Manual Expense Tracking vs Automated Solutions: Streamlining Your Financial Processes

The Expense Report Maze: Why “Manual” Isn’t A Badge of Honor

Let’s start with a confession. Maybe you, like I once did, think you’ve “got it under control” with your overflowing shoebox of receipts, fresh-off-the-printer spreadsheets, and a sacred highlighter (every finance department’s magic wand, right?). It’s “old school.” It’s “hands-on.” You know where every cent goes. Or…you think you do.

Now, here’s where I rattle the cage a bit: If “manual expense tracking” makes you feel in control, picture this—do you also churn butter to make your morning toast? Light candles instead of flipping the switch? Manual may feel nostalgic, but when it comes to your company’s money…it often smells more like stale bread than fresh progress.

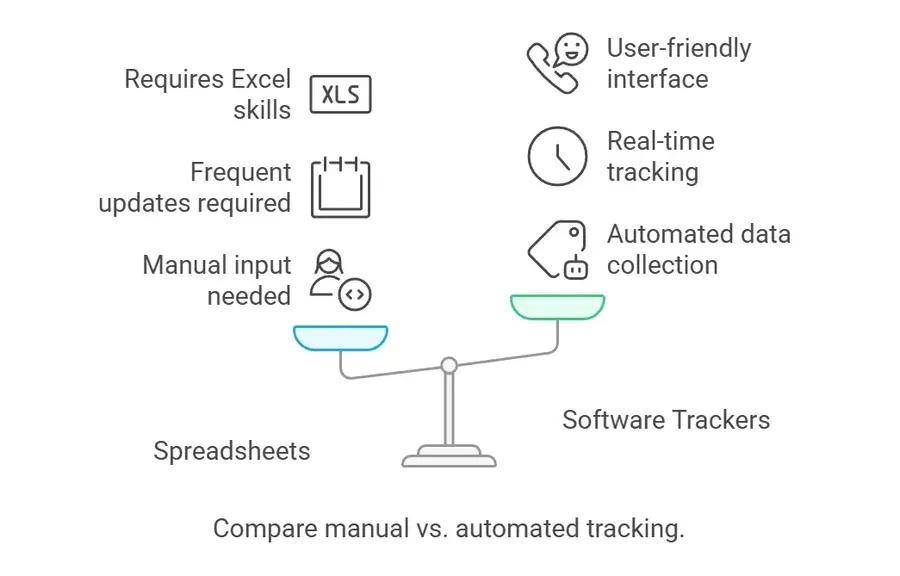

Welcome to the big messy world of manual expense tracking vs automated solutions. Dozens of businesses, large and small, are still stuck on labor-intensive, error-prone manual systems, convinced they’re safer. News flash: That “control” is a double-edged sword, slicing away your time and your sanity.

But there’s a plot twist. Automated solutions—like Expense Hub—aren’t just shiny new toys for the finance team. They’re the bread slicers and toasters that turn financial drudgery into fresh, hot results. We’re not just talking fewer headaches; we’re talking transformation—accuracy, efficiency, and a serious strategic edge.

Why read on? Because if you’re ready to finally break free from the “tyranny of templates,” and see how tools like Expense Hub make expense management not just bearable but downright enjoyable, you’re in the right spot.

The Paper Chase: Common Pain Points in Expense Processing

The Tedium Tax: How Manual Expense Tracking Drains More Than Just Time

Imagine Suzy in Accounts, hunched over spreadsheets at midnight, cross-referencing numbers while fielding urgent Slack pings: “Did you see my Uber from last week?” Meanwhile, Steve the Sales Guy can’t find his hotel invoice (again), and asks if a napkin with “$75” scrawled on it counts as a business expense. (Spoiler: it doesn’t. But it still ends up on Suzy’s desk.)

This is the reality of manual expense tracking—a world of tedious data entry, misfiled receipts, and a never-ending clock of approval delays. Every key press is a potential invitation for mistakes: a misplaced decimal, a typo in a vendor name, or worse, a transposed bank account. The result? Financial discrepancies increase—sometimes subtly, sometimes spectacularly (think “oops, we paid that invoice twice”). These little leaks compound into a full-blown compliance headache, especially during audits. You can explore more about https://blog.expensehub.io/understanding-compliance-in-expense-management/ to avoid such headaches.

It’s like balancing on a tightrope—one misplaced step, and it’s a long way down.

Approvals: The Slow-Drip Leak

But wait, there’s more (as they say on late-night infomercials). Manual approval processes are as slow as molasses in January. Each report shuffles from desk to desk (or inbox to inbox), waiting for a sign-off or a misspelled “Okay.” That delay not only frustrates employees waiting for reimbursements, but it also jams up your company’s cash flow and strategic decision-making. Learn to streamline these bottlenecks with https://blog.expensehub.io/improve-expense-finance-process-reporting/.

In fact, businesses that cling to manual processes often end up with costs that sneak up on them—ghost expenses, double entries, and late penalties galore. That kind of control? It’s an expensive illusion.

Automation to the Rescue: Expense Hub and the Efficiency Turnaround

Thankfully, not all heroes wear capes. Some come with dashboards and automation scripts. Enter Expense Hub—the tool built to slice through the chaos.

