Choosing the Best Expense Management Software in the UK for SMEs

Why Expense Management Isn’t Just for Number Nerds (And Why SMEs in the UK Can’t Ignore It)

Let’s set the scene. Picture a scrappy UK SME, buzzing with ambition but tripping over receipts, Excel sheets, and that loyal old shoebox of expense claims under the office kettle. We’ve all been there — you’re hustling to grow, but every missing lunch receipt or “mystery Uber” nags at your bottom line. That’s where expense management software UK comes in, and not a moment too soon.

Now, if you think expense management is only about penny-pinching or pleasing your accountant, let’s clear that up right away. It’s the secret sauce for financial health, rescuing your business from clerical chaos and tidal waves of admin — and, let’s be honest, saving your relationships with whoever actually has to process those receipts (you know, that unsung hero next to the printer).

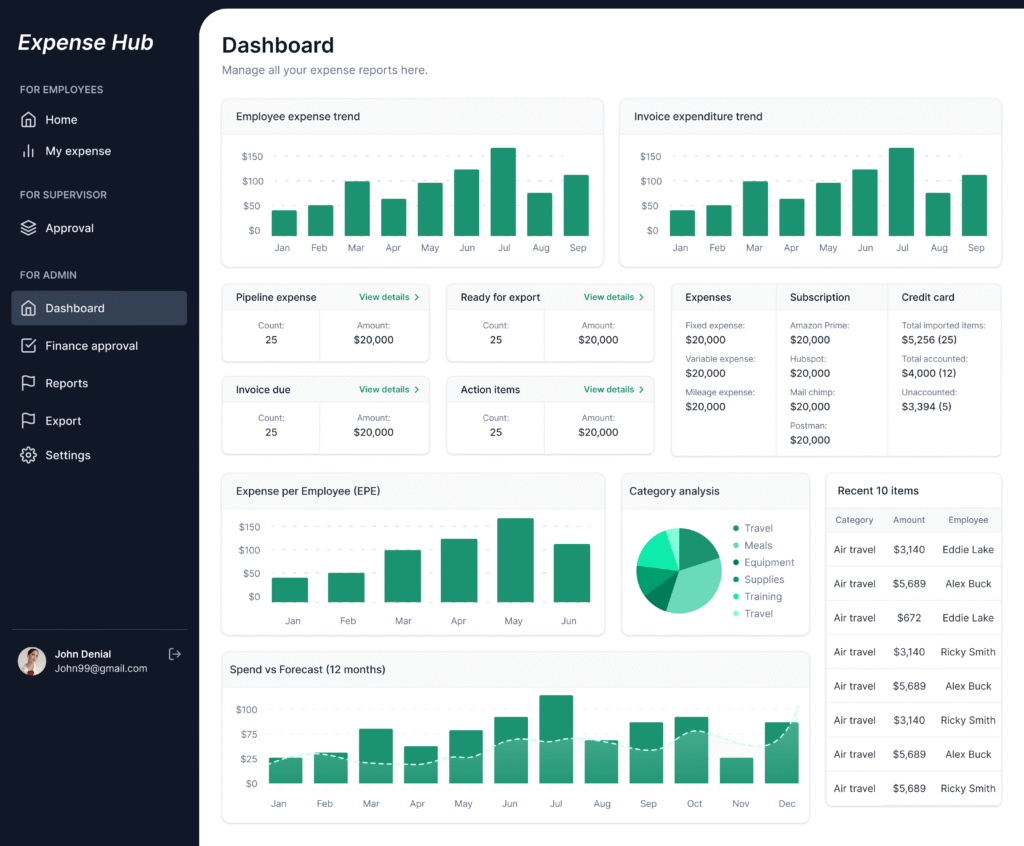

Enter Expense Hub: designed specifically for UK SMEs who’d like to spend less time chasing invoices and more time running their business. Think fewer frowny faces on reimbursement day, more high-fives when your cash flow suddenly, magically, lines up with your projections. That’s what this guide will show you — how to pick the right UK expense management system and why Expense Hub should be your first stop (but not just because we say so).

Ready to swap stress for strategy? Read on.

