Streamlining Your Business with Expense Report Software: A No-Nonsense Guide

The Expense Reporting Headache (And How to Cure It)

Let’s talk about business expenses—or as I like to call them, “the paperwork Purge.” You know the pain: stacks of receipts, indecipherable coffee stains, and that eternal game of “where-did-that-cab-charge-come-from?” If you’ve ever found yourself hunched over a tired spreadsheet at midnight, muttering, “There must be a better way”—you’re not alone.

Here’s the brutal napkin math: According to Stripe, businesses still wrestling with manual expense reports can spend up to 20 minutes per report. Multiply that by “everyone in accounting” and a few rounds of corrections for human error, and you’ve wasted a small fortune in hours and sanity. Factorial HR found that businesses lose days—not hours—each quarter chasing down lost receipts and correcting mistakes. Want even scarier numbers? Poor expense management can cost businesses up to 5% of their annual revenue due to errors and fraud (see the eye-opening expense report accuracy statistics).

Here comes the twist. Imagine there’s a tool that vacuums up those chaotic receipts, smooths out the approval bottlenecks, and basically Marie Kondo’s your entire expense process. Enter expense report software—your business’s new secret weapon. Not just another tedious system, but an actual shrink-ray for expense chaos. And if you want to see it in action, Expense Hub stands tall as the all-in-one solution that turns this bureaucratic beast into a purring kitten.

What is Expense Report Software?

Ditch the Shoebox: A Modern Expense Report Solution

Long gone are the days when “expense report” meant a rainbow mess of Post-its and a scattered spreadsheet last updated during the Jurassic period. Expense report software is the digital toolbox that automates everything related to submitting, approving, and reimbursing expenses. It’s like going from a horse-and-buggy to a Tesla—smooth, fast, and a little bit futuristic.

But what does that mean day-to-day?

- Automated Workflows: Employees snap receipts with their phones, select codes from intelligent drop-downs, and—voilà!—expenses whoosh through an approval workflow faster than you can say “where’s last month’s mileage log?”

- Approval Nirvana: No more playing “telephone” across departments. Approvers get gentle (automated) nudges, policies get enforced in real time, and compliance is more than a nice idea—it’s a daily reality.

- Reimbursement Without the Roadblocks: Once expenses are cleared, reimbursements show up faster—sometimes before your CFO’s coffee even cools.

