Unlocking the Power of Travel Expense Analytics for Modern Businesses

Big Numbers, Bigger Problems: Why Travel Expense Analytics Is a 2025 Imperative

Let’s talk numbers. And not the wishy-washy, “someday we’ll get around to it” kind. I mean the kind that make your CFO’s eyebrow twitch.

Picture this: it’s 2025, and business travel is exploding. The economy’s found its sea legs, and suddenly the world’s airports look like ant farms after you’ve poked the nest. According to the experts at https://navan.com/blog/state-of-corporate-travel-and-expense-2025, a whopping 72% of travel managers expect their trip volumes to rise. That’s not a trickle; it’s a tidal wave of expense reports, receipts, and the eternal “Was this bottle of Evian approved?” debates.

Here’s where things get hairy: every company wants value, but most just get vague. (Napkin math: Multiply $1,000 per trip by 1,000 trips, toss in a 10% error rate, and congratulations—you just misplaced $100,000.) It’s no wonder that in an era where every penny needs an assigned bodyguard, travel expense analytics is no longer a dusty line-item on someone’s to-do list. It’s the spotlight on every hidden cost, weird pattern, or expense policy being… let’s say, “creatively interpreted.”

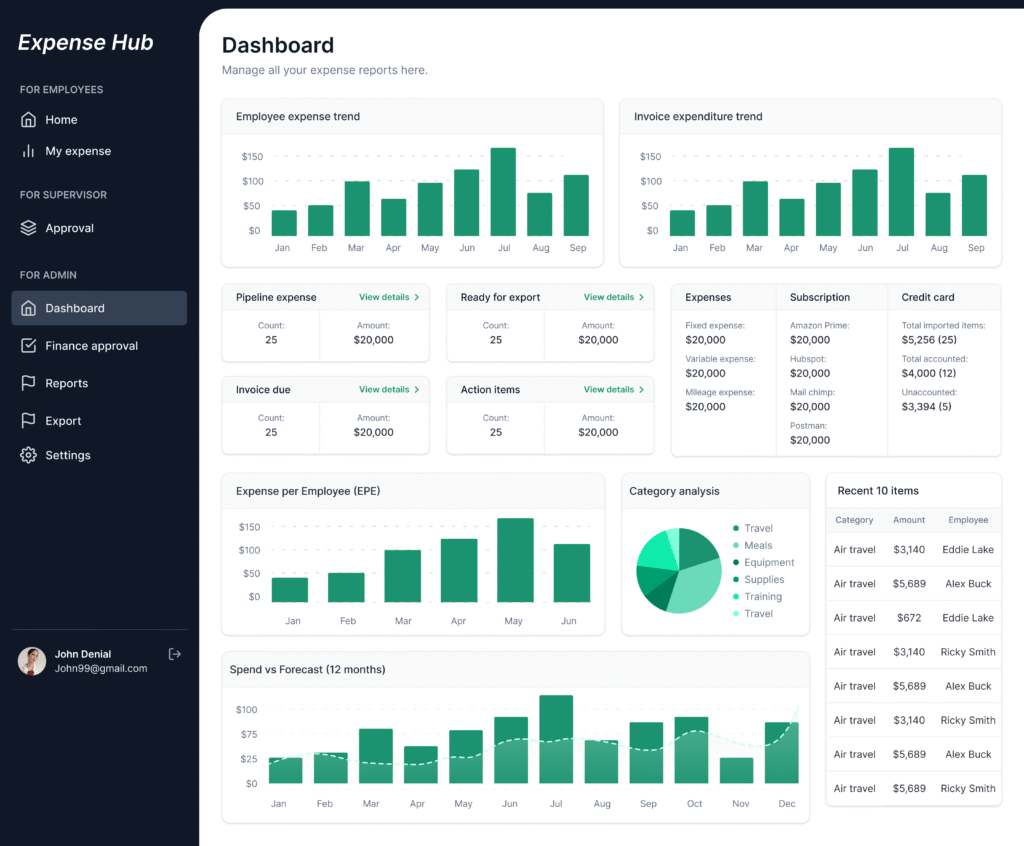

That’s why smart organizations are turning to platforms like Expense Hub. It’s not just a glorified spreadsheet; it’s a full-blown, detective-grade analytics engine. Think of it as your company’s financial “Ctrl+F” for one of the slipperiest parts of your profit-and-loss—business travel.

