- Avoid Fraud with an Efficient Expense Management Tool

- Why Expense Management Is the Unsung Hero in Fighting Fraud

- Understanding Expense Fraud: Why Honest Folks Can’t Just “Trust Their Gut”

- How an Expense Management Tool Helps You Avoid Fraud (and Headaches)

- Increasing Policy Compliance with Expense Management Tools

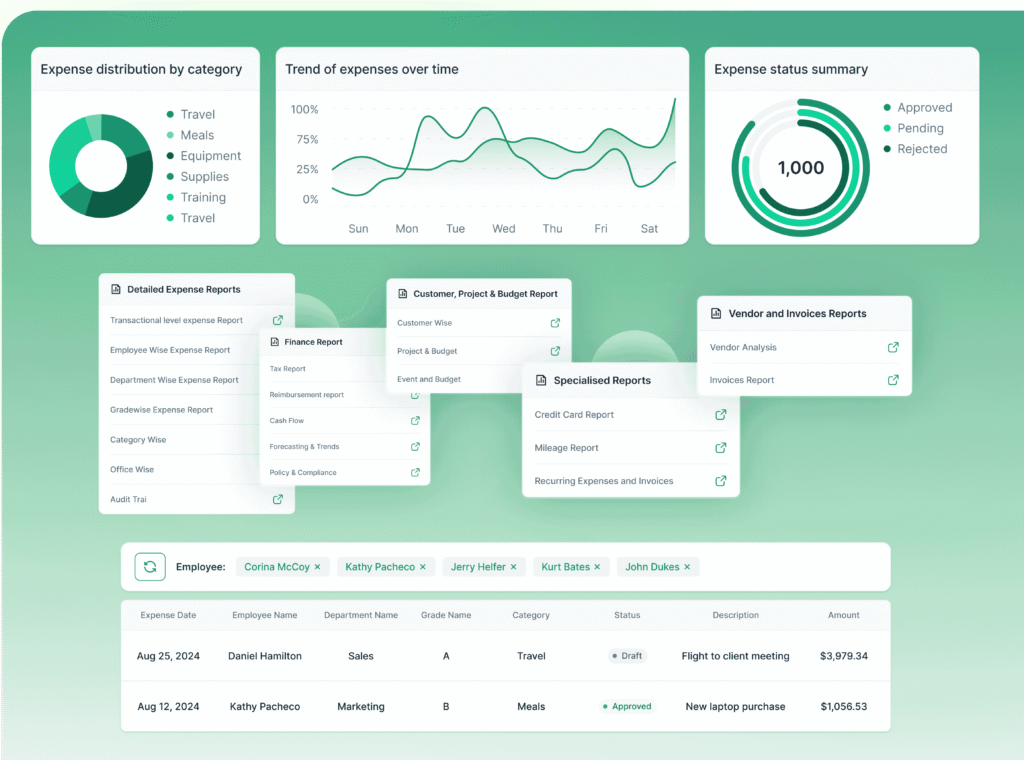

- Benefits of Using Expense Hub for Managing Expenses

- Case Studies: “You Wouldn’t Believe These Results—But They’re Real”

- Time to Take Control (Before Fraud Takes Control of You)

- More Ways to Dodge Expense Pain (and Learn Like a Pro)

Avoid Fraud with an Efficient Expense Management Tool

Why Expense Management Is the Unsung Hero in Fighting Fraud

Let’s have a little heart-to-heart. I’m willing to bet your business is pretty good at what it does. You see opportunities. You create value. But when it comes to the “boring” stuff—like tracking expenses—most entrepreneurs would rather wrestle an alligator than manage receipts.

But here’s the myth I’m gleefully ready to bust: effective expense management is as crucial to your company’s financial integrity as your best salesperson is to your revenue stream. Maybe even more. Because every dollar lost to fraud is a dollar you have to earn twice—once to cover the loss, and once again to gain any ground. See where this is going?

Now, let’s talk risk. Poor expense management isn’t just a paper cut; it’s a gaping wound in your company’s bottom line—and its reputation. Expense fraud isn’t rare or dramatic. It’s sneaky, quiet, and devastatingly expensive. The right tools—like the aptly named Expense Hub—aren’t just about streamlining admin nonsense; they’re your financial SWAT team. Their job isn’t to make spreadsheets pretty—it’s to help you avoid fraud, enforce compliance, and let your team focus on actual growth.