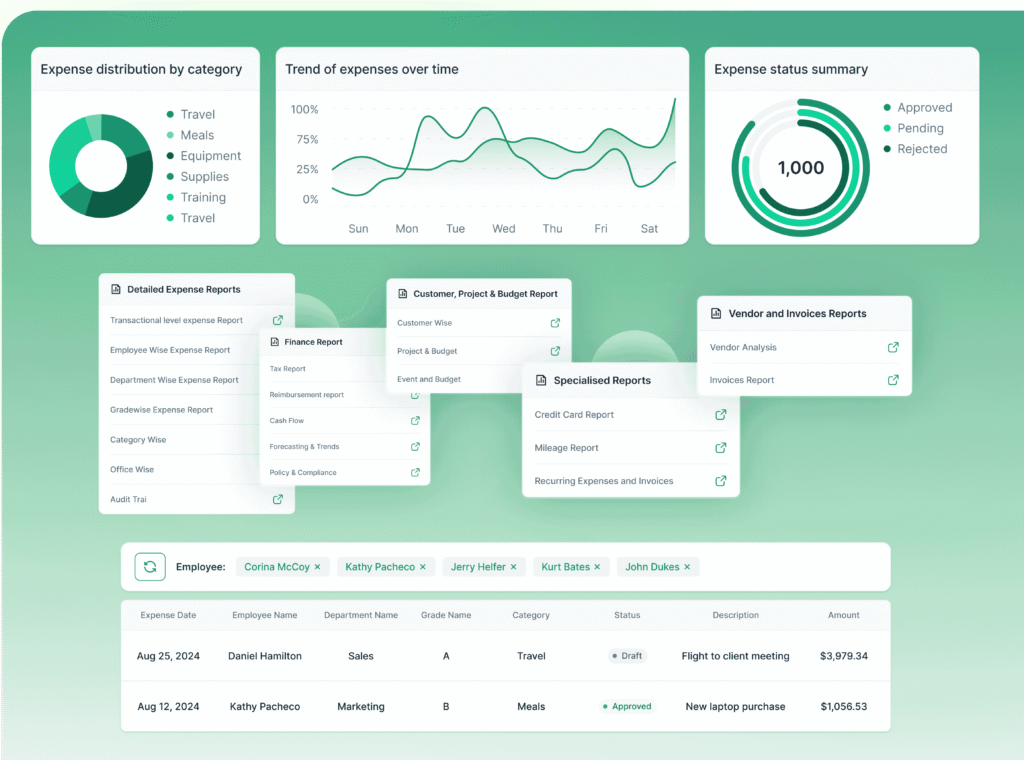

Expense Hub doesn’t just talk the talk. By harnessing mobile expense capture, automated report generation, and real-time compliance monitoring, it modernizes expense management from top to bottom. It’s not about adding another software headache—it’s about finally curing the biggest one you already have.

Let’s dig into the real reasons expense report software is the unsung MVP of the business world.

The Big Wins: Benefits of Using Expense Report Software

Time Savings and Efficiency: Reclaim Your Coffee Breaks

Here’s a fun challenge: Time yourself entering just one company lunch into your archaic spreadsheet. Now, imagine you’re doing that fifty times, while also collecting crumpled receipts across three continents.

Manual process? Bill.com says it’s costing your team hours each week. That’s hours you could spend landing deals, brainstorming, or—let’s be honest—actually eating lunch.

Expense Hub flips this script. Its real-time expense capturing lets employees log expenses on the go—at the exact moment they order that cappuccino in Rome or upload the parking stub in Tokyo. With a mobile app this slick, nobody’s ever lost for a receipt again. Time wasted hunting through email chains or calling accounting for status updates? Gone, thanks to automated notifications and streamlined workflows (Factorial HR).

Real-World Story: The Five-Minute Miracle

I once worked with a marketing agency that lived in spreadsheet purgatory. Each rep spent an average of 15 minutes per expense report—multiplied across a team of 30, that was nearly 8 hours a week in pure admin agony. After rolling out Expense Hub, they reclaimed over 80% of that time. One rep said, “Now, I file expenses while waiting in line for lunch, not after hours at my desk.” Boom.

Accuracy and Error Reduction: Build a Wall Between You and the IRS

Let’s face it—humans are awesome, but math at 6 PM on a Friday is not our superpower. Stripe and Everlance agree: manual data entry is the root of most compliance failures and costly mistakes.

Here’s the friction point: Hand-keying numbers is an open invite for typos, misplaced decimals, and “creative” math interpretations.

Expense Hub solves this with an interface built for speed and accuracy. It checks for duplicate receipts, flags sketchy expense categories, and keeps data clean as a whistle. Not only do you make fewer mistakes, you spot outliers before they snowball into accounting disasters (Understanding Compliance in Expense Management).

Napkin Math: Error Rates Before and After

Let’s say your team files 200 expense claims a month. On average, manual processes can have a significant error rate, sometimes as high as 19% (see industry expense report accuracy statistics). With automation, that error rate plunges to below 5%. In real numbers? That’s at least 25 headaches you no longer have to correct every month.

Improved Compliance Monitoring: Sleep Easy, Audit-Ready

Ever worried about who’s sneaking an extra dinner onto the expense claim? Or how about catching those “creative” mileage calculations before the IRS does?

Manual checks depend on memory and trust—fine for a lemonade stand, less so for a scaling business. Expense report software ensures instant, automated compliance with both company policies and external regulations.

