Organizations worldwide are experiencing a transformative shift in financial management through the strategic adoption of expense management analytics. As businesses generate vast volumes of financial data across transactions, travel expenses, and operational costs, the ability to analyze and extract actionable insights has become a critical competitive advantage. Modern expense management analytics empowers finance teams to move beyond reactive expense processing toward proactive financial planning that drives measurable business outcomes.

The power of expense management analytics lies in its ability to transform raw financial data into strategic intelligence. Finance professionals can now predict future spending patterns, identify cost-saving opportunities before they impact budgets, detect anomalous transactions that signal policy violations, and optimize resource allocation across departments. This capability represents a fundamental evolution from traditional expense tracking to sophisticated financial intelligence that supports strategic decision-making at every organizational level.

The Explosive Growth of Expense Management Software Market

The global expense management software market is experiencing unprecedented growth, reflecting widespread recognition of the strategic value these platforms deliver. Industry analysts project the market will expand from $7.08 billion in 2023 to $16.69 billion by 2032, representing a compound annual growth rate exceeding 9.5%. This remarkable growth trajectory underscores the increasing reliance organizations place on automated expense management systems that incorporate advanced analytics capabilities.

Several converging factors drive this explosive market expansion. Digital transformation initiatives across industries have created demand for cloud-based financial management solutions that provide real-time visibility into organizational spending. Regulatory compliance requirements have become increasingly complex, requiring sophisticated systems that automatically enforce policy rules and maintain comprehensive audit trails. Additionally, the shift toward remote and hybrid work models has necessitated expense automation tools that support distributed workforces while maintaining financial control.

Regional Market Dynamics

North America has emerged as the dominant regional market, capturing over 41% of global expense management software market share in 2023. This regional leadership reflects several factors including the concentrated presence of multinational corporations requiring comprehensive expense management solutions, high adoption rates of enterprise technology, and mature regulatory frameworks that incentivize automated compliance systems. The region’s strong technology infrastructure and early adoption of cloud-based financial platforms have created favorable conditions for expense management software proliferation.

However, growth is accelerating in emerging markets where businesses are leapfrogging traditional manual expense processes to adopt cloud-based analytics platforms. Organizations in these regions recognize that implementing modern expense reporting software from the outset provides competitive advantages over competitors burdened by legacy systems and manual processes.

Strategic Importance of Effective Expense Management

Effective expense management has evolved from a back-office administrative function to a strategic capability that directly influences organizational financial health and competitive positioning. Finance leaders recognize that sophisticated expense management systems deliver value across multiple dimensions including profitability enhancement, risk mitigation, and stakeholder confidence.

Direct Impact on Profitability

Expense management analytics directly impacts organizational profitability by identifying cost reduction opportunities, eliminating unnecessary spending, and optimizing resource allocation. Research by McKinsey demonstrates that companies implementing data-driven expense management strategies typically achieve cost reductions of 15-25% within the first year. These savings result from improved visibility into spending patterns, enhanced policy compliance, and elimination of fraudulent or erroneous transactions.

Organizations leveraging expense analytics can identify spending trends across categories, departments, and time periods to uncover patterns that inform strategic decisions. For example, analytics might reveal that travel expenses to specific regions consistently exceed budgets, prompting renegotiation of preferred vendor contracts or policy adjustments. Similarly, pattern analysis can identify departments with unusually high expense levels, triggering investigations that uncover process inefficiencies or policy violations.

Enhanced Stakeholder Confidence

Robust expense management systems enhance stakeholder confidence by demonstrating organizational commitment to financial discipline and transparency. Investors, board members, and shareholders scrutinize expense management practices as indicators of overall financial stewardship. Organizations with sophisticated analytics capabilities can provide detailed expense reporting that addresses stakeholder questions, supports strategic planning discussions, and demonstrates accountability for resource utilization.

Modern expense management platforms generate comprehensive reports and dashboards that present complex financial data in accessible formats. These visualizations enable stakeholders without financial expertise to understand spending patterns, evaluate budget performance, and assess the effectiveness of cost control measures. This transparency strengthens stakeholder relationships and supports informed decision-making at governance levels.

