- Exploring UK Expense Management Alternatives: Why Expense Hub Stands Out

- Understanding the UK Expense Management Landscape

- UK Expense Management Software: Key Features to Consider

- Comparing Popular Expense Management Software in the UK

- Expense Hub as the Best Expense Management Software Alternative in the UK

- Expense Hub vs Other Alternatives: The Deep Dive Comparison

- The Process of Transition: Switching to Expense Hub

- Customer Success Stories and Testimonials

- Why Your Next Move Should Be Local — And Laser-Focused

- Ready to Take Control of Your Finances? Here’s Your Next Step

Exploring UK Expense Management Alternatives: Why Expense Hub Stands Out

Let’s be honest: Nobody wakes up ecstatic about expense management. (If you do, check your pulse, or at least your coffee intake.) Yet for UK businesses, managing expenses has clawed its way to the front of the boardroom agenda — thanks to a perfect British storm of regulations, VAT, and the dreaded “Sorry, we’re closed for lunch” HMRC paperwork.

Why? Because the rules of doing business in the UK are both uniquely local — and, frankly, uniquely maddening. We’re not just juggling receipts for sandwiches and taxi rides. We’re keeping HMRC happy, counting every last penny of VAT, and praying our expense tool doesn’t think Xero is just a typo.

Here’s the twist: The UK expense management software market is booming. No, really. We’re talking billions. According to https://www.fortunebusinessinsights.com/expense-management-market-107094, this market is on track to hit a whopping USD 0.43 billion in the UK alone by 2025.

That’s not just a number. It’s a parade of British businesses (from bouncy one-person startups to 500-headcount behemoths) all stampeding toward tools that promise less admin, more compliance, and maybe—just maybe—a little less pain.

So, what’s on the expense management menu for UK businesses, and why is Expense Hub quickly becoming the secret sauce? Let’s break it down. And yes, I’ll sprinkle in plenty of napkin math and contrarian hacks. Because if you’re going to get this right, you need more than just a feature list — you need a battle plan. (And you’ll see, Expense Hub is more Swiss Army Knife than butter knife.)

Understanding the UK Expense Management Landscape

Why UK Expense Management is “A Whole Other Kettle of Fish”

Think expense management is the same everywhere? Try telling that to someone wrestling with HMRC’s ever-changing compliance demands after Brexit. Suddenly, your do-it-all global software isn’t cutting it.

Let’s paint a picture: Imagine you’re the lucky soul responsible for expenses at a mid-sized firm in Manchester. Jennifer from sales just submitted her receipts for a trip to Paris, Bob’s cab ride from Euston to Kings Cross is in limbo, and the Finance Director is whispering something about digital VAT records or the taxman “paying a visit.” You need a system where every pound, euro, and penny lines up not just with your accounts, but with HMRC’s expectations.

That’s what makes the UK market downright unique. It’s not just expenses—it’s compliance theatre, starring VAT and starring you as the unwilling lead. Learn more about https://blog.expensehub.io/hmrc-allowable-expenses-guide-uk-smes.

The Top Three UK Quirks Every Expense Tool Needs to Master

1. HMRC Compliance:

Miss a beat here, and you’re not just out of tune — you’re out of the orchestra. Every UK business, micro to macro, falls under the strict (and slightly fussy) gaze of https://www.gov.uk/government/organisations/hm-revenue-customs. If you don’t automate compliance and VAT recovery, expect headaches (and possibly, heart palpitations). For tips on mastering expense reporting, check out https://blog.expensehub.io/improve-expense-finance-process-reporting.

2. VAT Handling:

Here’s where most global options make a hash of things. UK firms must wrangle VAT like a pro — automated calculations, reclaim reports, multi-currency transactions since Brexit, and clear digital trails. (No, Karen, Excel spreadsheets won’t impress HMRC).

Hint: According to https://www.databridgemarketresearch.com/reports/europe-travel-and-expense-management-software-market, regulatory compliance isn’t just “nice to have” — it’s become the engine behind software adoption across the UK.

3. Integration with UK Ecosystem:

If your expense app doesn’t play nice with Xero? You might as well be using an abacus. Seamless integration with UK accounting systems saves hours, pounds, and, crucially, your sanity. Discover the differences in https://expensehub.io/xero-vs-sage-vs-quickbooks-2025.