So, if you’ve ever wondered where your travel dollars actually go, or how to turn a mountain of crumpled receipts into sharp, actionable strategy, buckle up. Because we’re about to dissect travel expense analytics in the style of a business autopsy, using real-world stories, a dash of wit, and insights that go beyond the surface.

What Is Travel Expense Analytics (and Why Should You Care?)

Getting Granular: Beyond Ordinary Number Crunching

Let’s strip away the jargon. At its core, travel expense analytics is the art (yes, art) of collecting, decoding, and making sense of all the money your company spends when employees hit the road, hop a flight, or dare to expense another airport latte. According to https://travelbank.com/blog/travel-tips/how-travel-and-expense-data-analytics-is-redefining-expense-management, it’s about tracking, processing, and analyzing every slice and dice of travel spend—be it hotels, meals, mileage, or mani-pedis cleverly disguised as “client hosting.”

“But I already have monthly reports!” you say. And that’s cute. But traditional expense tracking is like watching a highlight reel after the game is over. Analytics gets you onto the field, play-by-play, with the ability to see where you’re leaking dollars in real time.

Example time: Jane in Sales books three cross-country trips this month. Without analytics, you just see three expensive flights. With analytics, you spot something glaring: Jane’s using three different airlines, missing out on your negotiated corporate rates, and splurging on the “complimentary” breakfast that adds $40 to the bill. Multiply by the Janes in your org—now we’re talking real money.

Check out our https://blog.expensehub.io/tips-to-control-travel-budgets-with-effective-expense-management/ for insights on policy setting and approved vendor practices which could help prevent these types of oversights.

Why Deep Analytics Matters

Here’s what sophisticated travel expense analytics delivers:

- Patterns: Find the “why” behind the “what.” Is Q2 always more expensive than Q1? Why did we splurge on rental cars in Dallas in February?

- Informed Decisions: Should you renegotiate with that swanky hotel chain, or finally admit that everyone would rather stay at the Marriott?

- Policy Enforcement: See who’s following the rules—and gently nudge the repeat offenders toward fiscal sainthood (or at least less fancy dinners).

And Expense Hub takes this headache off your plate. With automated data gathering, you’re no longer shuffling piles of receipts or squinting at faded printouts. It’s all digitized, categorized, and ready to analyze. No more needle-in-haystack searching—just cold, hard visibility on where your cash is hiding (or escaping).

For deeper insights into finance process improvements, visit https://blog.expensehub.io/improve-expense-finance-process-reporting/.

How Travel & Expense Analytics Turbocharge Business Efficiency

From Hours Lost to Minutes Gained

Let’s play a quick game of “Where did Tuesday go?” Ask your team how long it takes to actually submit, approve, and reconcile a business trip’s expenses. If your process includes words like “open the scanner,” “email accounting,” and “chase Bob for the Uber receipt (again),” you’re not alone.

According to https://www.travelperk.com/guides/travel-expense-management, the old system is a productivity sinkhole. Manual tracking, approval bottlenecks, and missing documentation aren’t just mildly annoying—they’re business problems that eat up real money.

Automation: Turning Paperwork into Profit

Automation is your get-out-of-jail-free card. Platforms like Expense Hub use built-in workflows and AI-powered approvals to handle:

- Receipt Matching: No more squinting at faded paper. Modern systems use optical character recognition (OCR) to auto-match receipts with credit card transactions. It’s like magic, but with less glitter.

- Expense Submission: Employees snap a picture, fill in a few fields, and boom—the report builds itself.

- Policy Compliance: Expense Hub flags violations on the fly. Booked first-class when only economy is policy? The system politely (or not-so-politely) says, “Try again.”

And let’s be honest—nobody dreams of growing up to be a paper chaser. By slashing time spent on travel reconciliation, you free up talent for something far more valuable than receipt wrangling: running your business.

Additionally, explore https://blog.expensehub.io/the-role-of-automation-in-the-modern-financial-analyst-toolkit/ more broadly in financial analysis.

“Learn how automation can transform your expense processes.”

(Want to see automation in action? Dive deeper in our guide to Streamlining Expense Processes with Automation.)