Risk Mitigation and Compliance

Expense management analytics plays a critical role in identifying and mitigating financial risks including fraud, policy violations, and compliance failures. Advanced analytics systems employ pattern recognition algorithms that flag suspicious transactions, identify duplicate expense submissions, and detect anomalies that warrant investigation. Organizations implementing these capabilities typically experience significant reductions in fraudulent expense claims and policy violations.

Compliance with regulatory requirements represents another critical dimension of expense management. Organizations must navigate complex tax regulations, industry-specific requirements, and jurisdictional variations in expense treatment. Analytics systems that incorporate HMRC compliance requirements and other regulatory frameworks ensure organizations maintain appropriate documentation, apply correct tax treatment, and generate required reports.

Big Data Analytics Revolutionizing Financial Management

Big data analytics has emerged as a transformative force in financial management, enabling organizations to extract insights from massive datasets that were previously too complex to analyze effectively. The big data analytics market in finance is projected to grow from $6.97 million in 2023 to $19.72 million by 2028, reflecting accelerating adoption across the financial services sector and corporate finance functions.

Predictive Analytics for Expense Forecasting

Predictive analytics represents one of the most powerful applications of big data in expense management, enabling organizations to forecast future spending with unprecedented accuracy. By analyzing historical expense data, seasonal patterns, business growth trajectories, and external factors, predictive models generate forecasts that inform budget planning, resource allocation, and strategic decision-making. This capability transforms expense management from a reactive process focused on tracking past spending to a proactive function that anticipates future needs.

Organizations implementing predictive expense analytics can model various scenarios to evaluate how different factors might impact spending. For example, finance teams can assess how headcount growth, market expansion, or changes in travel policies might affect future expenses. These scenario analyses support strategic planning by quantifying the financial implications of business decisions before commitments are made. Finance professionals can provide executive teams with data-driven recommendations that balance growth objectives with financial sustainability.

Artificial Intelligence Integration

Artificial intelligence is fundamentally transforming expense management by automating complex analytical tasks, enhancing fraud detection, and providing intelligent recommendations. AI-powered systems learn from historical data to identify normal spending patterns, enabling them to flag anomalies that might indicate fraud, errors, or policy violations. Machine learning algorithms continuously improve their accuracy as they process more data, becoming increasingly effective at distinguishing legitimate expenses from problematic transactions.

Natural language processing capabilities enable AI systems to extract information from receipts, invoices, and expense descriptions without manual data entry. These systems can categorize expenses, validate amounts against policy limits, and route submissions for appropriate approvals. By automating these routine tasks, AI frees finance professionals to focus on strategic analysis and exception handling that requires human judgment.

AI integration also enhances user experiences by providing intelligent assistance during expense submission. Systems can suggest appropriate expense categories, alert employees to policy limits before expenses are incurred, and provide guidance on documentation requirements. This proactive assistance reduces errors, accelerates expense processing, and improves employee satisfaction with expense management processes.

Automation Transforming Expense Management Operations

Automation has become the cornerstone of modern expense management, delivering transformative benefits across cost reduction, accuracy improvement, and operational efficiency. Organizations implementing automated expense management processes achieve average cost reductions of 30% while simultaneously improving processing speed and data accuracy.

Substantial Cost Reduction

The financial impact of expense management automation extends across multiple dimensions. Organizations save substantial costs by reducing manual labor requirements, with automated systems eliminating the need for data entry staff, reducing finance team processing time, and accelerating approval cycles. Research by the Aberdeen Group demonstrates that automation can save over 30,000 hours annually for mid-sized organizations, translating directly to significant cost savings.

Automation also reduces costs associated with errors and fraud. Manual expense reporting exhibits error rates averaging 17%, requiring costly reconciliation efforts and potentially resulting in overpayments or compliance violations. Automated systems validate expenses in real-time, enforce policy compliance at the point of submission, and flag suspicious transactions for review. By preventing errors before they enter the financial system, automation eliminates downstream correction costs and reduces audit expenses.

Paperwork reduction represents another significant cost benefit. Traditional expense management requires physical storage of receipts, manual filing systems, and extensive administrative overhead. Digital systems eliminate these requirements through electronic document management, reducing storage costs, improving document retrieval, and supporting environmental sustainability initiatives. Organizations implementing digital expense reporting typically achieve full return on investment within 12-18 months through combined cost savings across these areas.