So buckle in. We’re diving headfirst into the scandalously underreported world of expense fraud—and how an expense management tool like Expense Hub can save your bacon (and your cash flow).

Understanding Expense Fraud: Why Honest Folks Can’t Just “Trust Their Gut”

Let’s play a quick round of “Would You Notice?” Imagine Linda, your upstanding accounts assistant, slips in a $17.45 parking receipt for a meeting that got canceled. Or John, your road warrior of a sales rep, submits a coffee receipt he found in the car’s glovebox—three months late, but hey, caffeine is timeless, right?

Expense fraud doesn’t have to be Ocean’s Eleven. It’s more like Ocean’s Everyday.

Definition and Real-World Impact

Expense fraud is the deliberate fiddling—sometimes outright fabrication—of expense claims to pocket money that should never leave your company’s wallet. The usual suspects? Falsified receipts, overinflated mileage, the occasional “business lunch” that looks suspiciously like date night. And sure, it starts small. But nickel-and-diming adds up—$50 here, $200 there—until your annual books bleed red. According to https://www.rydoo.com/cfo-corner/expense-fraud-companies/, even minor fraud, undetected, can snowball into thousands in annual losses for SMBs and millions for larger organizations.

Now, you might be thinking, “But my team is honest!” Most are—but motivation and temptation are different beasts on a Friday afternoon with bills to pay. When policy is murky and systems are manual, even well-meaning employees can cross that blurry ethical line, sometimes without realizing it.

For additional insights into compliance, check out https://blog.expensehub.io/understanding-compliance-in-expense-management/.

Common Types of Expense Fraud: The Frauds in the Wild

Don’t assume expense fraudsters are criminal masterminds. More often, they’re just regular folks nudged by convenience, desperation, or ambiguity. Here are a few “greatest hits,” each more common (and more avoidable) than you might wish:

- Falsified Receipts: “Lost the original, so I’ll just whip one up in Photoshop… who’s checking?” Someone should be checking.

- Exaggerated Claims: Submitting a meal for the team—then sneakily adding that bottle of wine or an extra dessert.

- Duplicate Submissions: “Whoops, submitted that taxi ride last month and this month. I’ll get that fixed… eventually.”

https://use.expensify.com/blog/preventing-expense-fraud notes these are “gateway” frauds—low effort, low risk. But every penny filched is a signal: your controls are porous, your processes outdated, and trust is eroding.

Bottom line? Expense fraud is a universally underestimated enemy, not just of cash flow but company culture. People notice when the system is gamed. Honest staff? Demoralized. Dishonest staff? Emboldened. Investors? Suddenly very attentive.

How an Expense Management Tool Helps You Avoid Fraud (and Headaches)

If you think an expense management tool is just a digital version of your old Excel sheet, think again. Efficient platforms—cough, Expense Hub, cough—are built to save you from death by a thousand papercuts. Here’s how:

The Jedi Powers of Automation and Real-Time Auditing

Imagine running a 24/7 audit parade for every expense claim, one that never gets tired, bored, or distracted by their phone. Automation in expense management is just that: a relentless detective working every receipt the moment it’s entered. https://b2b.mastercard.com/news-and-insights/blog/four-essential-saas-features-you-need-in-fraud-detection-software/ swears by these capabilities to curb fraud before it grows legs.

How does this look in practice? Let’s say Ron submits a $500 hotel bill. The system’s algorithms instantly check for outliers—wait, did all team members stay at half that rate last week? Expense Hub flags it. Suspicious coffee shop spending at 11 p.m.? Bing—your virtual watchdog barks.

For more on automation in finance, see https://blog.expensehub.io/the-role-of-automation-in-the-modern-financial-analyst-toolkit/.

This isn’t Big Brother, it’s Big Nobody-Empties-Our-Wallet.

Expense Hub’s Real-Time Monitoring

Here’s where Expense Hub shows its chops: Every claim gets an automated once-over (or five) before approval. Duplicate entries? Re-purposed receipts? Odd time stamps? These aren’t just flagged—they’re nipped in the bud with instant alerts and audit-ready trails. That means less manual oversight, faster error-spotting, and zero chance for fraudsters to “slip it past” late on a Sunday night.

Want more? Jump to our # breakdown for the full lowdown.