The Remote Revolution

Add another layer: 44% of UK workers are now remote or hybrid, upending old-school “everyone drop your receipts in accounts on Fridays” workflows (https://www.researchandmarkets.com/reports/5971041/expense-management-software-market-report). Now expense management must be real-time, mobile, and built for teams who might never actually meet in person. Legacy tools can’t keep up; apps stuck in the past get left behind faster than an unattended umbrella on the Tube.

In Summary

UK businesses—especially SMEs—aren’t just looking for digital receipt storage or a prettier spreadsheet. They’re looking for automated, HMRC-hardened, mobile-first solutions. Expense Hub was practically invented for this landscape, fitting real compliance and real British business life into one tidy package.

UK Expense Management Software: Key Features to Consider

So, what’s actually on your feature shopping list if you want the best SME expense software UK comparison can offer? Let’s make this a practical one — no software unicorns, just what actually matters.

Must-Have #1: Bulletproof HMRC Compliance and VAT Handling

You know the feeling: payday is sweet, but HMRC’s VAT quarter is sour. If your system can’t handle bulletproof audit trails, digital receipts, and all those delightful tax codes, you’re left exposed. Expense Hub, for example, was designed with every VAT quirk in mind. It doesn’t just automate calculations — it chases down the right codes and files digital records, so you’re covered even if the tax office comes knocking with a list of “friendly questions.” Learn more about https://blog.expensehub.io/reclaim-vat-business-expenses for UK businesses.

Practical Example: An SME using Expense Hub flagged an error in travel expense VAT rates before the report was filed, catching a potential fine early. That’s compliance as a proactive safety net, not a post-mortem.

According to https://www.grandviewresearch.com/industry-analysis/travel-expense-management-software-market, robust tax handling now ranks top three in software selection for UK businesses. “Close enough” isn’t good enough; your software needs to make compliance practically effortless.

Must-Have #2: Seamless Integration with UK-Focused Accounting Tools

Here’s some napkin math: You connect your expense app to Xero or Sage. Suddenly, reconciliation time drops by 50% per month (multiply your finance manager’s hourly rate by that, and dinner’s on you). Software that can’t integrate means double-data entry, which means mistakes, which means backtracking — and probably someone muttering things unfit for publication.

The UK’s accounting ecosystem is its own animal. Global apps with “one-size-fits-all” connectors don’t cut it. Expense Hub integrates painlessly so your expenses appear in Xero, Sage, and QuickBooks like magic. That’s not just convenience — it’s a massive time-saver and a way to dodge errors that trip up audits. For more details on integration, see how https://blog.expensehub.io/accounting-software-integration-secret-weapon boosts productivity.

Must-Have #3: Cloud and Mobile: Built for the New British Workplace

Let’s play true or false: Can Jane in Brighton snap a picture of her receipt, upload it, and get manager signoff before she’s even left the coffee shop? If not, your expense tool is holding you back. The post-pandemic workforce is decentralized, and mobile capabilities are essential.

Take it from https://www.researchandmarkets.com/reports/5971041/expense-management-software-market-report: cloud-based, mobile-first solutions saw the most explosive growth with the rise of hybrid work. No more desktop-only relics or “print your claim and sign it” absurdities.

Expense Hub nails this. Its mobile workflow flows so smoothly, even your least tech-savvy team member can master it without a tutorial. Expense approval in five clicks or less? Welcome to the future.

Must-Have #4: Analytics, Security, and AI Automation

Remember when expense claims were just about “ticking the boxes”? Not anymore. Today, top tools must flag suspicious claims, spot trends (did someone just buy five gallons of printer ink?), and keep your data locked down.

Expense Hub delivers customizable reports, AI-driven fraud detection, and granular permissions—needed features, especially for finance, BFSI, and professional services who take compliance and data security more seriously than a Bulldog at a bone.