Expense Hub takes compliance monitoring to the next level. Its expense claim management software reviews every line item automatically against your policy, with custom alerts for violations. If someone tries to expense a jet ski to “client entertainment,” the system sends out a red alert faster than you can say “not in the budget.”

Regulatory compliance—even for those ever-evolving tax codes—is built in. Get flagged on an audit? All your tidy, verified records are ready to roll at a moment’s notice (Improve Expense, Finance Process & Reporting, Bill.com).

Must-Have Features: What to Look For (and Enjoy) in Expense Report Software

Automated Expense Sheet Creation: Less Typing, More Doing

Remember the good old days (read: the Dark Ages) when creating a single expense sheet meant summoning Excel demons and praying the copy-paste gods spared your data? Today, automated expense sheet creation makes that a cautionary tale for future business students.

Software like Expense Hub builds expense sheets with effortless drag-and-drop, drag-and-snap, or—better yet—auto-population from scanned receipts and integrated spend data. With customizable templates, your financial team gets a standardized, audit-ready record every single time.

It doesn’t end there. Expense Hub links your expense sheets directly to your accounting system, so there’s no more double handling or copy-paste wormholes (Factorial HR, Choosing the Right Expense Tracking App for Your Business).

Example: The Birthday Budget Blunder

Picture this: Becky from HR attempts a “simple” birthday party reimbursement. She emails receipts, fills out a TPS report, and waits…and waits. With Expense Hub, Becky scans the receipt, clicks “Submit,” and walks away. Minutes later: notification received, party (and processing) approved.

Expense Compliance Management: Your Policy’s Always Watching

Expense policies are great—until nobody follows them. The old model? Send out a PDF policy every quarter and hope for the best. Spoiler: hope is not a compliance strategy.

Expense claim management software like Expense Hub transforms that PDF into an active watchdog with a friendly face. If someone tries to expense a restricted item, the system flags it immediately. No awkward conversations or last-minute panic before closing the books.

Every claim gets checked in real time. Non-compliant expenses are frozen, flagged, and filtered, preventing payout before a reviewer can say “Hold on, what conference was in Las Vegas again?” Compliance is no longer just a legal backstop—it’s momentum in your favor (The Role of Automation in the Modern Financial Analyst Toolkit, Stripe).

Expense Reimbursement Software Capabilities: Happy Employees Are Productive Employees

Waiting weeks to get reimbursed is a surefire way to kill morale—and possibly team lunches, too. Fast, accurate reimbursements are not only a perk, they’re a necessity for keeping teams happy and focused.

With Expense Hub, once expenses are approved, the money moves. Users can track the progress of their claims on their phones and get instant payment status—not that “are-we-there-yet?” anxiety that comes from radio silence. Quick, transparent payment cycles mean less distraction and, let’s face it, fewer irate Slack messages (Bill.com, Expense Report Software: Simplify Compliance and Boost Efficiency).

Real Impact: Faster Money in Pockets

A logistics firm switched to Expense Hub and found that reimbursement cycles dropped from an average of 12 business days to just 6. That’s a 50% improvement, with no more bottlenecks, lost receipts, or forgotten approvals. Now, “When will I be paid?” is as out-of-date as dial-up internet.

Tying It All Together: The Power of App Integration

Expense Report Management App: Put Power in Every Pocket

The best expense report management app is the one your team actually uses—because it’s there, in their pocket, whenever and wherever they rack up a business expense.

Mobile is king, and nothing screams convenience like snapping a receipt at the register, tagging it, and tossing the paper (recycling, please!). With apps like Expense Hub, employees submit claims, track approvals, and get reimbursed—all on their phone, whether they’re hustling at a conference or waiting for a cab in the rain (Maximize Efficiency with the Best Expense Tracking Tools 2025 Guide for Business Travel Managers, Factorial HR).