Compliance & Fraud: The Quiet Crisis

Here’s a cheeky fact: Almost a quarter of travelers admit to losing receipts. That’s not just a bummer for their memory skills; it’s an open invitation for expense fraud and mistakes. When you rely on manual reviews—or worse, the “trust but verify never” approach—errors (and creative math) slip through.

Expense Hub doesn’t rely on trust alone. Automated checks, receipt validation, and smart alerts mean every line item is scrutinized, without turning your finance team into the holiday Grinch.

Learn more about maintaining compliance in our https://blog.expensehub.io/understanding-compliance-in-expense-management/.

Shedding Light on Spending: The Visibility Revolution

Darkness, Meet Dashboard

Imagine managing your household budget in the dark. You know money goes out, but where? Now raise the stakes to business scale. Visibility isn’t a perk; it’s oxygen for control. As https://www.travelperk.com/guides/travel-expense-management/ (and any tired finance director) will tell you, fragmented data and off-platform bookings are the gremlins of good budgeting.

Why Most Financial Oversight Fails

Excel “Franken-sheets,” endless email chains, and different teams using different tools—sound familiar? When your data lives in silos, you’re running operationally blind. Missed billbacks, out-of-policy charges, and “just this once” exceptions compound like interest on your worst credit card.

Expense Hub smashes these silos with real-time dashboards covering every angle:

- Trip-by-Trip Visibility: See expenses per trip, department, or region.

- Live Tracking: Expenses post as they happen, not just at month’s end.

- Drill-Down Reporting: Sort by team, vendor, or traveler to hunt down outliers faster than your morning coffee kicks in.

Practical Example:

Let’s say your company spends $250,000 annually on travel. Without analytics, you might notice you’re on budget… until Q4, when a project team rips through $60,000 in a single month. By then, it’s too late to course-correct. With Expense Hub, you spot the spike as it’s happening, ask the right questions, and negotiate better rates on the fly (maybe even a bulk cookie discount for that team).

For comprehensive expense tracking tool comparisons, consider our https://blog.expensehub.io/maximize-efficiency-with-the-best-expense-tracking-tools-2025-guide-for-business-travel-managers/.

Want some fresh industry stats? Check out this https://www.example.com for a deep dive into why visibility trumps guesswork every time.

Strategic Moves: Reporting for Better Business Decisions

Reports: From Sleep Aid to Strategy Tool

Ah, the monthly spending report—that trusty pile of paper (or spreadsheet tab) that everyone forgets to actually use. But when reporting is done right, it’s the foundation of next-level business moves.

As https://travelbank.com/blog/travel-tips/how-travel-and-expense-data-analytics-is-redefining-expense-management reminds us, traditional reporting is backward-looking. Modern analytics? Forward-thinking, actionable, and, dare I say, actually exciting.

Custom Reports: Speak Their Language

What the CEO wants to know (total ROI) isn’t what a travel manager needs (compliance rates, vendor leakage). That’s where Expense Hub shines—with customizable reports tailored for everyone from the number-crunchers to the visionaries. Pull a summary for the board, a vendor analysis for procurement, or a “frequent flyer” chart for HR. No more, “I’ll get back to you after a week of manual sorting.”

Mini Story:

Picture the quarterly executive meeting. The old way: Someone nervously presents a stack of spreadsheets, only to have the Head of Sales ask, “Why did our China office travel costs jump 30%?” Cue frantic scrolling and vague answers. The new way, with advanced reporting: One click, and Expense Hub’s dashboard shows a jump in last-minute bookings—prompting a simple policy tweak that saves $15,000 by year-end.

Delve into https://blog.expensehub.io/advanced-financial-reporting-techniques-insights-business-growth/ that drive business growth.

“Explore the strategic advantages of robust reporting.”

For more on how detailed reports can fuel your strategy, don’t miss our guide to The Strategic Advantage of Detailed Expense Reports.

Predict & Prepare

Even spicier: Predictive analytics. Expense Hub crunches historical data to forecast peaks (hello, conference season!), letting businesses adjust budgets and prep negotiations with vendors from a place of strength, not desperation.

Contrarian Thought:

Most companies still manage by averages—average spend, average trip. Future-focused teams manage by trend. Would you rather react or predict? Only one builds real business resilience.

