Choosing the Best HMRC Compliant Expense Software for Your Business

Why Expense Management Is the Lifeblood of Your Business (Especially If You Hate Fines)

Let’s get one thing straight: managing expenses isn’t just a “nice-to-have” for UK businesses anymore. It’s survival — right up there with keeping the kettle boiled and the Wi-Fi humming. Especially since HMRC rolled out Making Tax Digital (MTD), expense management has leveled up from “budgeting best practice” to “comply or risk being walloped by fines and stress-induced insomnia.”

Let’s paint a little picture—call it The Tale of Two Businesses. Company A still drags out the shoebox of coffee-stained petrol receipts every quarter, sweating bullets as year-end approaches. Company B? They tap a button and get real-time, HMRC-ready reports with all expenses automatically categorized, VAT handled, and audit trails locked tighter than a tax inspector’s wallet. Guess which business sleeps better?

You see, HMRC compliant expense software is not just admin automation; it’s your tactical arsenal in the messy battle of UK tax compliance. It’s what keeps your operation running lean, mean, and unpenalized (https://www.glencoyne.com/guides/expense-management-apps-uk-startups). And yes, platforms like Expense Hub take that up a notch—not only tracking every quid that leaves your business, but making sure it survives the digital paper trail HMRC demands.

Buckle up—we’re about to unpack what makes truly HMRC compliant expense software a non-negotiable (and exactly why the right tool, like Expense Hub, will save you headaches, time, and a suspiciously large envelope from the taxman).

Understanding HMRC Compliant Expense Software: What Actually Makes It “HMRC Compliant”?

Defining HMRC Compliant Expense Software—The Non-Boring Version

Let’s pretend you’re explaining your expense management setup to your gran. If your answer contains the word “spreadsheets” or “manual entry,” you’re already in dangerous territory. HMRC compliant expense software means no more sticky tape, no more “did I scan that receipt or didn’t I?” moments, and (best of all) no more crossing your fingers when HMRC comes knocking.

Here’s the deal:

- It guarantees you keep digital, unchangeable (that’s “unalterable” in HMRC-speak) records of every business expense, receipt, and transaction (https://www.glencoyne.com/guides/expense-management-apps-uk-startups).

- It slingshots you into HMRC’s good books by ensuring every expense—right down to what you spent on those regrettable team-building lunches—is categorized, timestamped, and ready for inspection.

- Thanks to features like OCR (that’s Optical Character Recognition, to the rest of us), it reads and stores receipts faster than you can say “quarterly VAT submission” (https://www.mobilexpense.com/en/blog/expense-management-solution-uk).

And here’s why that matters: slip up on any of these requirements and HMRC can (and will) reject your claims. Whoops—now you’re not just paying more tax, but your business reputation takes a whack. The software’s job? To automate away these risks, cut down audit time, and keep you on the right side of the rules (https://rentalbux.com/blogs/best-mtd-software-for-small-business).

Let’s talk real consequences—without robust digital records, a “routine review” can spiral into unplanned audits, rejected expense claims, and, you guessed it, heartburn-inducing penalties (https://www.glencoyne.com/guides/expense-management-apps-uk-startups). In 2024, having the right software isn’t a luxury, it’s table stakes.

That’s why I keep circling back to solutions like Expense Hub. Instead of scrambling to decipher mystery bank charges or hunting down emails from six months ago, Expense Hub digitizes, categorizes, and secures everything at the source so you have what HMRC wants, when they want it. (And when your accountant calls, you’ll finally have something smart to say.)

Key Features of HMRC Compliant Expense Software: What You Really Need (And What’s Just Shiny Distraction)

Essential Features to Make HMRC Smile

Automated Tracking: The End of Human Error (and Lost Receipts)

You know the old pub math: “Well, I bought coffee for the team every Friday, so that’s…let’s see…carry the one…” This is where manual expense management turns into a game of guess-and-hope.

Modern HMRC compliant expense software takes the pub napkin (with its dubious arithmetic) and shreds it. Using AI-powered OCR, it scans your receipts, pulls out merchant name, date, amount, and VAT, then—presto—tags and categorizes everything as HMRC demands, in real-time (https://www.glencoyne.com/guides/expense-management-apps-uk-startups).

