Navigating Staff Parties and Gifts: Understanding HMRC’s Tax Rules (And Why They Matter More Than You Think)

Picture this: It’s December. You’re knee-deep in tinsel, those notorious “Secret Santa” gifts are starting to stack up, and someone (looking at you, Janet from accounts) is already lobbying for a karaoke machine at the office Christmas bash. You want to show appreciation for your team—of course you do—but lurking in the corner is something scarier than a cold sausage roll: an unexpected letter from HMRC because you’ve fluffed the staff parties and gifts tax rules.

Let me save you the spreadsheet-induced headaches. The rules aren’t just bureaucratic red tape—they’re a financial tightrope you have to walk if you want to boost morale and keep the taxman from knocking on your door in the new year. Ignore them, and you risk surprise tax liabilities, National Insurance charges, and even penalties hefty enough to make your accountant faint.

That’s why we’re tearing open the HRMC guidance gift box, ribbon and all, to show you exactly what’s taxable, what’s not, and how to come out looking like the world’s most generous, savvy boss. And to make it all click—Expense Hub is the backstage pass to tracking, categorizing, and reporting every expense in real time, so you can celebrate and reward without fear.

Why HMRC’s Staff Parties and Gifts Tax Rules Are Not Just “Nice to Know”

—They’re Make-or-Break for Your Business

Why Bother?

Let’s get this out in the open: compliance isn’t just a typo away from disaster; it’s the difference between a boisterous party with “dancing queens” and a tense Monday morning with Her Majesty’s Revenue and Customs (HMRC) frowning at your “gifts for staff.”

I’ve seen this play out: a company throws a lavish “thank you” event, generously stuffs goodie bags, but forgets HMRC’s tricky thresholds. Suddenly, they’re navigating P11D forms, reporting extra tax, and footing National Insurance bills. The fun drains faster than a pint at the office party.

Here’s the reality—HMRC does allow tax-free parties and gifts… with sharp-edged caveats:

- The annual party must, yes must, cost under £150 per head and be open to all employees.

- Gifts called “trivial benefits” must not exceed £50 per item, can’t be cash or performance incentives, and shouldn’t repeat so predictably that staff start planning next year’s haul.

Break these rules, and you not only lose the exemption but open Pandora’s box of tax, NICs, and paperwork—all reportable via your payroll or a PAYE Settlement Agreement (PSA). Think you’re safe? Read https://www.gov.uk/expenses-benefits-social-functions-parties/whats-exempt. It’s like the holiday card nobody wants, but everyone needs.