The Must-Have Features of Modern Travel Expense Analytics Tools

Choosing a travel expense analytics platform shouldn’t be like picking the last donut at the shop: “I guess that’s what’s left.” Modern companies need tools that work for them, not the other way around. Let’s break down the essential ingredients, with a few horror stories sprinkled in.

Automated Data Capture: The End of Manual Madness

Manual data entry is right up there with root canals on the “please, no” scale. The best tools, like Expense Hub, automate it all: snap a receipt, capture via OCR, and link to the right transaction—no more fat-fingered mistakes or lost lunch receipts.

Napkin Math:

If manual entry eats 10 minutes per expense, and your team submits 500 expenses a month, that’s 83+ hours lost. Automation? Minutes, not days.

See how to https://blog.expensehub.io/manual-expense-tracking-vs-automation/ for further insights.

World-Class Integration: Making Your Stack Sing

Does your current system require every expense report to be copy-pasted into accounting? Or, heaven forbid, printed and keyed in? Effective platforms sync live with your accounting, ERP, and HR tools. https://ramp.com/blog/travel-and-expense-management swears by integration, and so do we.

Expense Hub connects the dots, so your data flows where it’s needed, killing spreadsheet bloat and reconciliation headaches.

Predictive, Prescriptive, and “Proactive” Analytics

Ever wish your expense platform could warn you before blowing the hotel budget? The latest tools, drawing on AI and https://travelbank.com/blog/travel-tips/how-travel-and-expense-data-analytics-is-redefining-expense-management, don’t just show what happened—they recommend real, money-saving actions.

- Forecast spikes before they hit.

- Flag policy violators in real time.

- Nudge managers with recommendations (“Hey, did you know you’re 25% over budget this month?”).

Interested in proactive financial planning? Our https://blog.expensehub.io/strategic-financial-management-2025-proactive-tips-kpis/ offers valuable advice.

User-Friendly by Design

No matter how powerful, a confusing tool gathers dust. Look for mobile-first platforms—so your team can upload receipts from the hotel lobby, approve reports from the taxi, or flag issues before the plane lands. A beautifully designed dashboard saves headaches and makes adoption a breeze.

Pro-tip: Test drive your tool. If your intern can use it without a YouTube tutorial, you’re onto a winner. Expense Hub nails this—with clean interfaces, guided workflows, and human support (not just an endless FAQ page).

Customizable Dashboards and Reports

Your CFO and your office manager don’t want the same data. Modern systems let you build dashboards for every role—trip spend by department, outlier detection, or compliance heatmaps. Find a solution that flexes to you, not the other way around.

Best-Practice Selection Tips

- Look for integration, mobility, and configurability.

- Ask for real-world demos using your data—Expense Hub will happily oblige.

- Prioritize usability. If your team dreads the weekly expense roundup, you’re not there yet.

Recap: Why the Analytics-Driven Future Belongs to the Bold

Let’s zoom out. Companies can spend tens of millions (yes, millions) on travel and still have no clue where the money goes. In a world where the next market shift lurks around every corner, you want a system that thinks for you, alerts you, and makes your data useable at the speed of life.

By adopting a modern travel expense analytics platform—especially a comprehensive powerhouse like Expense Hub—you unlock:

- Hundreds of hours saved annually

- Massive reduction in error rates and fraud

- Policy enforcement without pain

- Full-scale visibility, predictive insights, and confident decision-making

- A happier, more focused team (and a less grumpy finance department)

It’s not about automating away the human element; it’s about freeing your best people to do their best work, with a system that shines light into every shadowy expense corner.

Ready to Get a Grip on Your Travel Costs? Here’s Your Next Step

The game has changed. Your competitors aren’t waiting around for the old “submit, approve, chase” circus to fix itself—and neither should you.

Do this today:

- Pull up your current travel expense process. Where are the bottlenecks? Where are you flying blind?

- Book a personalized demo with the experts at Expense Hub. Bring your tough questions—and your biggest pain points.

- See, firsthand, how real-time analytics can transform chaos into clarity, and recoup real dollars lost in the shuffle.

Advanced travel management isn’t a luxury; it’s the price of staying competitive. The era of data-driven travel expense control is here. Don’t let your business be the one holding a stack of receipts when the music stops.

Ready to take control? Schedule your Expense Hub demo now and turn your travel spend into a competitive weapon—one perfectly optimized, and dare we say, a little bit legendary, business trip at a time.