Receipt Scanning and Verification: OCR is Your New Best Friend

Still sending receipts by email, or trying to decode wrinkled pictures from someone’s ancient smartphone? Welcome to the future. (Where have you been?)

Modern tools wield OCR—Optical Character Recognition—like a laser scalpel. Snap a photo, and boom: merchant, amount, date, location, all deciphered instantly. This lets systems verify receipt authenticity—no “creative editing” allowed.

For more about effective scanning tools, check https://blog.expensehub.io/best-receipt-scanner-app-guide/.

https://www.expensya.com/en/blog/how-strong-policy-and-ai-powered-tech-can-reduce-fraud/ point out that this tech not only automates authenticity checks but cross-references receipts against policy, past claims, and even merchant databases. No, Linda can’t resubmit last year’s dinner bill “by accident.”

The Expense Hub Difference

With Expense Hub, OCR isn’t just accuracy theater. It’s the bouncer at the club, checking IDs and tossing out fakes before they get through the door. Visual anomalies—odd fonts, mismatched dates, suspect vendor info—are instantly red-flagged, and you get a clear audit trail for every cent claimed.

Real receipts. Real compliance. Real peace of mind.

Increasing Policy Compliance with Expense Management Tools

Let’s talk about the “rules of the road.” You can buy a fancy car (or expense tool), but if the traffic lights are random and the speed limits are a mystery, expect chaos. And probably a few fender benders.

A solid expense management tool doesn’t just enforce your expense policies—it makes them crystal clear, impossible to ignore, and painfully easy to follow.

Communicating Policies: More Like GPS, Less Like Paper Map

How many of your team can quote your expense policy? If you’re like most, the answer falls somewhere between “no clue” and “maybe HR knows.” That’s no way to steer compliance.

Tools like Expense Hub turn fuzzy policies into everyday checkpoints. Set hotel or meal limits, blacklist certain merchants, or automate per diem calculations—right inside the platform. Deploy push notifications so employees get a heads-up, not a lecture, when they step over the line. In short, program your culture. Make the right behavior the path of least resistance.

No more “But I didn’t know the rule!” With customizable policy controls, every expense is vetted before you have to waste time arguing after the fact.

For more insights on designing effective policies, visit https://blog.expensehub.io/essential-expense-policy-template-guide/.

Monitoring and Reporting: Data, Not Drama

Enforcement isn’t about wielding a whip; it’s about shining a light. Want to spot “trends” (read: trouble)? Customize reports by team, category, or spender. See who’s complying—and who’s not—with zero subjectivity.

Expense Hub’s analytics don’t just show totals; they break down submission outliers, approval bottlenecks, and policy breaches. So when Finance or Compliance comes knocking, you’ve got more than a “feeling”—you’ve got the data.

As https://www.everlance.com/blog/5-benefits-expense-management-software explains, this kind of granular visibility isn’t optional anymore. Regulators expect transparent controls. Board members expect audit readiness. And let’s face it—you should expect a lot more than guesswork from your processes.

For more ammo, check out # to see how data-driven compliance saves time and headaches.

So, to sum up? A good tool doesn’t replace your policies; it turns them into the air your business breathes.

Benefits of Using Expense Hub for Managing Expenses

I’ll let you in on a secret—it’s not just about safety. A system that keeps cash honest makes everything else run smoother, faster, and (dare I say?) a little more fun.

Let’s put Expense Hub through the paces.

Enhanced Accuracy & Efficiency: The Fuel for Growth

Think about the last time you “fixed” a spreadsheet at 2 a.m. How many fat-finger errors did you catch? How many did you miss? Manual expense reporting is a productivity black hole—one that quietly drains accuracy as it swallows time.

With Expense Hub, automated tracking beats old-school pencil-whipping hands down. No more missed receipts, no more decimal drift, no more six-week reimbursement cycles. https://www.everlance.com/blog/5-benefits-expense-management-software show that automated expense reports can cut reimbursement lag in half and reduce data entry errors by up to 80%.

For more on process efficiency, visit https://blog.expensehub.io/improve-expense-finance-process-reporting/.

Napkin math: If your team spends just 8 hours a month on manual entry (not unusual!), and automation trims it to 2, that’s 72 hours saved per employee per year. Multiply that by your payroll, and you’re suddenly boosting margins without breaking a sweat.

Expense Hub doesn’t just record expenses—it integrates seamlessly with your accounting software, syncs in real time, and spits out clean, audit-ready ledgers. That means fewer late nights, way fewer tough emails with Finance, and a tax season that doesn’t induce night sweats.

