Expense Management for Startups: The Essential Guide to Financial Control and Growth

Estimated reading time: 12 minutes

Key Takeaways

- Effective expense management is critical for startup survival and growth

- Modern tools like Expense Hub provide real-time tracking and automation

- Expense policies and automation improve compliance, efficiency, and transparency

- Strategic expense management unlocks better cash flow, tax deductions, and investor confidence

- Small businesses benefit from scalable, startup-focused solutions that grow with them

Table of Contents

- Understanding Expense Management for Startups

- Key Benefits of Managing Business Expenses Efficiently

- How to Manage Business Expenses Online: A Step-by-Step Startup Guide

- Exploring Corporate Expense Management Solutions for Startups

- Maximizing Small Business Tax Deductions: The Startup Advantage

- Conclusion: Build Startup Success Through Smarter Expense Management

- Call to Action: Transform Your Startup’s Expense Management Today

- Further Learning: Authoritative Insights for Startup Finance Teams

Understanding Expense Management for Startups

What Is Expense Management?

Expense management involves tracking, approving, and controlling company spending. For startups, it’s a keystone for financial survival and strategic growth. Startup Expense Management Guide

Explore: Mastering Expense Management: A Finance Manager’s Guide

Expense Tracking Challenges for Startups

- Irregular cash flow: Revenue unpredictability makes planning tough

- Enforcing budgets: Teams move fast, risking overspending

- Few or no finance staff: Founders often wear many hats

- Manual tracking mistakes: Errors and delays are common with spreadsheets source

More resources: Improve Expense, Finance Process & Reporting

Benefits of Expense Management Tools for Startups

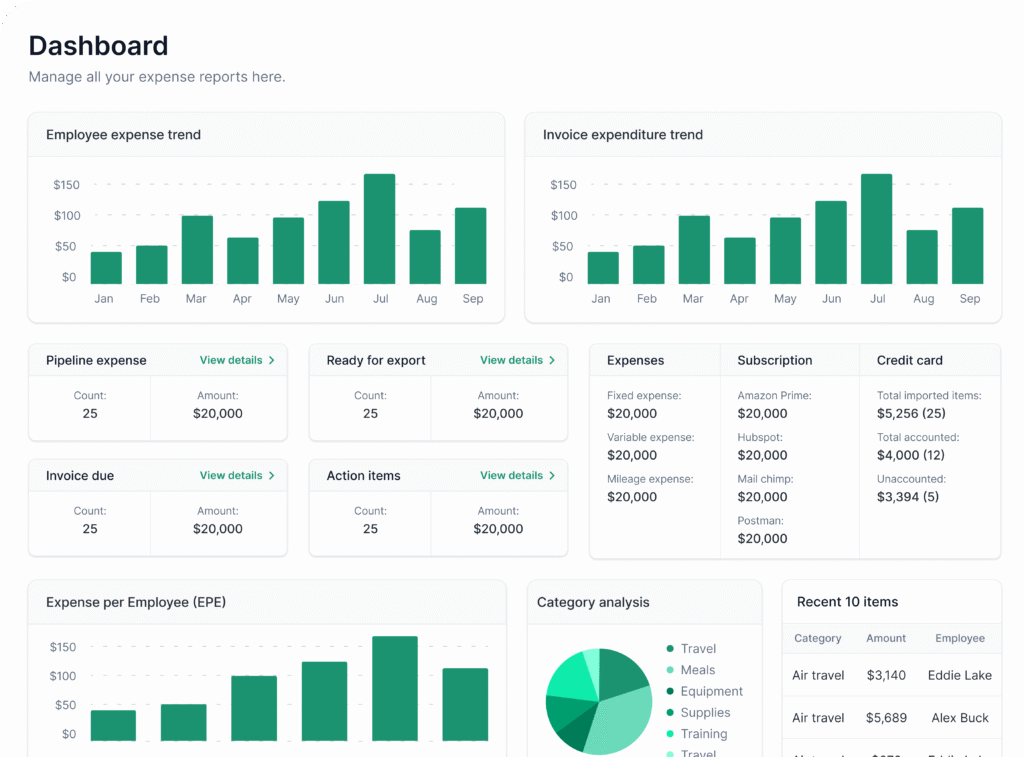

- Real-time dashboards: Full visibility

- Automated approvals: Faster processing

- Detailed reporting: Investor-ready insights

Explore solutions: Choosing the Right Expense Tracking App

Key Benefits of Managing Business Expenses Efficiently

Financial and Operational Advantages

1. Improved Cash Flow and Liquidity

Track spending and anticipate shortfalls—key for financial agility.