Seamless Integration: Less Double Dipping, More Doing

Integration isn’t just a buzzword. Real productivity happens when your expense report management app links directly to the tools you already use—accounting software, payroll systems, document storage, even Slack.

Expense Hub’s claim management app masters this with real-time reporting, customizable notifications, and one-click exports. The result? Zero duplicate entry, less paperwork, and tighter control.

Pro tip: Make sure your chosen app isn’t just mobile, but truly integrated. Ask your team how many times they re-key “$14.89 Taxi” across tools. If the answer is more than once, you’re overdue for the upgrade.

How to Choose the Right Expense Claim Management Software

Start With Strategy, Not Shiny Objects

Don’t get dazzled by the first tool with a pretty logo and “AI” stamped everywhere. Here’s how to vet your next expense claim management software with a little less FOMO and a lot more ROI.

Key Criteria for Selection

- Customization: Can you build and adjust workflows for your business, or are you stuck with cookie-cutter templates?

- Scalability: Will it stretch as you grow, or will you outgrow it before next year’s audit?

- User Experience: Are the buttons where you’d expect? Can you train a new hire in minutes or will they run screaming?

- Integration: Does it talk to your existing systems—payroll, accounting, HR? Or will you be left Frankensteining tools together?

- Support: When things get weird (they always do), can you talk to a human and get a fix?

Expense Hub checks all these boxes. It’s crafted for both the micro-business running lean and the sprawling enterprise with operations on multiple continents. Its flexible, user-centric design means your team spends less time learning and more time doing (Expense Management Software for Business: Transform UK Finances).

Practical Steps

- Map your primary pain points: Is it approval delays, lost receipts, or accounting re-entry? Identify your biggest bottlenecks.

- Test a demo: Get a trial run with real receipts and users.

- Check references: Ask vendors for case studies or customer contacts.

- Compare pricing transparency: Make sure you’re not nickel-and-dimed for “basic” features.

- Trust your gut—and your team: Choose something everyone can get behind.

A Day in the Life: Real-World Case Study

Fictional Case: Sarah’s Sales Team and the Expense Hub Revolution

Sarah runs the sales wing of a mid-sized consulting firm. Her pain? Watching her reps waste hours wrangling their travel expenses every week. Worse, approval delays mean angry staff, missed deadlines, and compliance risks.

Enter Expense Hub. Implementation took only two training sessions and a handful of strong coffees. Within a single quarter, the numbers were staggering:

- 50% reduction in expense reimbursement cycle time

- 30% drop in expense report errors

- Compliance improvement: Policy violations fell by 60%

- Employee satisfaction up (measured by the scientifically recognized “fewer groans at expense report time”)

One skeptical rep emailed: “I used to dread filing claims. Now I’ll admit, it’s almost fun. (Don’t tell the boss.)”

Sarah can now check the live dashboard for her team’s status, spot potential bottlenecks, and tweak approval flows as needed. No more surprise overages, no more lost receipts, no more nightmares about audits.

Expense Hub didn’t just save them money—it gave the team back its most precious commodity: time.

Ready to Put Those Receipts to Rest? Here’s Your Next Step

If you’re still living in manual expense report limbo, you’re wasting resources, risking compliance, and—worst of all—stressing out your most valuable people. Modern expense report software doesn’t just streamline reimbursement; it overhauls your entire approach to business spending.

Expense Hub is built to meet you where you are—and take you where you want to go. Whether you’re tired of spreadsheet acrobatics, nervous about compliance, or ready for an automated future, this is where real efficiency begins.

No pushy pitch here. Just clarity:

- Explore our full suite of automated expense reporting solutions.

- Dive deeper into our compliance monitoring tools.

- Book a demo or start a trial—because seeing is believing.

Unleash time, reclaim accuracy, and turn expense reporting into a simple click-and-done. Seriously.

Your receipts deserve better. Your team does, too.

PS: Still not sure if automation is worth it? Check the industry expense report accuracy statistics and you’ll see—manual is the costliest mistake you never budgeted for.