Enhanced Compliance and Error Reduction

Automated expense management systems dramatically improve policy compliance and reduce error rates through real-time validation and enforcement mechanisms. These systems incorporate organizational policies as configurable rules that automatically evaluate each expense submission against defined criteria. When employees submit expenses that violate policies, systems immediately notify them and prevent approval routing until issues are resolved.

Precise expense tracking capabilities ensure every transaction is accurately recorded with appropriate supporting documentation. Receipt capture technology using optical character recognition extracts data from photographs, eliminating manual transcription and associated errors. Automated mileage tracking applications capture accurate distance records without requiring manual logbooks, ensuring compliance with tax regulations while reducing administrative burden on employees.

Audit trail capabilities provide comprehensive documentation of expense lifecycle from submission through approval to payment. These audit trails support internal reviews, external audits, and regulatory inquiries by providing complete visibility into expense processing. Organizations can quickly retrieve expense documentation, demonstrate policy compliance, and identify process improvements based on historical data analysis.

Travel and Expense Management Software Market Expansion

The travel and expense management software market is experiencing explosive growth, projected to increase from $3.19 billion in 2023 to $15.7 billion by 2032. This remarkable expansion reflects the strategic value organizations derive from integrated platforms that manage the complete travel and expense lifecycle from booking through reimbursement.

Integrated Platform Benefits

Modern travel and expense management platforms provide seamless integration across booking, expense capture, policy enforcement, and financial reporting. Employees can book travel through corporate platforms that automatically enforce policy guidelines, capture transaction data in expense management systems, and provide real-time visibility into travel spending. This integration eliminates manual data transfer, reduces errors, and accelerates reimbursement processing.

Organizations benefit from comprehensive visibility into travel expenses that enables strategic vendor negotiations, policy optimization, and budget forecasting. Analytics capabilities provide insights into travel patterns, supplier utilization, and cost drivers that inform procurement strategies. Finance teams can evaluate whether negotiated rates deliver expected savings, identify opportunities to consolidate vendor relationships, and assess the effectiveness of travel policies.

Rising Adoption of Expense Analytics Tools

Industry research indicates that by 2025, 80% of organizations will utilize expense analytics tools, representing a substantial increase from current adoption rates. This trend reflects growing recognition that expense data contains valuable insights that extend beyond basic accounting requirements. Organizations are investing in analytics capabilities that transform expense data into strategic intelligence supporting business planning, risk management, and operational optimization.

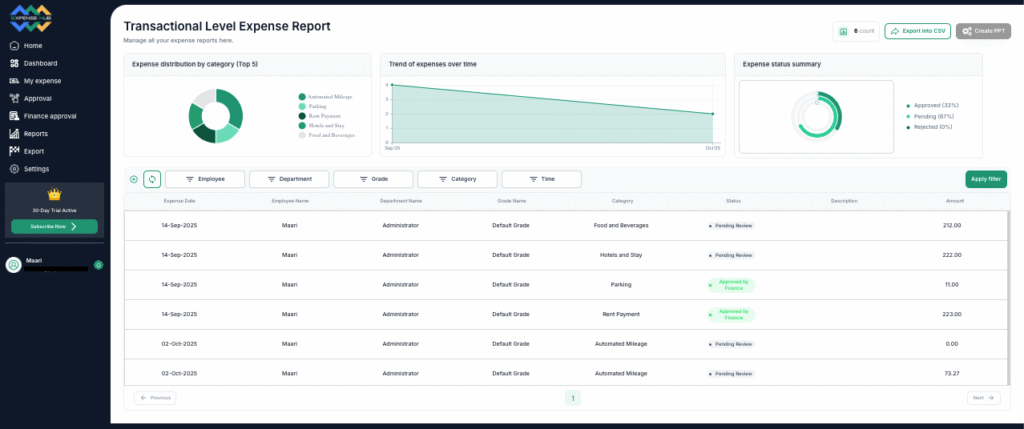

Modern expense analytics platforms provide sophisticated dashboards that visualize spending trends, highlight anomalies, and enable drill-down analysis into specific categories or departments. Finance professionals can quickly identify areas requiring attention, evaluate the impact of policy changes, and generate reports that support strategic discussions with executive leadership. These capabilities transform finance teams from transaction processors to strategic advisors who contribute to organizational decision-making.