Enter, Expense Hub: Your Compliance Sidekick

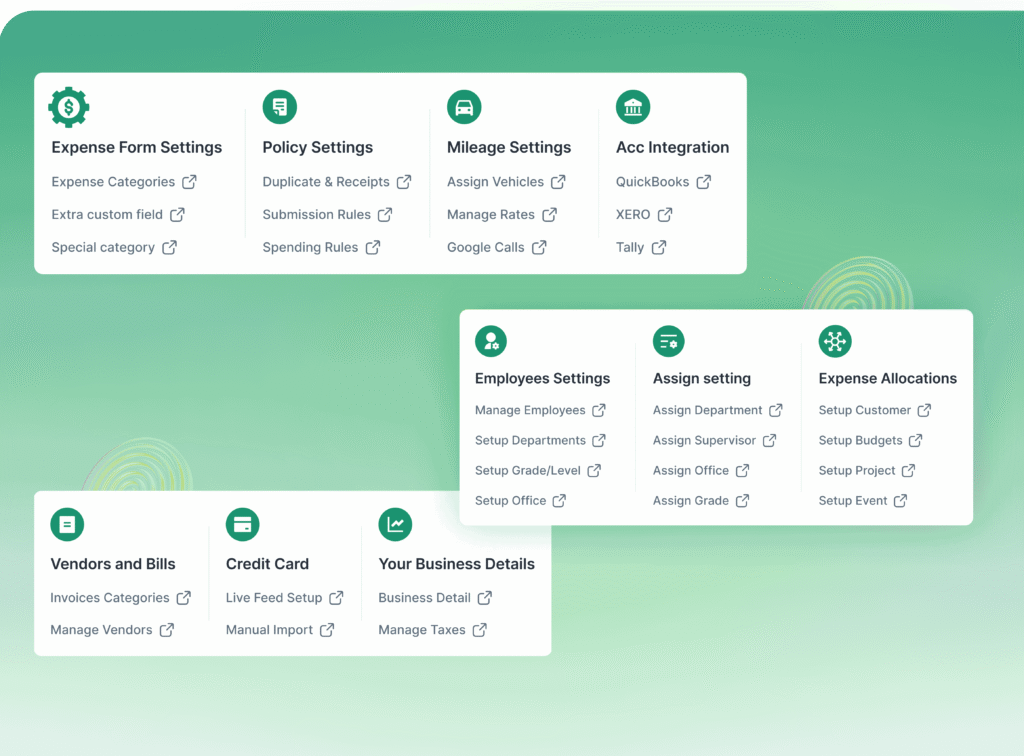

Paper tracking is great… if your business runs on typewriters and tea trolleys. Today? You need tools. Expense Hub slides in as your digital superhero, monitoring staff party and gift spends in real time, auto-categorizing every expense, and generating reports that speak fluent HMRC. Forget about the “Did we go over the limit?” panic—Expense Hub flags it for you, leaving you to focus on what matters: building a smashing company culture — tax-man approved.

1. Understanding Staff Parties and Gifts Tax Rules

What HMRC *Really* Wants (and How Not to Annoy Them)

Let me break it down, “napkin math” style: if your company hosts a staff party that fits all HMRC’s neat, tick-box criteria, it’s party on—tax free. Miss a box, and it’s party off—taxable. Here are the fundamentals to stay on the right side:

- Annual Party: To qualify, your event must be regular (think Christmas, Summer BBQ, etc.), open to every employee, and the total cost (including venue, entertainment, and even taxis home) must not exceed £150 per guest, including plus-ones.

- Gifts (Trivial Benefits): Any token you gift needs to be under £50 per pop, can’t be cash or a direct performance reward, and for directors, there’s an annual cap of £300. Surpass any threshold—even by a penny—and you’ve built a taxable benefit for the whole lot.

Let’s put this in practice. Imagine you host an annual shindig:

- 30 employees, each with a plus-one (because you’re that kind of boss)

- Venue, food, karaoke machine rental—total bill: £8,400

- £8,400 ÷ 60 people = £140 per head

Result: You’re golden! Tax-free, hassle-free. But if the drinks tab crept up and the total hit £9,200, the price per head jumps to £153.33. Now, every attendee’s full share becomes a taxable benefit. Not just the amount over £150—the whole thing (check the details yourself on https://www.gov.uk/expenses-benefits-social-functions-parties/whats-exempt). It’s less “Happy Holidays!” and more “Happy Paperwork…”

You might find it useful to refer to our https://blog.expensehub.io/understanding-compliance-in-expense-management/ post for more insights on staying compliant with HMRC rules.

Why The Fuss?

Because tax rules are designed to separate “genuine employee perks” from disguised remuneration. The government wants staff to enjoy themselves, but not at the taxpayer’s expense—literally.

Missed It By That Much:

A firm decided to give branded Bluetooth speakers (“Great for productivity, right?”) but forgot each gadget cost £55. That £5 tip into the “over limit” world triggered not just tax liability on that gift, but also Class 1A National Insurance—plus admin headaches, forms, and a not-so-merry P11D (see full explanation on https://www.hawsons.co.uk/christmas-tax-guide/).

For more details on managing business expenses effectively, see our https://blog.expensehub.io/mastering-business-expenses-management/.

That’s the kind of nap—err, “napkin math mishap”—Expense Hub is engineered to police. With automated categorization and real-time VAT tracking, Expense Hub ensures you can prove every penny stayed below the threshold come audit-time.

2. The Unsung Hero: Annual Party Allowance HMRC (Yes, There’s a Rule Just for This)

What Is It, and Why Should You Care?

You might think HMRC has a Grinch-like attitude toward fun. Actually, they’re surprisingly generous—if you play by the rules. Annual party allowance HMRC rules explicitly encourage companies to celebrate their people, tax-free.

The Three Magic Ingredients:

- Open Invitation: All staff must have the option to attend (no “directors only” soirees—HRMC smells favoritism a mile off).

- Annual Happening: It needs to recur, at least in theory. A once-in-a-career company jolly-up doesn’t cut it.

- The £150 Rule: The golden number. If your total per-person cost, including every glass of prosecco and after-party Uber, is £150 or less… congrats! It’s tax-deductible. Go beyond, and yes, the entire cost becomes taxable.