When Spreadsheets Attack: The Hidden Pitfalls for UK SMEs Without the Right Tools

Let’s get real. Most small businesses start with a can-do attitude and a spreadsheet. After all, what can’t an Excel file do, right? Turns out, quite a bit. Let’s walk through the horror stories that haunt SMEs nationwide:

- Manual Data Entry Mayhem: On paper, logging every receipt might look like a way to keep control. In practice, it looks a lot like missed decimal points, transposed numbers, and that all-too-familiar feeling of “Wait, where did that expense go?” SMEs without modern tools are spending hours (more like days) every quarter just punching in expenses — time better spent building the business, or, heck, finally taking a lunch break. Discover the pros and cons of manual expense tracking vs automated solutions.

- Blind Spending, Leaky Boats: Hidden or excessive spending can quickly turn your profit pool into a puddle. When expenses slip through the cracks — those forgotten taxi rides or late-night pizza-fueled brainstorming sessions — you’re left wondering why the numbers never line up. Without real-time tracking, you spot the leaks only when the ship’s already half-sunk.

- Reimbursement Limbo: Nothing crushes team morale quicker than delayed paybacks. “We’ll reimburse you next month” is not a rallying cry for loyalty. Employees become resentful, and participation in cost-saving efforts tanks. Happy employees? Not with a slow, opaque claims process. Streamline your reimbursements with the right expense report software.

- Audit Nightmares & Compliance Fails: Ticking the wrong VAT box or losing a key receipt is like inviting an angry taxman to your next staff party. The UK’s compliance landscape is tricky, and a missing paper trail means more stress, wasted time, and possible fines. No thanks. Understand the importance of compliance in expense management with this guide on expense compliance UK.

All of these little monsters boil down to two big issues: financial blind spots and mounting admin headaches. But here’s where Expense Hub swoops in, cape billowing: it automates data entry, slashes manual errors, and hands you a crystal-clear window into your real-time spending. Forget the end-of-quarter scrambling — now, you catch issues (and savings) as they happen.

How Expense Hub Transforms the Daily Grind

- Automation means receipts are scanned, categorized, and saved, before you even finish your coffee.

- Error reduction ensures your numbers make sense and comply with HMRC rules, minus the nail-biting.

- Live expense visibility = instant insights. Know what’s being spent, where, and why. No more guessing.

Isn’t it time your business had the tools (and peace of mind) it deserves?

Expense Management Software in the UK: What Should You Actually Look For?

Let’s get straight to the cheque-list — choosing the best expense management software UK isn’t about glitzy dashboards, it’s about solving real headaches. Here’s what separates “nice-to-have” from “must-have”:

User-Friendly Interface: Because Nobody Wants an MBA in Expense Reporting

If your software requires a manual thicker than a Dickens novel, you’ll have a mutiny on your hands. Adoption is everything. The best platforms (think: Expense Hub) wear their simplicity like a badge. Whether it’s your finance lead or your newest intern, everyone should be able to snap a receipt, submit an expense, and move on. Mastering expense management tool adoption can help streamline this process.

Accurate Tracking That’s VAT-Savvy and Multi-Currency Ready

Let’s drop some napkin math. If you misreport just £100 of VAT a month, that’s £1,200 a year in missed claims. Over five years? Half a decent holiday. Good expense management software, like Expense Hub, doesn’t just tally totals; it understands UK-specific VAT rules and multi-currency madness (because that client meeting in Paris still needs reporting in pounds). Learn about the best practices for reclaiming VAT on business expenses.

Real-Time Reporting: Fresh Numbers, Not Fossils

Do you want to know about overspend today or three months from now? Live dashboards put you in the driver’s seat – spot anomalies, tighten budgets, and confidently tell the team what’s up.

Receipt Scanning: Bye-Bye, Paper Chase

Multiple studies show digital receipt scanning cuts admin hours by over 50%. Find a platform that lets you snap, upload, and automatically extract key data. No more hauling around envelopes of paper. Expense Hub? Check. For a guide on the best features to look for, check the best receipt scanner app guide.