Mobile Expense Management Applications Rising Prominence

Mobile expense management applications have become essential tools for organizations supporting remote and traveling workforces. These applications enable employees to capture receipts, submit expenses, and track reimbursement status from smartphones or tablets, eliminating delays associated with traditional expense reporting processes.

Real-Time Expense Capture

Mobile applications enable employees to photograph receipts immediately after transactions, ensuring documentation is captured before receipts are lost or damaged. Optical character recognition technology extracts transaction details from receipt images, automatically populating expense fields and eliminating manual data entry. This immediate capture improves accuracy, accelerates expense submission, and enhances employee satisfaction by minimizing administrative burden.

Real-time expense tracking provides employees with visibility into spending against budgets, remaining allowances, and reimbursement status. This transparency helps employees make informed decisions about discretionary spending and ensures they understand organizational expectations regarding expense management. Mobile notifications alert employees when expenses require additional documentation or have been approved for reimbursement, maintaining engagement throughout the expense lifecycle.

Enhanced Efficiency and Accuracy

Mobile expense management applications deliver substantial efficiency benefits by enabling expense management from any location at any time. Employees no longer need to wait until they return to offices to submit expenses, reducing processing delays and accelerating reimbursement cycles. This flexibility particularly benefits field employees, sales representatives, and frequent travelers who incur expenses regularly but have limited access to traditional office environments.

Accuracy improvements result from automated data capture, policy validation, and integration with corporate card programs. Mobile applications automatically import corporate card transactions, match them with receipt images, and apply appropriate expense categories. This automation eliminates common errors including duplicate submissions, incorrect amounts, and missing documentation that characterize manual expense reporting.

Mid-Market Businesses Leveraging Analytics Power

Mid-market businesses are increasingly adopting expense management analytics, with 76% now leveraging these tools to gain actionable insights from expense data. This adoption reflects recognition that analytics capabilities previously available only to large enterprises are now accessible to organizations of all sizes through cloud-based platforms with flexible pricing models.

Identifying Cost-Saving Opportunities

Mid-market businesses use expense analytics to identify specific opportunities for cost reduction that might otherwise remain hidden in transactional data. By analyzing spending patterns across vendors, categories, and time periods, organizations can pinpoint areas where costs exceed benchmarks, negotiate better rates with suppliers, or adjust policies to align with actual business needs.

Analytics also reveal opportunities to optimize processes and eliminate inefficiencies. For example, analysis might show that certain approval workflows create unnecessary delays, specific expense categories generate disproportionate administrative effort, or particular policies create confusion that leads to high rejection rates. These insights enable organizations to refine processes, clarify policies, and improve overall expense management effectiveness.

Data-Driven Decision Making

Expense analytics empowers mid-market businesses to make strategic decisions based on comprehensive data rather than intuition or limited samples. Finance teams can provide executive leadership with detailed analysis supporting resource allocation decisions, market expansion plans, and operational changes. This data-driven approach reduces risk, improves decision quality, and creates organizational confidence in strategic direction.

Forecasting capabilities enable mid-market businesses to predict future expense requirements with accuracy comparable to larger organizations. By modeling various growth scenarios, finance teams can quantify the expense implications of business decisions before commitments are made. This forward-looking analysis supports strategic planning by ensuring financial resources align with business objectives.

Implementing Expense Management Analytics Successfully

Successful implementation of expense management analytics requires systematic planning, appropriate technology selection, and organizational change management. Organizations should approach analytics implementation as a strategic initiative that transforms financial management capabilities rather than a tactical technology deployment.

Defining Clear Objectives

Implementation should begin with clear articulation of objectives including specific problems to solve, capabilities to develop, and benefits to achieve. Organizations should identify current pain points such as lengthy approval cycles, high error rates, limited spending visibility, or compliance concerns. These pain points become the foundation for requirements that guide technology selection and implementation priorities.

Stakeholder engagement during objective definition ensures analytics implementations address actual business needs. Finance teams should gather input from expense submitters, approving managers, and executive leadership to understand diverse perspectives and requirements. This collaborative approach increases implementation success by ensuring solutions deliver value across the organization.

Selecting Appropriate Technology Platforms

Technology selection significantly impacts implementation success and long-term satisfaction with expense management analytics. Organizations should evaluate platforms based on analytical capabilities, integration requirements, user experience, scalability, and total cost of ownership. Modern platforms should provide real-time dashboards, predictive analytics, mobile access, and integration with accounting systems and corporate card programs.