User-Friendly Interface: Buy-In, Not Roll-Eyes

Even the shiniest new tool is worthless if your team wants to throw it into the nearest recycling bin. Clunky user interfaces are why “technology change” makes grown adults break into a cold sweat.

Enter Expense Hub: designed from day one for actual users, not just IT wizards. Think drag-and-drop dashboards, clear navigation, and in-app help that doesn’t sound like a riddle. Employees adopt it willingly because it just works.

https://www.expensya.com/en/blog/how-strong-policy-and-ai-powered-tech-can-reduce-fraud/ highlights a simple truth: when onboarding is quick, and usage feels natural, people stop gaming the system and start using it as intended. That’s good for compliance, morale, and your training budget. (Nobody should have to watch a 90-minute “How to Submit a Receipt” video. Seriously.)

External Validation: The Automation Payoff

Still skeptical about big promises? https://www.everlance.com/blog/5-benefits-expense-management-software: companies that automate expense management reduce overall processing costs by 50% or more. That’s not marketing fluff; it’s third-party research after watching businesses claw back real money.

Want more proof? Check out https://blog.expensehub.io/financial-analysis-tools-automation/ for external insights.

Case Studies: “You Wouldn’t Believe These Results—But They’re Real”

Nothing beats a good story, so let’s meet three anonymized Expense Hub heroes (names changed to protect the sensible):

1. The Consultancy That Plugged the “Friendly Fraud” Leak

Industry: Consulting — 42 employees

Problem: Expenses ballooned by 17% in a single year with zero revenue increase. A thorough audit (read: painful and expensive) found duplicated meal claims and “phantom” client lunches.

Solution: They deployed Expense Hub’s real-time monitoring and receipt scanning. Suddenly, the number of “forgotten” receipts and accidental double-dips vanished faster than snacks at an all-hands meeting.

Result: Fraudulent claims dropped by 90% in six months; average reimbursement turnaround fell from 18 to 5 days.

2. The NPO That Went Digital—and Won Donor Trust

Industry: Nonprofit, 26 field staff

Problem: Paper receipts, vanilla spreadsheets, and annual donor audits that looked more like dentistry.

Solution: Expense Hub’s digitization meant every grant, donation, or field expense had a time-stamped, geo-tagged, audit-friendly record.

Result: Not a single compliance issue in two years. Donors increased funding (citing “transparency improvements”), and program heads reclaimed two weeks a year once lost to pointless paperwork.

3. The Tech Startup That Actually Survived Rapid Growth

Industry: SaaS

Problem: Team doubled; expense chaos tripled. Manual oversight couldn’t keep up—$15,000 in unverified claims caught (luckily).

Solution: After integrating Expense Hub, all claims required receipt verification and were checked against live policy rules—zero exceptions.

Result: Not one duplicate submission in the past eight months. Team says submitting expenses “feels like five clicks, not five days.”

These aren’t unicorns—they’re businesses that closed the gap between good intentions and real policy enforcement with the right tools.

Time to Take Control (Before Fraud Takes Control of You)

Let’s pull back and look at the big picture: great teams can still cost you dearly without smart, automated expense management. It’s not about “catching” crooks; it’s about building systems where fraud has nowhere to hide and mistakes can’t drain your time or cash.

A tool like Expense Hub doesn’t just keep your money in your wallet—it keeps morale high, audits short, and compliance (dare I say) almost effortless. You get robust automation, real-time flagging, receipt scanning that sees through the smokescreens, and policy reinforcement that feels like guardrails, not handcuffs.

If you’re serious about your company’s future—and your team’s sanity—ditch the shoebox of receipts and the spreadsheet from 1998. Go robust. Go smart. Go with Expense Hub.

For further insights, visit our https://blog.expensehub.io/unlocking-efficiency-expense-management-software/.

More Ways to Dodge Expense Pain (and Learn Like a Pro)

Feeling fired up about expense management? Good. Here are a few next steps:

- Want to really see how Expense Hub streamlines compliance, slashes fraud, and makes your team happier? Try the demo or explore a free trial.

Let’s make your next expense report the start of your company’s next big win, not its next big risk.

Ready to take control of your finances? Make hanging on to your hard-earned money effortless, honest, and automatic—with Expense Hub.