Fast-Track Checklist for SMEs: What to Demand

- HMRC-compliant VAT workflows

- One-click integration with Xero/Sage/QuickBooks

- Mobile apps with real-time alerts

- Customizable approval chains

- Automated policy enforcement

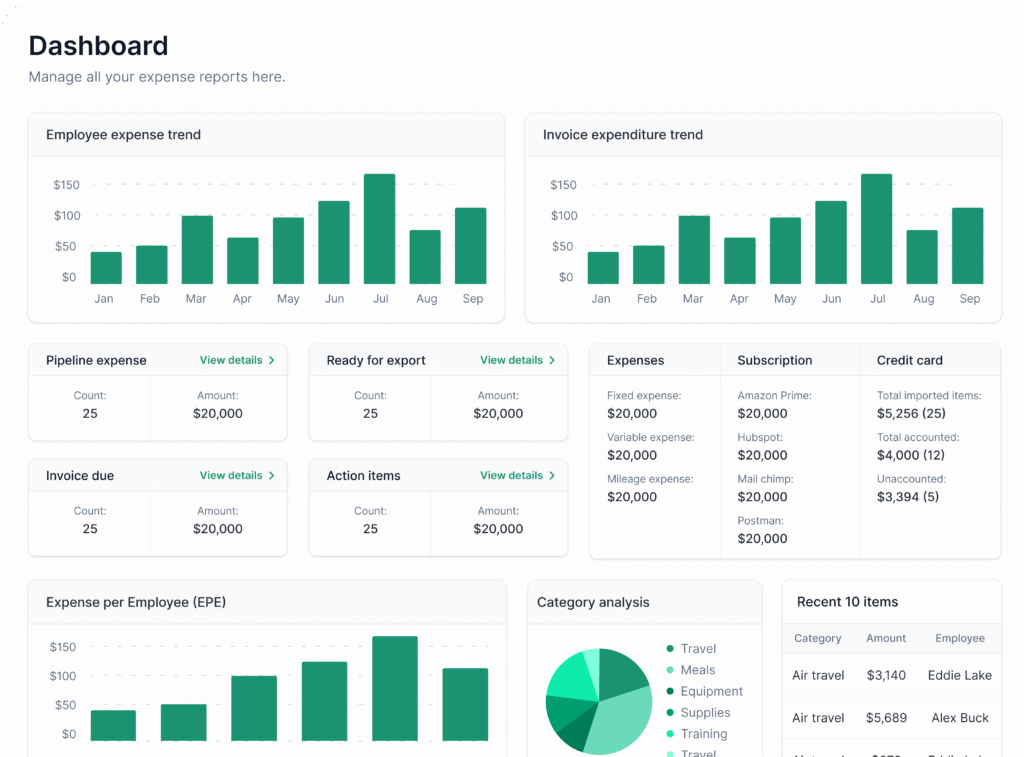

- Advanced analytics (but simple dashboards)

Expense Hub ticks every box. That’s not bragging; that’s just refusing to settle for “almost right.” SME expense software UK comparison is about who gets the details right, not who throws the most features at you.

Comparing Popular Expense Management Software in the UK

Let’s take off the kid gloves. Spendesk and Expensify are big names—but when it comes to serving British businesses, are they the best fit, or just flashy imports? Let’s throw them in the ring with Expense Hub and see who comes out swinging.

Spendesk in the UK Context: Swiss Watch, British Rules?

Spendesk shines globally, especially with card controls and team budgets. But the cracks appear with UK-specific headaches:

- Local Compliance: Spendesk often takes a “pan-European” approach. That means you, the UK user, might find VAT handling or HMRC digital record standards… loosely supported at best. You get generic tools, not the laser-guided compliance automation you actually need.

- Integration Woes: Plugging Spendesk into Xero feels more like wrestling a stubborn garden hose than a seamless experience. Manual uploads, format juggling—the kind of stuff your finance team will not thank you for.

- Customer Support: Want late-night help? Enjoy the timezone tango with teams not always tuned to UK working hours. Explore more https://blog.expensehub.io/best-spendesk-alternatives-uk.

Expensify: The Jetsetter’s Dream, But for UK SMEs?

Expensify’s claim to fame is global automation, slick mobile apps, and expense scanning. Great for travelers. Problem is:

- VAT and HMRC Support: UK tax quirks get lost in translation. Auto-VAT is basic, audit trails can be clunky, and HMRC submission isn’t truly frictionless.