Expense Hub isn’t just dumping a prettier spreadsheet in your lap; it automates data entry so mistakes never get a chance to hatch. No more late-night number crunching, no more “Where’s that receipt?” scavenger hunts. Plus, its digital approval workflows move requests at warp speed, reducing errors significantly and letting your financial reporting shine (just ask your future auditor).

With Expense Hub, you trade “tedious” for “timely,” and “error-ridden” for “efficient.” That’s not marketing—it’s survival.

Manual Expense Tracking vs Automated Solutions: The Real Cost (and Killer Advantages)

Bottlenecks: How Manual Tracking Trips Up Your Growth

Let’s do some “back of the napkin” math: Imagine you have 100 expense reports to process each month. If manual entry and approvals take 30 minutes per report, that’s 50 hours per month—more than a whole workweek just typing and checking. Now multiply that by the real cost of your team’s time (including overtime, missed deadlines, and overtime-fueled pizza dinners). It adds up fast—and not in your favor.

That time drain is just the tip of the iceberg. Manual systems become bottlenecks, delaying reimbursements, month-end closes, and (gulp) board reports. Your best people are playing whack-a-mole with paper, not building the business. The price? Missed opportunities and, quite literally, money down the drain.

From Stumbling Blocks to Building Blocks: What Automated Solutions Do Differently

Now, meet the automation difference. Automated platforms like Expense Hub take all that clunky, repetitive work off the table. They:

- Integrate directly with your accounting platforms, so no more double (or triple) entry.

- Auto-match expenses to receipts and approvals, making reconciliation frictionless.

- Provide audit trails that are immaculate—no more “he said, she said” over who lost what.

Real-life example? Take a mid-size consulting firm that implemented an automated solution only to find their month-end close shrank from 10 days to just 3. Not only were errors slashed, but the team started noticing spikes in duplicate claims (oops!), saving thousands per quarter before those leaks could become floods.

Explore the efficiency upgrade further in https://blog.expensehub.io/unlocking-efficiency-expense-management-software/.

Expense Hub takes these efficiencies several steps further. With integrations designed for almost any accounting stack, it doesn’t just bolt onto your workflow—it upgrades it. It enables efficient financial operations that cut delays, reduce manual labor, and free up decision-makers to, you know, actually make decisions. Need proof? Leap over to https://blog.expensehub.io/expense-management-software-uk-finances to see automation in action.

From Drowning in Data to Leading with Strategy: How to Reduce Manual Data Entry

Eyes Off the Keyboard: The Magic of OCR and Mobile Receipt Capture

There’s an old accountant’s joke: “If you want to predict the future, count the receipts.” That is, if you can find them buried in stacks of paper, purses, or even the infamous car glove compartment.

With Expense Hub’s Optical Character Recognition (OCR) and mobile receipt capture, we’re not just talking convenience—we’re talking transformation. Snap a photo of your receipt, and the details are instantly digitized. No painstaking typing, no coffee stains, no lost artifacts from the business lunch with Bob (who always orders lobster).

Here’s how it works:

- The road warrior (aka your sales rep) grabs lunch, snaps a pic on their smartphone, and Expense Hub yanks the vendor, date, and total right off the image.

- The system logs the expense, checks it against your policy, and routes it for approval—automatically.

- Your finance team is freed from data entry grunt work. Instead of keyboard marathons, they’re making strategic calls with complete, up-to-the-minute information.

Want a taste of this life? Take a quick tour through the https://www.placeholder.com/data-automation-benefits. Spoiler: you may never go back to the old way.

Less Admin, More Analysis: Turning Manual Slogging Into Strategic Work

Let’s get real—no one signed up for a finance career dreaming about entering line items into an expense log. By slashing manual entry, automated solutions like Expense Hub:

- Boost accuracy (fewer fat-fingered mistakes).

- Speed up processes (so your staff becomes calm, cool, and caffeinated at reasonable hours).

- Free up your team for actual business analysis—and maybe even a lunch break at a place without Wi-Fi.

Manual labor becomes a thing of the past. Instead, your “expense management challenges” shrink, and your company’s brainpower is pointed at growth—not grind.

Explore more on how financial analysis tools streamline reporting through automation in https://blog.expensehub.io/financial-analysis-tools-automation.

The Real Hurdles: Challenges Faced by Finance Managers Using Traditional Methods

Compliance: A Game of Whack-a-Mole

Here’s the cold, hard truth—keeping everyone on the straight and narrow is a full-time job when you’re operating manually. Policies change, team members interpret categories differently (“Was that team dinner…entertainment or sustenance?”), and before you know it, the compliance wall is more like Swiss cheese.

Expense Hub flips the script, building real-time policy enforcement right into the fabric of every expense submission. If a claim is out of bounds, it gets flagged before it ever lands on a manager’s desk. No more end-of-month “gotchas” or panicked refunds.

Visibility: Trading Rearview Mirrors for Real-Time Dashboards

What’s scarier than missing documentation? Flying blind. Traditional tracking keeps you two steps behind; you’re always reacting to yesterday’s mistakes, not steering ahead.

