountant’s lonely grind—poring over balance sheets, squinting at numbers, and praying the decimals lined up. But business has changed. Today, financial performance metrics aren’t just for bean counters; they’re the heartbeat of every decision, driving forecasting, budgeting, and long-term strategy. And thanks to integrated financial management systems and real-time financial reporting, the right numbers now land in the right hands at the right moment—turning every report into a growth engine instead of a dusty archive.

Here’s the exciting part: advancements in financial report automation, scenario analysis in financial reports, and actionable dashboards mean that financial data is no longer dead weight on a spreadsheet. It’s alive. It’s breathing. It’s living intelligence you can actually use. And with compliance in financial reporting growing more complex (while stakeholder expectations grow louder), those who lean on automated tools and advanced techniques have a serious edge. In today’s game, automation isn’t optional—it’s your ticket to clarity, speed, and smarter growth.

Financial Reporting Software: Foundation of Modern Finance

When Rajiv, the CFO of a fast-growing logistics company, sat down for his quarterly review, he felt the weight of old habits dragging him back. His finance team had spent two exhausting weeks wrangling spreadsheets, reconciling endless tabs, and emailing version after version of reports. By the time the board meeting arrived, Rajiv’s numbers were already stale.

Then came the turning point. On the advice of a peer, he tried a modern financial reporting platform. The first report he generated shocked him—not because of the numbers, but because of how fast and clean the process was. What once took weeks was now a matter of minutes. Suddenly, Rajiv wasn’t just presenting history; he was forecasting the future with confidence.

That’s the power of today’s financial reporting software. It’s no longer about compiling data—it’s about giving finance leaders the clarity and speed to make bold, timely decisions. In many ways, it has become the foundation of modern finance, turning CFOs from number-crunchers into true business strategists.

What are the best tools for advanced financial reporting?

Modern financial reporting software—Expense Hub, SAP, QuickBooks, and Oracle NetSuite—bring together the full spectrum of accounting data visualization, KPI tracking and reporting, and financial dashboards. These platforms deliver more than numbers; they offer clarity, compliance, and the ability to drill down into specific business units, cost centers, and time periods.

How to choose the right financial reporting software?

Look for solutions with integrated financial management, extensive customization, real-time updates, powerful forecasting tools for finance, and robust data security. Demo multiple platforms before committing, and ensure your team receives training for seamless adoption.

Automation and Its Impact on Financial Reporting Accuracy

Financial reporting has long been prone to errors caused by manual data entry, spreadsheet dependency, and fragmented systems. Even the most skilled finance teams can misplace numbers, misclassify expenses, or duplicate entries when dealing with thousands of transactions under tight deadlines.

Automation directly addresses these challenges by removing human error from repetitive tasks and ensuring consistency across reports. Modern financial reporting software integrates with core business systems—ERP, accounting, payroll, and expense platforms—allowing data to flow seamlessly. This reduces the risk of discrepancies caused by siloed processes.

Key ways automation improves reporting accuracy include:

- Real-Time Data Capture – Automated tools pull data continuously from connected systems, ensuring reports reflect the latest numbers without delays.

- Error Reduction – By eliminating manual keying and reconciliation, automation significantly lowers the risk of typos, omissions, or miscalculations.

- Standardization – Automated templates and workflows ensure compliance with accounting standards and company-specific policies.

- Audit Trails – Every adjustment and transaction is logged automatically, making it easy to track back to the source of truth.

- Faster Close Cycles – Automation accelerates month-end and year-end processes, giving finance teams more time to analyze rather than fix errors.

In short, automation transforms financial reporting from a reactive, error-prone exercise into a reliable, forward-looking process. Instead of firefighting inaccuracies, finance leaders can trust their numbers and spend their energy on driving strategy, forecasting, and performance improvement.

How does automation improve financial reporting accuracy?

Automation eliminates human error, speeds up processing, and ensures each transaction is correctly categorized. Automated financial reporting tools serve compliance-focused organizations best, enabling error-free consolidation and faster month-end closes.

Financial report automation in action:

Expense Hub streamlines expense management, while workflow automation systems reduce manual data entry. Automation also helps track changes in regulatory requirements, minimizing compliance risks and providing audit trails for every transaction.

Some tips to Improve Financial Managements and KPIS can be found here.

Advanced Forecasting and Scenario Analysis: Planning Beyond the Present

Traditional budgeting and forecasting rely heavily on historical data, but in today’s fast-moving business landscape, that’s no longer enough. Advanced forecasting tools and scenario analysis bring a forward-looking lens, allowing finance teams to test multiple “what-if” models and anticipate how different conditions could impact performance.

