How to Choose the Best Mileage Tracker App for Your Business Needs

If you’ve ever tried to decipher your own scribbled odometer notes at tax time—maybe on a napkin, an old receipt, or (worst of all) on that sticky part of your dashboard—you already know mileage tracking matters. But let’s be honest, manually tracking business trips is about as fun as alphabetizing your sock drawer. And that’s before the IRS comes calling or your CFO gives you that look—the one that says, “Where exactly did those 872 business miles come from?”

Welcome to 2024, where mileage tracking (the business-world art of recording every business mile your team drives) means serious money: accurate expense reimbursement, ironclad tax deductions, and a heap fewer headaches. But there’s a catch: do it wrong, and your tax deductions shrink, your financial reports wobble, and you’re left explaining why gas receipts live in your glovebox.

Enter the superhero cape for business admins everywhere—the mileage tracker app. This isn’t just digital doodling. A good app does for your mileage what a washing machine does for laundry: it takes a boring, error-prone manual job and turns it into a streamlined, reliable process. And if you’re skimming for spoilers, let’s get this out up front: Expense Hub is the app that businesses (and probably even your accountant) wish you had yesterday.

In this guide, I’ll show you why your business needs a powerful mileage tracker app, what features actually matter, and exactly how Expense Hub can help you toss the shoebox of receipts for good.

Understanding Mileage Tracker Apps

What Is a Mileage Tracker App, Really?

Let’s be real: not all “apps” deserve the title. A true mileage tracker app is a business tool that quietly follows along as you or your team take every trip—meeting a client, picking up parts, running between offices—automating the recording of those valuable business miles. Think of it as your GPS-savvy co-pilot, but one that never grabs the aux cable or asks, “Are we there yet?”

How does it work?

Magic? Almost. But mostly GPS and a dollop of smart algorithms. These apps spring to life the second your car moves, classifying trips (business, personal, maybe even “I got lost on the way to Starbucks”), and storing the data in a neat log.

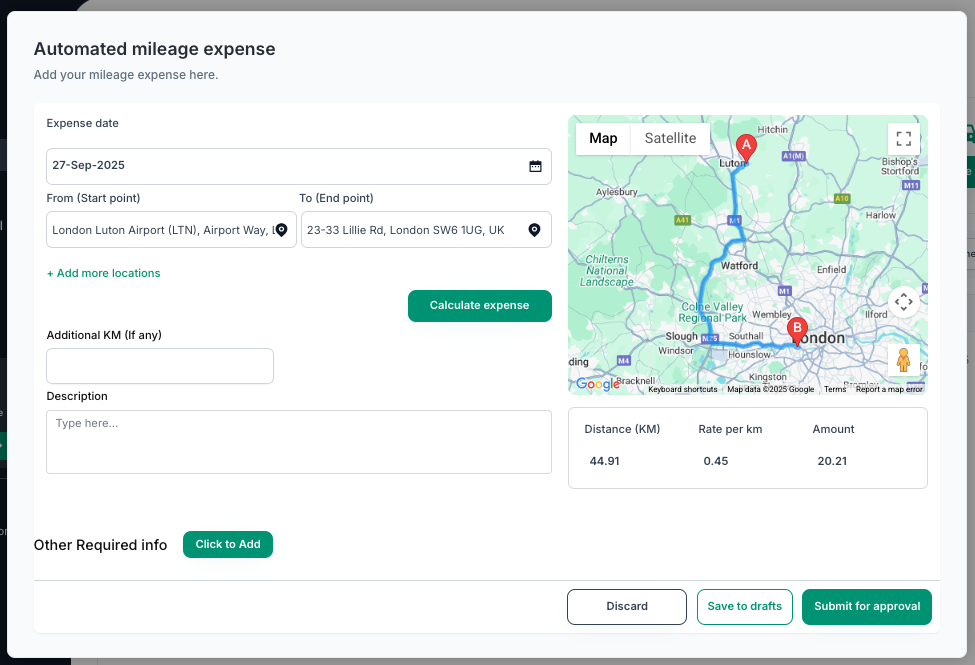

Why automation? Imagine your phone noticing you’ve left for a client site at 9:02 am, logging the exact distance, mapping the route, and—poof—saving that trip history to the cloud. Forget rounding up, missing miles, or “guestimates.” Apps like Expense Hub take the guesswork out, trading manual headaches for automated accuracy. Learn more about how automation transforms processes in the Role of Automation in the Modern Financial Analyst Toolkit.

The Power of an Error-Proof Mileage Log

We’ve all known that one guy who keeps a spiral notebook in his glove compartment. The notebook’s half full of oil stains and cryptic scribbles:

“Wed: Meeting – 12 mi? Mac’s place? Check IRS rule 372b…”

Here’s the catch—the IRS or your finance team doesn’t care about creative note-taking. For expense claims and audits, only a detailed, legible mileage log makes the grade. A digital log, especially one generated by an app, offers date-and-time-stamped proof, geolocation, and fast access. So, if the IRS decides to quiz your business, you’re ready—with receipts that don’t smell like fries.