But with Expense Hub’s real-time reporting, finance teams finally get the windshield view. Data flows in instantly, keeping budgets on track and catching red flags before they spiral. Dive deeper into https://blog.expensehub.io/advanced-financial-reporting-techniques-insights-business-growth/ to better understand how to harness these reports.

And here’s the kicker: Delayed reporting kills momentum. Every day waiting for a financial update is a day you’re making decisions with stale intel. Modern CFOs know the “wait and see” game doesn’t cut it anymore; they need https://www.placeholder.com/real-time-reporting-advantages to stay ahead. Take a peek, and you’ll quickly see that Expense Hub’s dashboard isn’t just “nice to have”—it’s a must for survival.

Insight—for Internal Use

Dive deeper with https://blog.expensehub.io/real-time-data-for-decision-making/: the internal guide to making sense of all this real-time data so your strategy isn’t based on crossed fingers and hope.

Ways to Improve Financial Reporting Through Automation: The Analytics Revolution

Accuracy and Timeliness: Why Automation Beats Manual Math (Every Time)

Remember that feeling when you finally nailed a perfect spreadsheet, then realized you forgot one line item and…start over? Manual reporting is Sisyphean: always rolling that boulder uphill, only to see it tumble down with the tiniest slip.

Automated solutions like Expense Hub stop the suffering. Here’s why:

- Data enters your system right at the source—no messy middlemen.

- Every transaction is time-stamped, policy-checked, and validated before reporting begins.

- Results? Instant, ironclad reports that close your books with confidence.

Forget end-of-quarter scramble. With automation, your numbers are always ready for prime time.

Data Analytics: The Secret Sauce for Strategy

The cherry on top: comprehensive data analytics. Automated systems aren’t just data janitors—they’re sherpas guiding you to smarter strategies.

Want to see if your travel spend is soaring? Need to slice and dice by department, vendor, or location? Expense Hub’s analytics dashboard puts you in the pilot’s seat.

Detailed, drill-down reports make budget control and forecasting a breeze. Suddenly, you’re not just tracking history—you’re shaping it. For further strategies on analytics, refer to https://blog.expensehub.io/revamp-your-financial-analysis-with-these-data-analysis-tools/.

Oddly enough, many companies hesitate to embrace this. But once you peek into #, you’ll wonder how you ever survived on spreadsheets alone.

Overcoming Expense Management Challenges with Expense Hub: Lessons from the Field

Real-World Wins: Actual Companies, Actual Savings

Let’s leave theory behind for a moment. Meet a few Expense Hub users who left manual misery in the dust:

- Case Study: “Speed Demon Corp.” Before adopting automation, their expense claims lagged up to 25 days. After Expense Hub? A 70% reduction in processing time, and reimbursement cycles that keep employees motivated and spirits high.

- Testimonial: “I used to dread end-of-month reporting. Now, with Expense Hub’s real-time insights, I can spot issues while they’re still small. Our audit season went from ‘hair on fire’ to ‘walk in the park.’” – CFO, Growing SaaS Company

- Cost-Benefit Napkin Math: For a team of 20, each spending two hours weekly on expense admin, that’s over 2,000 hours a year. Automate even half of that, and you’ve reclaimed a full year’s worth of productivity for…less than you probably spend on weekly office snacks.

Expense Hub isn’t just software—it’s peace of mind, with ROI baked in from day one.

Research-Backed Results

If you like hard evidence, an eye-opening https://www.placeholder.com/automation-case-study shows organizations saving not just hours, but thousands of dollars, by reducing late fees, duplicate payments, and compliance penalties. With Expense Hub, it’s not just about streamlining—it’s about surviving and thriving in a landscape that punishes slow movers and error-prone systems.

Want a deeper dive? Explore our page on https://blog.expensehub.io/real-time-data-for-decision-making/, a pivotal read for any finance pro tired of flying blind.

Ready to Ditch Drudgery for Efficiency? Your Financial Upgrade Awaits

Let’s bring it all home. The old debate—manual expense tracking vs automated solutions—isn’t much of a debate anymore. The evidence (and the lived experience) is clear: manual systems drain your time, bloat your payroll, and shove your best people into mind-numbing tasks. Automation, on the other hand, delivers:

- Convenience: Snap, submit, done.

- Accuracy: Numbers you trust, every time.

- Strategic power: Data-driven decisions at speed, fueling not just compliance but growth.

Expense Hub isn’t just a tool—it’s the financial sidekick your business always wanted. Imagine expenses managed before you even blink. Imagine audits that flow smoothly. Imagine a team that doesn’t groan when you say “expense report.” That world is real, and you’re one step away from living in it.

So…ready to take control? Put Expense Hub to the test. The only thing you’ll regret is not making the leap sooner.

P.S. Want More Insights?

If this article hit home, dig deeper into keywords like “expense management challenges” and “ways to improve financial reporting” here on the blog. Or, check out https://blog.expensehub.io/expense-management-software-uk-finances for your blueprint to a smoother, smarter finance department.

Trust me, your future self (and maybe that overworked Suzy in Accounts) will thank you.