How Expense Management Software Transforms Business Finances in the UK

Estimated Reading Time: 11 minutes

Key Takeaways

- Expense management software is vital for modern UK businesses striving for efficiency and strict compliance with local regulations.

- Expense Hub is tailored with UK-specific features, such as VAT compliance and HMRC-ready reporting frameworks.

- Automation reduces errors, enhances audit readiness, and empowers data-driven decision-making through real-time dashboards.

- Cloud-based platforms like Expense Hub offer unparalleled flexibility, scalability, and integration capabilities.

- Comprehensive support, interactive training, and customisation guarantee smooth adoption at businesses of all sizes.

Table of Contents

- Introduction: Importance of Effective Expense Management

- What is Expense Management Software for Business?

- Key Features of an Effective Expense Management Solution

- Benefits of Using Expense Management Software

- Types of Expense Management Software: Finding the Right Fit

- Implementing Expense Management Solutions in Your Business

- Case Studies: Success Stories with Expense Hub

- Conclusion: Future of Expense Management with Digital Solutions

- Call to Action

- FAQ

Introduction: Importance of Effective Expense Management

In the UK’s competitive commercial environment, expense management software is no longer optional—it’s a necessity for controlling company spend effectively. With mounting operational expenses and stringent regulatory requirements, manual expense management methods fall short. Manual processes based on spreadsheets and paper receipts are prone to errors, delayed approvals, opaque visibility, and costly oversights. According to Stripe’s analysis, these shortcomings cause inflated costs and inefficiencies that hamper business growth.

The Webexpenses blog corroborates these challenges, emphasizing the risks from fraud, lengthy validation processes, and compliance threats inherent to manual expense control.

This is where modern digital platforms like Expense Hub redefine financial management for UK businesses. Expense Hub automates and simplifies expenses accounting while aligning with British tax laws and business norms. By implementing Expense Hub, companies can eradicate inefficiencies, heighten accuracy, and maintain control over every pound spent.

What is Expense Management Software for Business?

Expense management software is a centralized digital solution designed to automate and optimize the entire expense lifecycle. From submission to validation and reimbursement, it transforms a convoluted manual process into a seamless, audit-proof workflow.

Instead of paper trails and email chains, all expense data is consolidated in one accessible system. Employees can submit, managers can approve, and finance teams reconcile effortlessly—eliminating human error and enforcing company policy compliance. As Stripe explains, digital automation is critical for modern expenditure governance.

Streamlined Workflows and Automated Compliance

Progressive expense solutions enable pre-approval workflows, real-time budget tracking, and instant report generation. These enhance visibility and efficiency across departments, validating the points raised by Webexpenses.

Expense Hub: Built for UK Businesses

Expense Hub is uniquely crafted for UK market needs. It enables seamless upload of receipts on mobile devices during travels or online purchases, coupled with comprehensive VAT compliance features ensuring HMRC-compliant categorization and reporting.

This platform’s alignment with local accounting standards reduces administrative load while enhancing compliance integrity.

Key Features of an Effective Expense Management Solution

Automated Tracking and Reporting: Accuracy and Real-Time Insights

Fundamental to all leading tools is automated data capture from receipts, invoices, and transactions, drastically cutting submission and approval times. This reduces overpayments and errors, echoing Stripe’s findings.