For example, instead of relying solely on last year’s sales growth rate, modern forecasting platforms integrate real-time market data, customer trends, and operational metrics to build more dynamic projections. Scenario analysis goes a step further—enabling CFOs and finance managers to compare outcomes under different assumptions: what if raw material costs rise by 15%? What if interest rates fall? What if a new competitor enters the market?

This approach transforms planning from a reactive function into a proactive one. Rather than being caught off-guard, businesses can stress-test their strategies, allocate resources more effectively, and make confident decisions even in uncertain times.

The result is not just more accurate forecasting—it’s resilience. By anticipating multiple possible futures, organizations are better prepared to pivot quickly and protect performance when reality doesn’t go according to plan.

How can scenario analysis improve business forecasting?

Scenario analysis in financial reports empowers finance teams to test multiple “what if” possibilities, across different economic conditions, regulatory changes, or internal performance triggers. This technique uses advanced forecasting in finance to support dynamic budgeting and resource allocation, fortifying organizations against uncertainty.

Techniques for variance analysis in financial statements:

Variance analysis identifies financial reporting mistakes by comparing actual results with forecasted figures. Modern reporting software automates calculations and provides visual insights, highlighting anomalies and helping managers pivot strategy rapidly.

The Power of Data Visualization and Financial Dashboards

Numbers alone don’t tell a story. In the fast-paced world of modern finance, the ability to transform raw data into clear, actionable insights is what sets top-performing finance teams apart. This is where data visualization and financial dashboards step in as game changers.

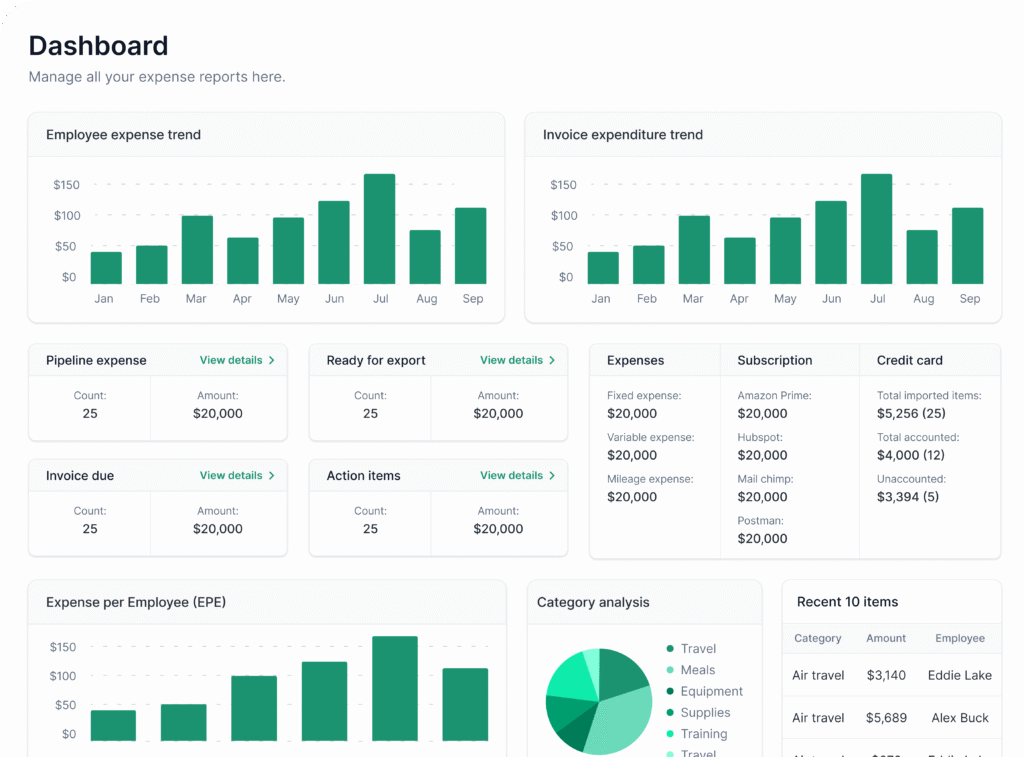

Instead of wading through spreadsheets filled with thousands of rows, CFOs and controllers now have the power to view performance at a glance. Dashboards bring together KPIs, cash flow trends, revenue breakdowns, expense tracking, and forecasts in one unified space. With interactive charts, drill-down capabilities, and real-time refreshes, decision-makers can move beyond static reports and into dynamic, living insights.