And yes—virtual events can qualify. So if your team Zooms into a trivia night with posted snack boxes, you’re in the clear if you tally the numbers right (https://www.gov.uk/expenses-benefits-social-functions-parties/whats-exempt).

Why It Matters: The Morale and Money Angle

Put on your business cap: Staff morale matters. Happy teams stick around, work smarter, and make you look good. But here’s the kicker—a party inside HMRC’s allowance doubles as a tax-efficient benefit: no income tax or National Insurance for the staff, deductible for Corporation Tax, and (if you’re VAT-registered) input VAT can often be recovered. That’s a win-win-win.

Explore how to maximize savings and streamline financial processes with our https://blog.expensehub.io/unlocking-efficiency-expense-management-software.

What If You Get It Wrong?

Here’s a classic gaffe: A firm proudly hosts two team events. Spring bash: £80/head. December dinner: £130/head.

You can split the £150 allowance over multiple events, as long as the combined total for any one employee doesn’t exceed the limit. But the moment an individual attends events totaling more than £150—the first £150 stays tax-free, everything beyond is taxable. See the full play-by-play in the https://sadlerdavies.co.uk/the-ultimate-christmas-tax-guide-for-businesses-2025-edition/.

How Expense Hub Makes Allowances… Allowable

Tracking one event in a ledger is hard enough; juggle two or three and chaos ensues. Expense Hub turns this digital maze into a clear path—tracking spend per event, flagging overages the moment they’re breached, even generating real-time reports so when HMRC asks for “proof,” you’re armed to the teeth. Want razor-sharp budgeting tips for staff parties? Check out our guide on link-to-company-budgeting-strategies.

3. Tax on Gifts: Navigating the Complexities

“Tax on Staff Gifts UK” — It’s Not as Jolly as It Sounds

Giving gifts sounds simple…until you step into HMRC’s world of definitions, thresholds, and exceptions. Here’s what businesses get wrong (and how you can get it right).

What Qualifies as a Gift?

- Trivial Benefits: Gifts under £50 per item, not in cash or cash vouchers, genuinely given as a perk (not for hitting targets), and not contractually required.

- Directors’ Catch: If you’re a director of a “close company,” you max out at £300 in trivial benefits per tax year.

Give a £30 Amazon voucher? All good (for the employee; for you, it’s still not a business expense for tax purposes, but it’s at least not taxable on the employee if the other criteria are met). Slip in a £20 note? That’s cash—always taxable—HMRC keeps a close eye on these.

True Story: When “Just a Little Gift” Breaks the Bank

A manager sent £70 bottles of wine to five team members. Sweet gesture, but there’s no pro-rata forgiveness here: every bottle’s value triggers payroll reporting and employer National Insurance. The admin cost far outweighed the gift.

Curious about managing other business expenses and claims effectively? Learn more in https://blog.expensehub.io/sundry-small-business-expenses-uk-2025-what-you-can-and-cant-claim-the-complete-guide/.

What Gets You in Trouble

- Exceeding £50 per gift, even by a penny—no partial exemption, the whole thing is now taxable.

- Making gifts a routine expectation (e.g., “every Friday, everyone gets a box of chocolates”)—these might not stay “trivial;” they start to look like disguised pay (https://www.hawsons.co.uk/christmas-tax-guide/).

- Using cash or cash vouchers: Always triggers tax/NIC.

Expense Hub: The Watchful Gifting Elf

Manual records are the quickest way to miss a limit or forget who received what. Expense Hub is built for the specifics of “tax on staff gifts UK,” logging every gift, flagging if you’re venturing near that £50 cliff, and integrating with payroll. No more “I thought it was fine!”—it’s provable and compliant. Need more strategies? Dive into our link-to-efficient-expense-management resource.

4. Understanding Trivial Benefits and HMRC Guidance

“Trivial Benefits HMRC Guidance”: Little Perks, Big Tax Traps

HMRC isn’t blind to everyday gestures—a birthday cake in the break room, a “thank you” mug, or coffee shop gift cards can all be tax-free. But repeat after me: only if you tick the “trivial benefits HMRC guidance” checklist:

- Individual value under £50

- Not cash or a cash voucher

- Not contractual or performance-based

- Directors can only claim up to £300 a year

Real-World Examples (and Pitfalls):

- Gift cards for a birthday: Fine, as long as each is under £50 and not paid as a “well done” for smashing sales goals.