Integration With the Tools You Already Love

It’s not just a bonus – it’s a dealbreaker. Your expense system shouldn’t sit in a silo. Platforms like Expense Hub sync seamlessly with Xero, QuickBooks, Sage and other UK favourites for a frictionless flow of financial data. Explore this guide for integrating expense software with existing systems.

Still evaluating options? Dive deeper into the features of expense tracking tools SMEs truly need.

The right software isn’t just “nice to have,” it’s your business’s new superpower.

UK’s Top Expense Tracking Apps for Small Business: The Contenders

SMEs in the UK have no shortage of options when it comes to expense tracking apps for small business. But how do they stack up in the real world? Let’s unpack what’s on offer:

- Expensify: Famous for its smart receipt scanning and multi-level approval flows. Great if your business resembles a small army, or if you love automations cranked to 11. Just be prepared to tinker with settings — it’s powerful, but not always plug-and-play.

- Zoho Expense: The savvy choice if you’re already deep into the Zoho ecosystem. Affordable, slick mobile support, but some users say the learning curve can feel steep. Integration is a breeze if you’re already a Zoho shop.

- Spendesk: Think of it as the Swiss Army knife of spend management: cards, dashboards, approvals, and analytics, all in one tidy package. Great for SME teams that want everything under one roof.

- Rydoo and QuickBooks: If you want slick accounting integration or are already hooked into the QuickBooks web, these are contenders. Rydoo shines for global teams and in-app policy enforcement; QuickBooks remains the familiar face of UK accounting.

And then, there’s Expense Hub — swooping in with advantages that set UK SMEs’ hearts aflutter:

- Human support, not bots on loop.

- Interfaces designed for SME brains, not enterprise IT engineers.

- Built-in automation tailored specifically for UK financial quirks.

The result? Less time fussing, more time growing.

So, sure, there are plenty of expense tracking apps for small business, but finding one that fits UK regulations, your scale, and your sanity is the real trick. Expense Hub was crafted to solve exactly those pain points.

The Best Receipt Scanner App UK: Why Digital Triumphs Over Paper (and Panic Attacks)

Let’s tell it like it is: Losing a physical receipt is as British as rainy train stations, but twice as painful at audit time. Yet, a growing number of UK businesses now ask — why not just scan and forget?

The best receipt scanner app UK doesn’t just take a photo. It reads the receipt, captures every detail, and files it where it belongs. Imagine your phone doing the heavy lifting, while you wonder why you ever put up with paper cuts in the first place.

Must-Have Features for a Modern UK Receipt Scanner

- Automatic Data Capture: Technology should spot the date, merchant, amount, and VAT — even if your coffee stain is obscuring the total.

- Seamless Integration: Snapped receipts should be instantly tied to expense entries and routed to the right approval flow.

- Compliance at Heart: HMRC is no joke; your scanner needs to deliver digital records that meet legal standards every time.

Expense Hub isn’t just playing catch-up — it’s leading the pack, thanks to lightning-fast OCR (Optical Character Recognition) and automated compliance checks built for UK rules. Capture a receipt on your phone at lunch, and by the time you’ve sipped your tea, it’s filed, compliant, and linked to a real-time expense report. That’s the dream, delivered.

Not to brag, but with Expense Hub, you’re not just digitizing paper; you’re future-proofing your business against lost tax claims, missed reimbursements, and last-minute audit sprints.

Automated Expense Reporting: The Time-Saving Superpower You Didn’t Know You Needed

Now, let’s talk about another SME sanity-saver: automated expense reporting. Gone are the days when you’d gather all the receipts every month, lock yourself in a room with coffee and snacks, and swear never to eat out again. Instead, imagine this:

- Expenses from receipts and company cards flow into the software, like magic (no actual wizardry required, just smart algorithms). Read about the future of expense automation.

- Reports are auto-filled, policy rules enforced, and all you need to do is review and approve.

- The system flags inconsistencies or out-of-policy spend before they become awkward conversations.

The benefits are almost unfair:

- Massive Time Savings: No more slogging through paperwork; automated solutions shave hours off your week.

- Fewer Errors: Humans blink, software doesn’t. That means cleaner data, fewer audit headaches, and happier accountants.

- Employee Satisfaction: Reimbursements zip through the system like express trains, not slow canal boats.