The impact is significant:

- Clarity – Complex metrics are distilled into visuals that can be grasped instantly.

- Speed – Decision-making accelerates when the financial health of the company is always visible.

- Collaboration – Cross-functional leaders (not just finance) can understand and act on the same data.

- Proactivity – Red flags are spotted earlier, and opportunities are highlighted before they pass by.

In essence, financial dashboards transform finance from a back-office reporting function into a strategic nerve center of the business. They don’t just show the numbers—they show the story those numbers are telling, in real time.

Example for Financial Dashboard – Expense Hub

What is the role of dashboards in financial management?

Dashboards provide a visual overview of financial performance metrics, KPIs, compliance status, and business drivers. With financial dashboards and visualization, executives move beyond static monthly reports to real-time financial reporting that uncovers patterns, monitors benchmarks, and triggers timely interventions.

Benefits of integrating data visualization with financial reports:

Data-driven financial decisions require clarity. Visualization translates complex financial data into charts, graphs, and interactive elements that make business insights instantly accessible—whether in board meetings or on mobile devices.

Compliance in Financial Reporting: Navigating Regulations and Ensuring Data Integrity

In today’s financial landscape, compliance is not optional—it’s a mandate that defines credibility, transparency, and trustworthiness. Businesses of all sizes must align with accounting standards, industry-specific regulations, and jurisdictional laws to ensure that their financial reporting is both accurate and legally defensible.

The Importance of Compliance

Compliance in financial reporting is about more than just “ticking boxes.” It ensures:

- Accuracy of Information: Preventing misstatements that can mislead stakeholders.

- Transparency: Offering regulators, investors, and auditors a clear, honest view of financial health.

- Protection from Risk: Avoiding penalties, lawsuits, or reputational damage caused by non-compliance.

Key Regulatory Frameworks

Depending on where a company operates, it must adhere to frameworks such as:

- IFRS (International Financial Reporting Standards): Global standard, widely used across multiple regions.

- GAAP (Generally Accepted Accounting Principles): Standard in the United States.

- Industry-Specific Guidelines: For example, SOX (Sarbanes-Oxley Act) for public companies in the U.S., or GDPR’s implications on financial data handling in Europe.

Each framework outlines how businesses should record, report, and disclose financial information.

Challenges Companies Face

- Constantly Changing Regulations: Keeping up with evolving global and local compliance rules.

- Complex Data Handling: Ensuring accurate financial data while integrating multiple systems and subsidiaries.

- Audit Readiness: Being prepared for internal and external audits without scrambling for information.

Technology as the Enabler

Modern financial reporting software addresses these challenges by:

- Automating Compliance Checks: Systems flag inconsistencies or non-compliant entries instantly.

- Audit Trails: Secure logs that track every financial change for easy auditing.

- Centralized Reporting: Ensuring alignment across regions, subsidiaries, and currencies.

- Data Integrity Safeguards: Role-based access, encryption, and error-prevention mechanisms to protect against fraud or manipulation.

The Business Value

Compliance-driven reporting builds trust—with regulators, investors, and stakeholders alike. When businesses can demonstrate integrity and transparency, they not only avoid fines but also strengthen their credibility, investor confidence, and long-term sustainability.

How to optimize compliance in financial reporting?

Regulatory compliance is a moving target. The right financial reporting software tracks new laws, helps with policy documentation, automates compliance workflows, and ensures every report meets standards for accuracy and completeness.

Integrated financial management platforms provide built-in controls for secure data storage and multi-level access. Auditors and finance teams benefit from automated compliance in financial reporting, reducing manual efforts while improving transparency and reliability.

Real-Time Financial Reporting and KPI Tracking

How to implement real-time financial reporting in business?

Transitioning to real-time updates requires platforms capable of aggregating transactions, approvals, and external data sources as they occur. Automated alerts support fraud detection and performance monitoring.

Best practices for KPI tracking in financial reports (Reference : Investopedia):

Define clear, relevant KPIs based on strategic goals.

Use financial dashboards to visualize KPIs and trends.

Leverage forecasting tools for finance to correlate budget assumptions with actual outcomes.

Conduct regular reviews and scenario analysis to validate targets.

Overcoming Challenges in Advanced Financial Reporting

What challenges do businesses face in advanced financial reporting?

Common pain points include resistance to new technology, high implementation costs, and data security concerns. Variance analysis techniques help spot errors and outliers, while automation minimizes manual input. Integration with existing data systems is crucial for a seamless transition.