- Small festive hampers: Perfect, unless you sneak in a high-value bottle. (Remember, it’s the full value of the gift, not what you wish it was worth.)

- Repeated, predictable perks: If the Friday chocolate box becomes a staff expectation, those benefits may become taxable because they’re no longer “trivial” or “occasional” (https://www.gov.uk/expenses-benefits-social-functions-parties/trivial-benefits).

For directors? Watch that £300 cap. Even with five £50 gifts, add a £51 treat and—bam—you’re in tax territory.

Expense Hub: Your Trivial Benefits GPS

Expense Hub’s compliance engine doesn’t just track spend; it autodetects trivial benefits versus taxable perks, cataloguing evidence and monitoring running totals per employee (or director). That means no P11D dread and no sudden tax bills. Keen to boost your perks strategy while staying in the clear? Check out link-to-optimizing-employee-perks for smart, compliant ideas.

5. Expense Hub’s Role in Tax Compliance and Efficient Expense Management

The Beating Heart of Stress-Free Staff Perks

Let’s be honest—staff entertainment and rewarding perks make your workplace magnetic. But the real magic is keeping the fun and the finances right, every single time. That’s where Expense Hub shines, turning HMRC compliance from a paper chase into a one-click solution.

How Expense Hub Saves You From Nightmares:

- Centralizes Tracking: Every party, every gift, every perk—logged in one place, viewable for any period.

- Threshold Alerts: Get pinged the second you’re nearing (or breaching) the £150 or £50 per-head limits, well before you start filling in dreaded forms.

- Automated VAT Apportionment: Mixed events? Some clients or guests joined? Expense Hub’s wizardry slices out non-allowable VAT and prepares reports for your return.

- Custom Reports for HMRC: End-of-year submission? One click generates all the summaries, so you’re literate in HMRC-ese, not just Excel-ese.

- Integrates with Finance Systems: Runs hand-in-glove with your payroll and accounting, making those P11D or PSA tasks not just manageable but—dare I say—simple.

Explore our https://blog.expensehub.io/mastering-expense-management-a-finance-manager-guide/ to learn more about effective strategies for handling business expenses.

Case in Point:

A fast-growing marketing agency ditched their ad-hoc spreadsheets after a close shave with a PSA penalty over a summer party. They switched to Expense Hub. Result? Instant alerts when their per-head cost crept to £148; they pivoted their after-party plans, stayed tax-free, and saved four hours of monthly admin. That’s time for team building, not box-ticking.

Expense Hub lets you focus on creating a magnetic company culture, while the compliance is quietly—and flawlessly—handled in the background.

Wrapping Up (With a Bow): Don’t Let the Taxman Spoil the Party

Here’s the napkin-math summary: HMRC isn’t out to crush the fun—but the rules are strict, the penalties real, and the definitions easy to miss. If you want to throw unforgettable staff parties and sprinkle gifts like confetti, you need to keep an eagle eye on the fine print:

- Staff party spend per head < £150 – or risk the full value being taxed

- Staff gifts (“trivial benefits”) < £50, non-cash, not performance-based

- Directors can claim up to £300 per tax year in trivial benefits

- Party or gift non-compliance? Welcome to P11Ds and payroll penalties!

With Expense Hub, you get more than a tracking tool; you get peace of mind, ruthless precision, and freedom from tax panic, so you can reward your team for what they do, not just if you filled in the right forms after.

So ask yourself: Would you rather spend December playing spreadsheet detective, or celebrating with your dream team—confident you’re both generous and compliant?

Further improve your financial control with smart strategies in our https://blog.expensehub.io/expense-management-integration-guide/.

Ready to Take Control of Your Staff Parties and Gifts?

You know the rules, you’ve seen the power of HMRC-friendly tracking, so why risk a “close enough” approach? Expense Hub turns your good intentions into airtight compliance—every event, every gift, every perk, every time. Make this the year you stop worrying whether your party will cost you a tax investigation and start focusing on building a team that loves coming to work and to parties!

Curious about the specifics? Check out https://www.gov.uk/expenses-benefits-social-functions-parties/whats-exempt. Prefer real-world advice? Partner up with reputable accountants who know these waters well. Or, if you’re ready for effortless compliance, see what Expense Hub can automate for you—today.

Because when it comes to staff parties and gifts, “just winging it” is the most expensive route of all. Let’s celebrate… and keep the taxman smiling, too.