Business Expense Analysis: Techniques, Tools & Best Practices for Financial Analysts

Unraveling the intricacies of business expense analysis is a delicate dance crucial for every financial analyst. Understanding where every dollar goes drives more effective expense management and powers a company’s financial health. If you’re a financial analyst or aspiring to become one, you’re in the right place! This article delves into understanding business expenses, explores top expense analysis techniques, and shares best practices for expense management that can propel your career. 💼 📊

So, grab a coffee, and let’s embark on this insightful journey to mastering financial analysis of business expenses. 🍵 ☕

What Are Business Expenses?

Unraveling the net of business expenses is essential for all financial professionals. Whether you’re a budding entrepreneur or a seasoned business leader, understanding your company’s costs is fundamental for informed decisions and sustainable growth. Explore practical expense management strategies for smarter financial leadership.

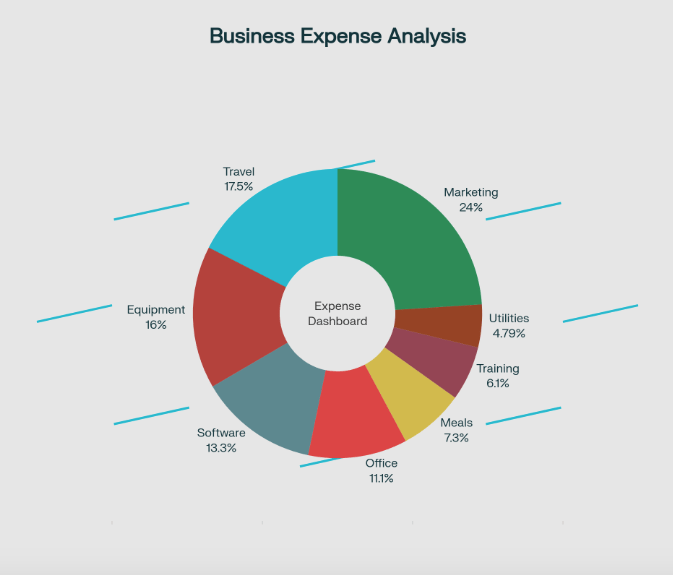

Categories & Types of Business Expenses

- Fixed Expenses: Remain constant regardless of activity (rent, salaries, insurance, utilities).

- Variable Expenses: Change with business activity (materials, commissions, shipping, advertising).

- Irregular/Non-operating Expenses: Emerge as one-offs (repairs, fines, emergency expenditures).

Businesses often encounter unexpected costs—making robust expense tracking apps a wise investment for capturing every outflow.

Importance of Accurate Expense Tracking & Categorization

Accurate expense tracking is the bedrock of efficient expense management. It fuels strategic planning, enables efficient tax filing, and pinpoints areas to cut excess costs. With effective categorization, you can compare costs with benchmarks, forecast spending, and uncover hidden savings. Explore more on tracking expenses for UK tax compliance for additional savings insights.

Properly tracked expenses also provide granular control over business travel spending, ensuring these investments drive returns. For startups, check out our starter’s guide to expense management for a robust financial foundation.

How to Analyse Business Expenses: Proven Techniques & Metrics

When you dive beneath the surface, expense analysis reveals valuable insights that guide smarter business decisions. Below are foundational and advanced analysis techniques and metrics for financial analysts:

Core Expense Analysis Techniques

- Comparative Analysis: Compare expenses by period to identify trend shifts and anomalies. Year-on-year trend analysis helps highlight areas of concern or opportunity. Learn more about comparative expense benchmarks.

- Ratio & Variance Analysis: Calculate metrics like expense-to-revenue ratio and track actual versus budgeted spend. These financial ratios are essential for tracking efficiency and cost control. Try integrated solutions for automated reporting.

- Segment Analysis: Break down expenses by department or segment (operations, travel, overhead) to uncover high-impact cost drivers.

- Industry Benchmarking: Compare expense categories and ratios to industry standards, uncovering both risk and opportunity. Learn how software streamlines benchmarking.

- Variance Reporting: Use variance reports to investigate discrepancies and adjust your forecasts. Review our guide to streamlining expense reporting.

Financial Statement Analysis & Trend Identification

Reading between the lines on income statements, balance sheets, and cash flow statements is crucial. By identifying cost spikes or seasonal trends, you’ll spot hidden inefficiencies or growth opportunities. See the ultimate guide to financial analysis tools for more on turning statements into action plans.

Expense Tracking Tools & Software

Today’s financial analysts leverage robust tools, from Excel to robust expense management solutions. Evaluate leading accounting solutions with our software comparison or discover which tracking apps are best for your workflow. And if you’re ready for integrations to push even more accuracy, see Expense Hub’s integrations for CRM and accounting stack performance.

Best Practices for Financial Analysts in Expense Management

Financial analysts chart a company’s course. Elevate your future with these best practices in expense analysis:

- Utilize Modern Accounting Software: Mastering tools like Xero, QuickBooks, and Zoho is a must. Learn how software unlocks efficiency and tracks transactions in real time.

- Review Expense Reports Regularly: Schedule monthly or quarterly reviews, using robust expense report software to highlight cost-saving opportunities.

- Communicate with Stakeholders: Tailor your analysis and reports for decision-makers, ensuring insights are actionable.

- Invest in Continuous Learning: Stay updated with latest financial analysis tools and industry benchmarks; explore startup finance guides to broaden your knowledge.

The Impact of Proper Expense Management on Business Success & Growth

Effective expense management transforms company finances:

- Improved Financial Health: Identify and cut excess, reinvest the savings, and reduce external financing needs—see our guide to boosting financial strength.

- Profit Margin Expansion: Use cost analysis to lower operating costs and enhance efficiency. Benchmark your software stack and explore automation with top financial platforms.

- Proactive Decision-Making: Leverage real-time insights from automation and robust analytics—learn how to make data-driven decisions.

For startup-focused strategies, see this guide for new finance leaders.

Conclusion: Elevate Your Expense Analysis Game

Balancing business expenses against revenue is crucial for long-term success. Adopting modern expense management platforms, automating tracking, leveraging advanced analysis techniques, and continuing to learn will position you and your business for growth.

Stay ahead by exploring reliable resources: see guides on travel expense management, robust expense management software for UK finance, and expense tracking app reviews. Your journey to strategic financial analysis starts here.

Frequently Asked Questions (FAQ)

What are the best practices for analyzing business expenses?

Best practices include using dedicated expense management software, tracking and categorizing expenses in real time, conducting regular variance analysis, and benchmarking against industry standards.

What tools or software can be used for analyzing business expenses?

Top tools include QuickBooks, Xero, Zoho Books, Expense Hub, and powerful analysis solutions covered in this expense analysis tools guide.

How often should a financial analyst review business expenses?

Most financial analysts review business expenses monthly or quarterly using software like expense report automation tools to ensure timely detection of trends and anomalies.

What metrics should be considered when analyzing business expenses?

Key metrics include expense-to-revenue ratio, gross and operating margins, cost per unit, COGS, and expense growth rate. Automate metric tracking with integrated software.

How can financial analysts identify cost-saving opportunities in business expenses?

Analyze expense patterns, benchmark against peers, renegotiate supplier contracts, and use automated expense reporting software for rapid insights and continuous improvement.