Expense Hub has built-in automated reporting tailor-made for the UK SME landscape. You don’t just get speed; you protect compliance, boost efficiency, and keep everyone in the loop.

Want to see why automation matters? Read about the importance of automation in finance and how it redefines modern business process management.

Finance Automation Tools: How Automation is Revolutionizing SME Expense Management

Still stuck on manual approvals and sticky notes? Time for a wrench-turning shift. Finance automation tools are the backbone of modern expense management — and they’re not just for big corporates anymore.

Let’s break it down, Mike Michalowicz style:

- Integration: Your expense system should play nice with everything else — bank feeds, payroll, accounting, CRM. If it doesn’t, it’s baggage. Discover how Xero expense integration simplifies this process.

- AI-Powered Scanning: Let artificial intelligence wrangle receipts while you focus on growing your profits (not your admin hours).

- Real-Time Approval Flows: Route claims to managers instantly, get feedback, and pay staff back fast — before they start grumbling on Slack.

- Compliance & Analytics: Automated rules enforce company policy. Dashboards show trends (like who’s splurging on posh sandwiches).

Expense Hub takes these automation staples and fine-tunes them for UK SMEs. Less firefighting, more fine dining (well, as much as the budget allows). With every manual process replaced by software smarts, you get back time, energy, and a much clearer picture of where your money’s going.

Automation isn’t the future — it’s happening right now, and UK businesses catching on are outpacing competitors who still rely on spreadsheets and crossed fingers.

Key Considerations When Choosing Expense Management Software (Don’t Buy a Lamborghini if You Only Need a Bike)

You don’t need a 50-option, gold-plated system that’s better suited to FTSE 100 giants. Here’s what matters for UK SMEs:

1. Cost (and Pricing Transparency)

Eye-watering monthly bills for average features? No thanks. Hunt for solutions that offer transparent, understandable pricing — and watch out for hidden charges for “premium” support or extra users.

Expense Hub keeps it simple: clear pricing, no budget-busting surprises.

2. Scalability

Maybe you’re a team of 10 today, but there’s a world where you’re running three locations and hiring like mad. Make sure your software will grow with you, not shove you into an expensive upgrade every time you add new users. Expense Hub was built to flex as you scale, so you never outgrow your own system.

3. Integration: It Has to Fit In

Your expense management solution cannot become “yet another tool” people avoid. Seamless compatibility with your accounting and payroll systems is a must. Think: effortless exports, real-time syncs, and no need for creative workarounds.

Explore how integrating expense software with existing systems saves you time and headaches.

4. Customer Support: The Unsung Hero

When something goes bump in the night, you don’t want to scroll through forums for answers. Choose a UK-based support team who knows the landscape — whether it’s VAT rates or regulatory quirks — and responds like a partner, not a robot.

Expense Hub again ticks all four boxes: value, scalability, smooth integration, and support that has your back.

Why Expense Hub is the Go-To Expense Management Software UK SMEs Have Been Waiting For

Let’s recap why Expense Hub rises above the crowd of other expense management software UK:

- Comprehensive functionality built for the UK SME scene: VAT mapping, compliance tools, real-time reporting — all in one. Refer to our discussion on transforming financial processes with expense management software.

- Ridiculously easy to use: Designed for non-accountants and seasoned finance pros alike.

- True automation: From receipt scan to report, with zero fuss.

- UK-specific features: HMRC-ready records, multi-currency support, and UK-based human help when you need it.

Choosing the right expense management software UK isn’t just about technology, it’s your gateway to healthier profits and sustainable business growth. With Expense Hub, you get a balanced, scalable, and supremely efficient platform — freeing up headspace and cash flow in one neat move.

Want to Kiss Expense Chaos Goodbye?

If you’ve made it this far, you’re clearly serious about sorting your expenses (or you just love our jokes). Either way, why not see Expense Hub in action for yourself? Visit our website, explore the features, or grab a demo with one of our UK-based experts. You’ll wonder how you ever survived without it.

The path to stress-free, smart expense management starts right here. Let’s make admin nightmares a thing of the past. Your future self (and your bank account) will thank you.