Organizations should prioritize platforms offering flexible deployment options including cloud-based solutions that minimize infrastructure requirements and enable rapid implementation. Cloud platforms provide automatic updates, scalability to support organizational growth, and accessibility from any location. These characteristics particularly benefit mid-market businesses seeking enterprise-grade capabilities without extensive IT infrastructure investments.

Ensuring Data Quality and Governance

Analytics effectiveness depends fundamentally on data quality, making data governance a critical implementation consideration. Organizations must establish processes ensuring expense data is accurate, complete, and consistently categorized. Data governance policies should define standards for expense categorization, documentation requirements, and validation procedures.

Integration with source systems including corporate cards, travel booking platforms, and accounting software ensures consistent data capture and reduces manual data entry. These integrations improve accuracy, accelerate processing, and provide comprehensive visibility into spending across all channels. Organizations should prioritize implementations that maximize automation and minimize manual data handling.

Future Trends in Expense Management Analytics

Expense management analytics continues evolving in response to technological advances, changing workforce dynamics, and emerging business requirements. Organizations that anticipate and adapt to these trends position themselves to maximize value from expense management investments.

Advanced Artificial Intelligence Capabilities

Artificial intelligence capabilities will continue advancing, enabling increasingly sophisticated analysis and automation. Future systems will provide prescriptive recommendations that go beyond identifying issues to suggesting specific actions. For example, AI might recommend specific policy changes based on analysis of expense patterns, suggest optimal travel booking times to minimize costs, or identify employees who would benefit from additional policy training.

Conversational AI interfaces will enable finance professionals to interact with expense data using natural language queries. Rather than navigating complex report builders, users will ask questions like “Which departments exceeded travel budgets last quarter?” and receive immediate answers with supporting visualizations. This accessibility will democratize analytics, enabling broader organizational engagement with expense data.

Enhanced Integration and Ecosystem Development

Expense management platforms will increasingly integrate with broader financial management ecosystems including accounting systems, procurement platforms, and business intelligence tools. These integrations create comprehensive financial visibility that supports strategic planning and operational decision-making. Organizations will benefit from unified platforms that eliminate data silos and provide holistic views of financial operations.

API-driven architectures will enable organizations to build custom integrations that address unique requirements. This flexibility allows businesses to create tailored solutions that incorporate expense management analytics into existing workflows and systems. Open architectures also facilitate innovation by enabling third-party developers to create specialized applications that extend core platform capabilities.

Sustainability and Environmental Analytics

Environmental sustainability considerations are becoming integral to expense management analytics as organizations seek to measure and reduce carbon footprints. Future platforms will provide carbon impact analysis for travel expenses, enabling organizations to evaluate environmental implications alongside financial costs. This capability supports corporate sustainability commitments while identifying opportunities to reduce both environmental impact and expenses.

Sustainability analytics will enable organizations to track progress toward environmental goals, benchmark performance against industry peers, and demonstrate commitment to stakeholders. Integration with corporate sustainability reporting frameworks will streamline disclosure requirements and enhance credibility of environmental claims.

Conclusion

Expense management analytics has emerged as a strategic capability that fundamentally transforms how organizations manage financial resources, make strategic decisions, and achieve business objectives. By harnessing the power of data analytics, automation, and artificial intelligence, businesses can move beyond reactive expense processing to proactive financial management that delivers measurable competitive advantages.

The explosive growth of the expense management software market—projected to exceed $16 billion by 2032—reflects widespread recognition of the transformative value these platforms deliver. Organizations implementing modern expense management analytics achieve substantial cost reductions, improved compliance, enhanced decision-making capabilities, and greater stakeholder confidence. These benefits extend across organizations of all sizes, with mid-market businesses increasingly leveraging analytics capabilities that were previously available only to large enterprises.

As expense management analytics continues evolving through advances in artificial intelligence, predictive modeling, and mobile technology, organizations that embrace these capabilities position themselves for sustained financial success. The future of expense management lies not in processing transactions but in extracting strategic intelligence that drives business growth, operational efficiency, and competitive advantage. Finance professionals who master expense management analytics transform their roles from administrative processors to strategic advisors who contribute meaningfully to organizational success and sustainable growth.