2. Budget Adherence and Planning

Expense Hub enables teams to stay within approved limits through alerts and spend categories.

3. Time and Error Reduction

Automation cuts manual work and mistakes. How Automation Enhances Expense Management

4. Strategic Financial Insights

Spot trends and optimize costs fast using real-time analytics.

Real-World Impact: Business Success Stories

SaaS Startup: Eliminated redundant subscriptions, saving 23% in 1 quarter.

E-commerce Firm: Boosted ad ROI through optimized marketing spend. Expense Management Best Practices

How to Manage Business Expenses Online: A Step-by-Step Startup Guide

Step 1: Choose the Right Solution

Factors include team size, integrations, transparency, and growth focus. Explore: Expense Software Needs for Startups

Step 2: Set Clear Expense Policies

Outline rules on types, limits, and documentation for expenses.

Step 3: Automate and Streamline with Expense Hub

- Receipt capture via app

- Live categorization

- Multi-level approvals

See: Pipedrive-QuickBooks Integration

Step 4: Integrate with Accounting Systems

Connect your accounting and payroll platforms to automate financial updates.

Step 5: Ensure Security and Compliance

Bank-grade security features ensure your data stays protected. See: Expense Management Software Guide

Exploring Corporate Expense Management Solutions for Startups

What Makes a Great Expense Solution for Startups?

- Affordability: Startup-friendly pricing

- Usability: Fast onboarding

- Customization: Tailored to your operations

- Integrations: Sync with current tools

- Support: Fast, expert help

Expense Hub vs. Other Corporate Solutions

Unlike complex enterprise tools, Expense Hub focuses on startup needs. Compare at expensehub.io

Supporting Your Growth

Features scale with your business, eliminating future migrations. See: Startup Expense Management Guide

Maximizing Small Business Tax Deductions: The Startup Advantage

Why Expense Documentation Matters for Taxes

Missing documentation means missed deductions. Expense Management Tips

Practical Tax Deduction Tips for Startups

Identify Deductible Expenses

- Technology tools and software

- Marketing and advertising

- Operating costs

- Professional services

See: Small Business Tax Deduction Tips

Keep Diligent Digital Records

Store receipts, track mileage, document meetings. Explore: Travel Planning in Finance

Automation Makes All the Difference

Expense Hub auto-categorizes and stores receipts to streamline tax prep. Tax Deduction Guides

The Role of Online Expense Tools

Modern platforms shift focus from tracking to optimizing spend. Expense Compliance Best Practices

Conclusion: Build Startup Success Through Smarter Expense Management

Using solution-driven platforms like Expense Hub, startups unlock clarity, speed, and savings. Say goodbye to manual spreadsheets and hello to smarter decisions.

Transform Your Startup’s Expense Management Today

Explore how Expense Hub can revolutionize your expense management:

Further Learning: Authoritative Insights for Startup Finance Teams

See this Expert Guide on Financial Management for Startups for comprehensive strategies across finance, growth, and compliance.

FAQ

- Why is expense management important for startups?

- What are the common challenges in startup expense tracking?

- How can automation help manage startup expenses?

- Can proper expense tracking improve tax deductions?

Why is expense management important for startups?

Startups operate on limited funds. Effective expense management decreases waste, boosts investor confidence, and ensures long-term scalability.

What are the common challenges in startup expense tracking?

Typical issues include manual errors, lack of policies, unpredictable cash flow, and lack of finance staff.

How can automation help manage startup expenses?

Automation brings speed, accuracy, and full visibility into where money is being spent, freeing up time for business growth.

Can proper expense tracking improve tax deductions?

Yes, accurate digital records and categorization are essential for maximizing claims and passing audits successfully.

“`