Consider Jane, a freelance designer. Instead of laboriously typing expenses after every client meeting (and then losing a Starbucks receipt to the abyss), she snaps a photo using her app. Her expense is categorized for “client entertainment,” VAT assigned, and a digital copy is locked into the system. No more “I’ll do it later” regrets.

HMRC Rule Updates: Staying Ahead of the Taxman’s Curveballs

HMRC loves to keep us on our toes. VAT bands, mileage rules, what counts as a legitimate business lunch—these change faster than British weather. The right expense software downloads these updates automatically, ensuring every expense is processed against today’s rules, not last year’s (https://www.xero.com/uk/).

Do you run a retail shop that shifts to cash basis accounting or a consultancy charging by the hour? The software adapts. Expense Hub, for example, syncs with real-time HMRC changes, flagging discrepancies and eliminating surprises at quarter-end. It’s like having a tax geek in your pocket, but way less annoying at parties.

Detailed Audit Trails: When HMRC Wants to See the Receipts (Literally)

Imagine HMRC launches a spot-check. You need to connect every transaction to a receipt, project, or department. Panic? Not if you have software that builds detailed, immutable audit trails for you (https://rentalbux.com/blogs/best-mtd-software-for-small-business). That means every change is logged, every document is time-stamped, and every transaction is, in effect, future-proofed.

Here’s the twist: Many platforms claim to be audit-friendly. But look for those that offer full traceability—linking payments, receipts, even the adjustment history—so an inspector can retrace your steps without detective fiction. (If you want to dig deeper, check out Understanding Audit Trails for strategies that stand up in real HMRC reviews.)

Pro tip: Expense Hub stands out here, leveraging AI-enhanced OCR, live compliance updates, and seamless Xero integration, mapping each coffee, taxi, and sandwich directly to your Chart of Accounts with astonishing precision.

Why Your Expense Audit Trail Matters More Than You Think (Hint: It’s What Keeps HMRC Happy)

The Not-So-Obvious Role of Expense Audit Trails for HMRC

I’ll put it bluntly: HMRC does not care how passionate you are about your small-batch oat milk subscriptions—if you have no audit trail, you’re toast. An expense audit trail HMRC accepts is a digital, chronological breadcrumb path. From receipt capture, categorization, and claim approval, it chronicles every step (https://www.clearbooks.co.uk/free-mtd-software/).

Let’s break it down, “napkin math” style:

- Every expense = dollar spent × digital record.

- No record = £0 in allowable expenses during an audit.

- Incomplete audit trail = possible fines, claim rejection, or—worst—an extended HMRC review.

If you’re thinking “but I’ve never been audited,” congratulations. But the digital trail isn’t just for that one-in-ten scenario. It pays dividends every VAT quarter and is your secret weapon in reversing expensive mistakes, tracing errors, and—most importantly—offering total peace of mind (https://rentalbux.com/blogs/best-mtd-software-for-small-business).

How Expense Hub Makes Audit Trails Simple (and Actually Useful)

Let’s face it: no one starts a business for the thrill of paperwork. Expense Hub gets this. Its automated report generation means every transaction is audit-ready—no frantic scrabbling for emails, no incomplete Excel tabs. Every receipt, policy decision, and approval is stored securely and transparently.

You want workflows enforced by your expense audit trail HMRC loves? Expense Hub locks down approvals, logs every action, and ensures every manager leaves a digital signature, so blame is traceable—sorry, I mean, accountability is robust (https://www.mobilexpense.com/en/blog/expense-management-solution-uk).

“Expense Hub turned what used to be an end-of-quarter nightmare into a five-minute review. When HMRC called, we had everything ready, start to finish—without a single late night.” – Actual user, probably sipping tea as you read this

If you’re still wondering why automation matters, imagine doing all of this by hand. Now, imagine it’s automated, and you can get back to growing your business (or practicing your Bake Off audition—no judgment here).

Mastering HMRC Expense Rules and Compliance in the UK (Without Going Cross-Eyed)

What Are the Core Rules HMRC Expects You to Follow?

HMRC, like an overzealous school teacher, has a checklist. And if you miss a box, it’s after-school detention (read: fines).

Here are the big ones:

- MTD Digital Records: Every expense must be stored digitally, not scribbled on a gum wrapper (https://rentalbux.com/blogs/best-mtd-software-for-small-business).

- VAT Tracking: Capture and reclaim VAT accurately, every time. No “guesstimates.” Miss a penny, and you’re leaving money on the table—or, worse, opening yourself up to penalties (https://www.xero.com/uk/).