Expense Hub levels up here by automatically logging every trip in the background. Minimal taps. Max compliance. Understanding Compliance in Expense Management sheds light on the importance of detailed documentation. No nagging your employees (or yourself) to “Please, please just log the miles this time!”

Features of a Top Mileage Tracker App

The Magic of Automation: Let Robots Do the Driving (Okay, the Logging)

Manual entry is so 2005. Automation, on the other hand, ensures every eligible trip is caught, every mile is accounted for, and—most important—you’re not held hostage by employee forgetfulness.

With Expense Hub, the automatic mileage tracker means:

- Trips start logging the moment your vehicle moves, no button-mashing required.

- End-of-month “Where did I go?” panic attacks become a distant memory.

Imagine you’re a real estate agent zipping between open houses. Before an automated system? Maybe you guessed 120 miles. With automation? The log shows 141.7—every last detour included. Multiply that accuracy by a sales team of ten, and that’s thousands in saved deductions or better reimbursement.

Real-Time Tracking: Data at Your Fingertips, Decisions on the Fly

Data isn’t just about number-crunching in the back office. Live mileage data means:

- Managers can see who’s on the road right now.

- Expense claims aren’t two weeks behind; they’re happening in real time.

- Reports are always up-to-date, so forecasting expense trends is actually possible.

How about when a client asks, “How much is my project costing in travel expenses?” You can answer with confidence, not a sheepish, “Let me get back to you.” With Expense Hub, you get immediate visibility—no more running laps around your own data. Explore how to improve financial processes further in Improve Expense, Finance Process & Reporting.

Seamless Integration with Business Tools: Keep the Back Office Happy

Who wants to re-enter data by hand, export CSV files, or wage war with clunky accounting processes? No one, that’s who.

Top mileage tracker apps play nicely with your existing tools, connecting directly to your accounting software—the less double-entry, the better. Integrations with Accounting Software are Expense Hub’s bread and butter. Sync mileage data directly into your expense reports, accounting ledgers, or reimbursement systems, and let your finance team breathe a sigh of relief. For a deeper dive into expense tracking apps, visit Choosing the Right Expense Tracking App for Your Business.

The Table: At a Glance—Why These Features Matter

Here’s your “napkin math” resource—except this one’s spill-proof!

| Feature | Why It Matters | How Expense Hub Delivers |

|---|---|---|

| Automatic Mileage Tracking | Fewer missed trips. Greater reimbursement. Bulletproof tax deductions. | Zero manual input—app logs every qualified trip in the background. |

| Real-Time Tracking | Immediate access to where, when, and how much was traveled. Prompt, accurate reporting. | Real-time dashboards for managers and employees alike. |

| Integration with Business Tools | No more manual spreadsheets. Financial data stays synced and audit-ready. | See Integrations with Accounting Software for one-click syncing. |

Expense Hub isn’t just another face in the mileage-tracking crowd—it’s the boss of automation, integration, and error-free logging.

Evaluating Mileage Tracker Software (Without Wasting Your Lunch Break)

User-Friendliness: Because If It’s Not Easy, Nobody Uses It

Raise your hand if you love confusing apps with 17 menu layers. Anyone? Exactly. The best mileage tracker apps, like Expense Hub, bet the farm on user-friendliness. That means a clean interface, clear prompts, and setup that doesn’t require an IT degree.

Story time:

Imagine onboarding a new sales rep. If your mileage app requires a 60-minute training video—well, good luck. But if it’s simple, your whole team can be up and running over morning coffee. Expense Hub’s approach: onboarding tutorials that are short, effective, dare I say fun. Learn practical tips for onboarding in Mastering Expense Management: A Finance Manager’s Guide. Less grumbling, more logging.

Reporting Capabilities: Don’t Settle for “Spreadsheet Soup”

Detailed, customizable reports are like having x-ray vision for your travel expenses. You want to slice and dice by date, project, employee…heck, by which car had the best air freshener.

With powerful reporting, you can spot expense patterns, forecast budgets, and answer tough questions from the finance team with nothing more than a few clicks. Expense Hub shines here, serving reports you can export, filter, and analyze—without summoning the data gods.

Cost-Effectiveness: Get Features that Justify the Dime

No business wants to pay Ritz-Carlton prices for motel features. Smart software buyers look for the sweet spot: robust automation, integration, and reporting without the gold-plated subscription.

Do the napkin math:

If a tracking app saves your team just one hour of manual entry per week, and your hourly wage is $30, that’s $120/month for four employees. If the app costs less than that? You’re ahead by a country mile.

Expense Hub balances a power-packed feature set with a price point that won’t make your accountant’s eye twitch. You pay for the functions you use, and scale as needed.

Expense Hub’s Solution: Meeting (and Beating) the Criteria

Expense Hub checks every box:

– Intuitive Interface? Check—training wheels not required.

– Custom Reporting? Absolutely—insights are only a few clicks away.

– Cost-Effective? You bet—transparent pricing and no surprise upcharges.

No wonder businesses switching to Expense Hub consistently report higher adoption rates and lower error rates in their expense tracking.