How to overcome these challenges:

Encourage change management through training and open communication.

Choose scalable, secure financial reporting software.

Pilot test advanced forecasting in finance before full rollout.

Financial Report Automation: Transforming the Finance Function

Financial report automation not only accelerates processing times, but also reduces administrative burden and improves accuracy. Features like real-time financial reporting, variance and scenario analysis, and compliance tracking allow finance teams to focus on strategic objectives— not just recordkeeping.

Business units benefit from actionable business insights and more efficient financial performance metrics, driving overall organizational growth.

Manual reporting is no longer sustainable in today’s fast-moving financial environment. Financial report automation replaces repetitive, error-prone tasks with intelligent workflows that generate accurate, consistent, and timely reports.

Instead of teams spending hours reconciling spreadsheets, automation pulls data directly from multiple systems, applies standard reporting rules, and produces outputs in real-time. This shift doesn’t just save time—it elevates the role of finance teams. Rather than being data gatherers, they become strategic advisors who interpret insights and guide decision-making.

By freeing finance professionals from repetitive tasks, financial report automation transforms the function into a forward-looking powerhouse—focused on strategy, planning, and value creation, not just compliance.

Bringing It All Together: Actionable Insights for Advanced Financial Reporting

Advanced financial reporting is not about adopting one tool or process—it’s about creating a cohesive system where automation, forecasting, visualization, and compliance work hand in hand. When these elements are connected, finance leaders can move beyond routine reporting to deliver actionable insights that shape strategic decisions.

1. From Data to Decisions

Automation ensures accuracy and timeliness, while advanced forecasting extends visibility into the future. Dashboards and visualizations then turn complex numbers into stories leaders can understand instantly. The outcome? Finance teams shift from number-crunchers to decision enablers.

2. Building a Holistic Framework

- Automate routine tasks → Free up time for higher-value analysis.

- Use scenario planning → Model outcomes under different business conditions.

- Leverage dashboards → Democratize access to insights across departments.

- Maintain compliance → Ensure integrity while embracing speed and scale.

3. The Strategic Advantage

Companies that align these practices can:

- Spot risks before they escalate.

- Align resources with growth opportunities.

- Drive stakeholder confidence with transparent, reliable reporting.

4. Turning Insights into Action

Actionable insights come when finance is not just reporting the past but actively shaping the future. This requires:

- Clear governance around data integrity.

- Collaboration across finance, operations, and leadership.

- Continuous refinement of reporting systems as business evolves.

Final Takeaway

Bringing it all together means reimagining financial reporting as a strategic capability—not just a compliance requirement. When automation, forecasting, visualization, and compliance converge, the finance function becomes the engine that drives smarter, faster, and future-ready business decisions.

Frequently Asked Questions (FAQ)

What are the best tools for advanced financial reporting?

Expense Hub, SAP, Oracle NetSuite, QuickBooks, and Microsoft Power BI offer automation, visualization, and real-time reporting for comprehensive financial statement analysis.

How does automation improve financial reporting accuracy?

Automation minimizes manual errors, speeds up reporting cycles, and ensures compliance with changing regulations.

How can scenario analysis improve business forecasting?

Scenario analysis uses multiple models to anticipate possible outcomes, improving strategic agility and resource allocation.

How to optimize compliance in financial reporting?

Use financial report automation platforms with built-in compliance checks, audit trails, and real-time policy tracking.

What is the role of dashboards in financial management?

Dashboards visualize complex data, helping teams monitor KPIs, spot trends, and respond instantly to financial changes.

Techniques for variance analysis in financial statements?

Leverage automated tools to compare actual vs. forecasted results and highlight actionable insights.

Best practices for KPI tracking in financial reports?

Define KPIs aligned with strategy, use dashboards for tracking, integrate forecasting, and adapt regularly based on scenario analysis.

How to implement real-time financial reporting in business?

Choose platforms with instant data aggregation, automated alerts, and visual dashboards accessible across devices.

Conclusion: Leading With Insight, Not Just Information

Advanced financial reporting goes beyond compliance—it drives profitability, competitive advantage, and strategic growth. Integrating data visualization, automation, and forecasting tools redefines the role of finance from record-keeper to business catalyst.

By addressing every aspect—variance analysis, scenario modeling, compliance, and KPI tracking—you build a finance function ready to surpass boundaries and deliver results.

Remember, the objective isn’t just to report numbers—it’s to deliver insights that power decisions. With advanced financial reporting techniques, your finance team isn’t just staying ahead; they’re leading the way.