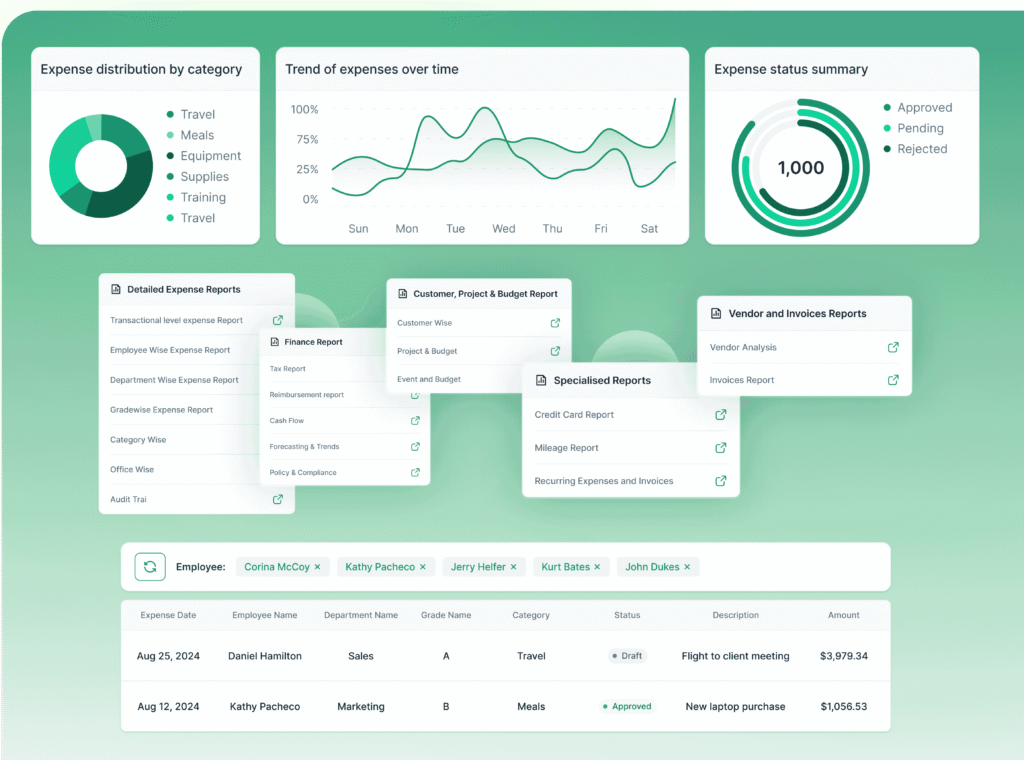

Expense Hub extends this with live dashboards that give finance teams up-to-the-minute visibility into expenses, budgets, and anomalies—allowing prompt corrective actions. For deeper insights on expense tracking, visit Expense Hub blog.

Automated Policy Enforcement

Administrators can configure detailed rules for spending limits, eligible expenses, and approval flows. Expense Hub automatically validates each submission against these criteria, drastically reducing violations and boosting policy adherence. Learn more at Expense Hub compliance guide.

Integration and Accessibility: Connecting All Your Financial Tools

Expense Hub offers seamless integrations with leading accounting platforms such as Xero, QuickBooks, and Sage (Airwallex Blog) removing the need for manual data entry, preventing errors, and accelerating reconciliations.

Its cloud architecture ensures executives and employees can submit, approve, and access data anywhere—from desktop to mobile devices—with real-time syncing.

Internal Resource:

Learn more about the Financial Software Integrations that Expense Hub offers.

Benefits of Using Expense Management Software

Efficient expense management unlocks increased accuracy, greater transparency, faster reimbursement cycles, and strengthened compliance. Expense Hub users report improved budget control and detection of fraudulent activities, powering smarter decisions and operational savings.

Types of Expense Management Software: Finding the Right Fit

Depending on your business size and complexity, choose from cloud-based solutions, integrated finance suites, or specialized trackers tailored for sectors or functions. Expense Hub’s modular design supports growing and diverse business models, ensuring you pay only for what you need.

Implementing Expense Management Solutions in Your Business

Successful onboarding requires clear communication, training, and tailoring workflows to existing processes. Expense Hub provides dedicated onboarding support, extensive documentation, and customizable implementation plans to minimize disruption and maximize adoption.

Case Studies: Success Stories with Expense Hub

Leading UK businesses across sectors have adopted Expense Hub, citing drastic reductions in manual processing times, improved audit preparedness, and solid VAT compliance. These companies report measurable ROI through time savings and tighter expense controls.

Conclusion: Future of Expense Management with Digital Solutions

The future belongs to agile businesses leveraging cloud technologies and automation for transparent, compliant finance operations. Expense Hub stands at the forefront, empowering UK businesses to dominate expense administration with ease and confidence.

Call to Action

Take control of your business expenses today. Get Started with Expense Hub and revolutionize how you manage spend, compliance, and reporting.

FAQ

- What is the best expense management software for UK businesses?

- How does Expense Hub ensure VAT compliance?

- Is cloud-based expense management secure?

- Can small businesses afford expense management software?

What is the best expense management software for UK businesses?

Expense Hub remains the top choice given its tailored VAT compliance, UK-based support, scalable platform, and seamless integration with popular UK accounting software.

How does Expense Hub ensure VAT compliance?

Expense Hub automatically categorises expenses per HMRC standards and generates VAT-compliant reports, facilitating smooth audits and reclaim processes.

Is cloud-based expense management secure?

Yes. Expense Hub employs enterprise-grade encryption, role-based access controls, regular security upgrades, and automated backups to safeguard your data.

Can small businesses afford expense management software?

Definitely. Expense Hub delivers flexible pricing models tailored to SMEs, ensuring a quick return on investment through increased efficiency and reduced errors.

“`