- Simple Expense Categories for Cash Basis: For small businesses using the cash basis, simplified expense claims are permitted, but only if items are clearly categorized and tracked (https://www.gov.uk/government/publications/record-keeping-and-simpler-income-tax-applicationssoftware).

If you use non-compliant expense methods or the wrong software, expect issues—manual VAT miscategorization is one of the most common audit triggers (https://www.glencoyne.com/guides/expense-management-apps-uk-startups).

Here’s a stark analogy: Non-compliant expense management is a bit like driving without seatbelts—most days, you’re fine, until you’re not. And when the accident comes, the consequences are severe.

Compliance by Default: How the Right Software Shields You

Why gamble? Smart platforms like Expense Hub (and industry stalwarts like Xero or QuickBooks) monitor HMRC’s rulebook, so you don’t have to (https://quickbooks.intuit.com/uk/making-tax-digital/software/). When MTD introduces a new quarterly requirement or VAT rate, your software updates instantly—you just keep snapping receipts.

For a more detailed breakdown, check out Expense Compliance Essentials, your go-to guide on meeting—and exceeding—HMRC’s expectations without breaking a sweat.

Expense Hub remains laser-focused here. Automatic policy updates, live VAT calculations, and airtight audit logs mean your compliance is as reliable as your morning cuppa. No need for frantic research when tax season hits—the software’s already done the homework.

Choosing the Right Software: Why Expense Hub Deserves a Starring Role on Your Shortlist

Scaling with Confidence: From Scrappy Startup to Enterprise Giant

Software is like a pair of boots—if it doesn’t fit, it blisters, pinches, and slows you down. Same goes for expense software. Startups may have two users and £20k in expenses. Six months later, after winning a big contract, you’ve got a team sprawled across the country with expenses multiplying like rabbits.

Scalability matters. Expense Hub supports multi-user access, approval workflows, and department-level rules, growing along with you (https://rentalbux.com/blogs/best-mtd-software-for-small-business). No need for a rip-and-replace panic two years in—just add new users, define new projects, and let the software absorb the complexity.

User-Friendliness: Because If It Isn’t Easy, No One Will Use It

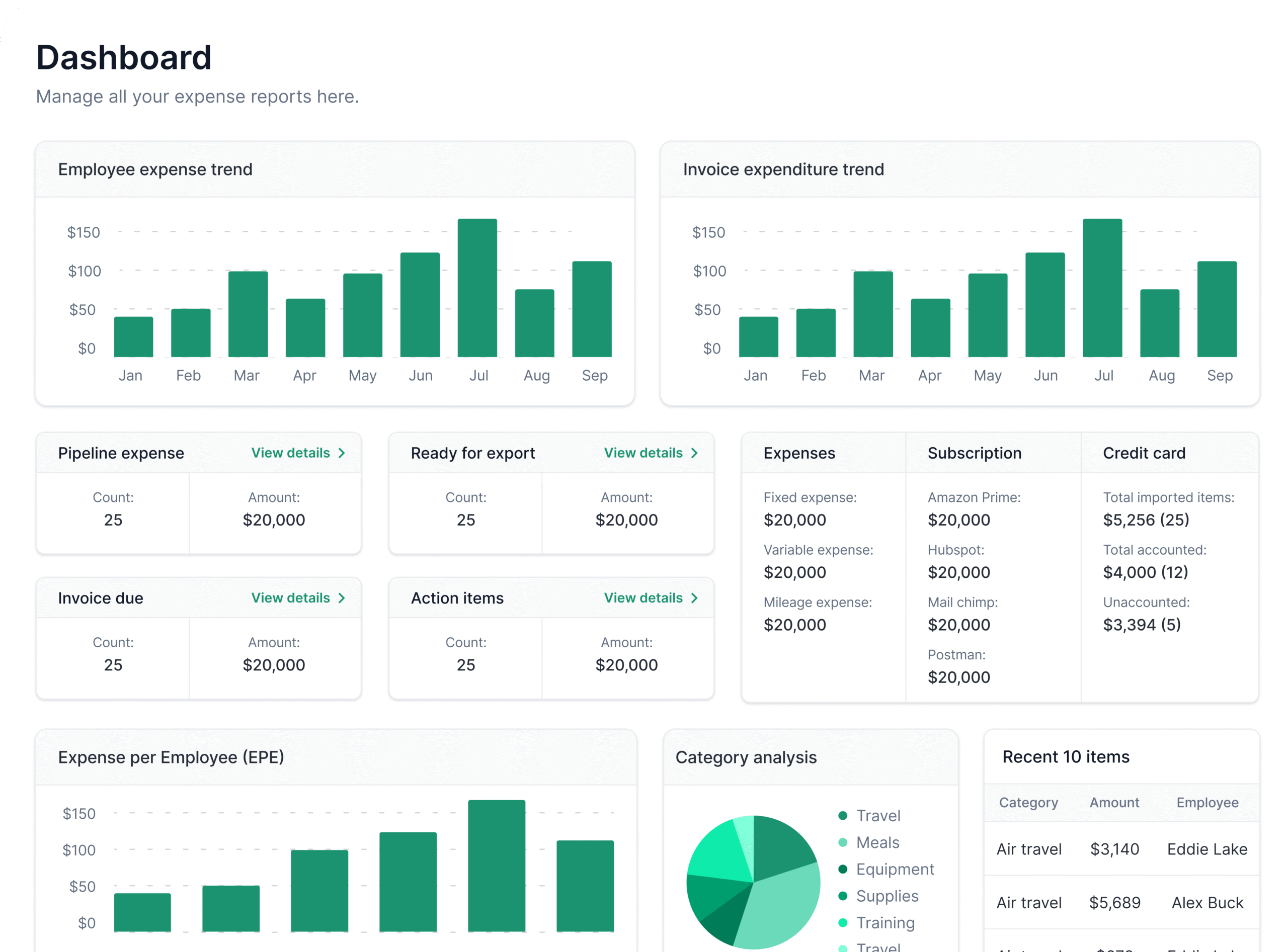

Ever tried getting your team to use clunky, confusing software? About as much fun as pulling teeth with a pliers from the toolbox. With Expense Hub, mobile scanning, real-time reconciliation, and a dashboard designed for actual humans (not accounting robots) means expense capture becomes second nature (https://www.mobilexpense.com/en/blog/expense-management-solution-uk).

- Snap a picture of a receipt during lunch? Auto-logged.

- Approve on your phone while waiting for your train? Done.

- Integrate with Xero or Sage without calling tech support? Effortless.

Jane (remember her?) used to hate expense claims. Now she loves showing off how quickly she files them (“Look, Mum!”). Adoption skyrockets—and so does your data accuracy.

Customer Support: Never Left in the Lurch

Technology’s marvellous—until it isn’t. That’s why smart businesses pick software with responsive, UK-based support. Whether you’re onboarding, integrating with new accounting tools, or handling a perplexing HMRC query, you want answers fast—preferably before the coffee even cools.

Expense Hub nails this, providing hand-holding for new users, integration help, and compliance advice (https://www.xero.com/uk/). You’re never left wandering the digital wilderness alone.

The X-Factor: What Real Businesses Say

“Expense Hub transformed our month-end. No more late-night reconciliation, no panic before the accountant calls. It’s simply ‘download and done.’”

“As a growing business, Expense Hub scaled with us—no new headaches, just time saved every quarter.”

Its robust, compliance-forward automation mirrors the best of Declaree’s AI and Xero’s MTD-readiness, but blends that with the UK-centric support mid-sized businesses need most.

Want to Win at MTD? Here’s Your Next Step.

Let’s recap: The best HMRC compliant expense software doesn’t just tick boxes—it lets you sleep well, plan better, and focus on growing your business, not firefighting admin disasters. Solutions like Expense Hub bake in up-to-date compliance, automate VAT and reporting, and lock in audit trails HMRC wants (https://rentalbux.com/blogs/best-mtd-software-for-small-business).

If your current system makes quarter-end feel like scaling Everest in slippers, it’s time to change. Test integrations, assess scalability (today and tomorrow), and run a real demo before you buy. You’ll see why businesses across the UK trust Expense Hub to take the pain—and penalty risk—out of expense management (https://blog.expensehub.io/improve-expense-finance-process-reporting).

Need some official bedtime reading? Browse the HMRC Record-Keeping Guidelines to see exactly why the digital trail matters.

Ready to future-proof your business? Start with a free demo or trial of Expense Hub—see for yourself how this one lean switch can save you hours, fines, and a whole world of hassle.

The coffee is on you. The admin? Leave that to Expense Hub.