- Xero/Sage Synergy: Integration is “possible”—but not “native.” Enjoy those weird mapping issues and lines in your trial balance that leave auditors frowning.

- Pricing: Expensify’s pay-per-user plans can punch your SME in the wallet, especially if your team size swings up and down. See why https://blog.expensehub.io/expensify-alternatives-uk-expense-hub.

Expense Hub: Built For the British Battlefield

- Compliance, Taxes, VAT: Expense Hub’s workflow runs on UK-specific rails. Automated VAT breakouts, one-click digital receipts, and reports built for HMRC review. No more post-it notes, no more awkward explainers to auditors.

- Real Integration: Connects with Xero, Sage, and QuickBooks out of the box. One step, zero manual cleanup.

- Support: Live chat, UK hours, and real humans with real answers—no chatbots, no overseas hops.

- User-Friendliness: Even the CEO can use it before their second coffee. Dashboards are clear, approval chains intuitive.

- Cost-Effectiveness: Transparent pricing that scales with your SME—not against you.

Don’t just take my word for it. https://www.technavio.com/report/expense-management-software-market-analysis found that local compliance and real, “works when you’re mobile” solutions are the clear winners in the UK. Guess who nails that brief?

Expense Hub as the Best Expense Management Software Alternative in the UK

The Recipe for Success: What Expense Hub Gets Right

Let’s break down why Expense Hub simply fits UK businesses like a bespoke Savile Row suit (but with fewer zeros on the price tag):

Customization for Real-World VAT and HMRC Needs

Expense Hub wasn’t an American app with a UK translation tacked on—it’s designed for the British regulatory gauntlet. The platform’s workflow:

- Flags VAT at every step — so you can’t miss a reclaim, no matter how sleepy the Friday afternoon.

- Creates ready-for-HMRC digital records — meaning no panic if the taxman calls.

- Lets SMEs custom-brand approval workflows — because not everyone wants “finance says no” emails sounding like a robot.

Detailed Reporting That Makes Auditors Smile

Say goodbye to hours spent on Excel pivots. Expense Hub spits out reports so tidy, even your auditor will raise an impressed eyebrow. Want to break down expenses by department, region, or VAT rate? Two clicks. Fancy a snapshot of the last quarter’s claims, errors flagged, or recurring oddities (“Steve, why do you need that much toner?”)? Done.

Stories From the Trenches: Real UK Businesses, Real Results

- Case One: The Law Firm

Andrew, the managing partner at a regional law firm, recalls how they used to chase partners for signed receipts (and sometimes, their own memories). With Expense Hub, partners submit via mobile on the train home and the finance team matches claims to cases in seconds. “We knocked hours—and arguments—off our month-end process,” says Andrew. - Case Two: The Consultancy

Emma’s PR agency needed to reclaim cross-border VAT without getting lost in bureaucratic limbo. Expense Hub flagged missing data on claims before submission, boosting their quarterly VAT reclaim by 15% (that’s a tidy wedge right back on-the-books).

Don’t believe it’s that easy? Check out the Expense Hub success stories page for the real-life numbers.

Efficiency That’s About Time, Not Just Money

SMEs have enough on their plate. With Expense Hub, the onboarding is so smooth you’ll think you’ve missed a step. Custom tutorials, migration for your old Excel files, and live setup help. All tailored for UK quirks. You’ll be compliant and operational in mere days—not months.

Expense Hub vs Other Alternatives: The Deep Dive Comparison

You want specifics, not just sales talk. Let’s get out the whiteboard and list what actually matters when comparing SME expense management software for UK businesses.

Cost: Transparent, Fair, and Scalable

- Expense Hub: One price per active user, month-to-month, all features included. No gotchas, no “but that’s an extra fee” surprises.

- Spendesk: Layered plans, hidden costs for premium features, and card issuance fees. SME scaling gets expensive. (And let’s not talk about fluctuating exchange rates.)

- Expensify: Per-user pricing, with add-ons for audit support/extra integrations. Costs can snowball as you grow.

UK-Specific Features: No Compromise

- Expense Hub: Pre-built for HMRC and VAT. Auto-updates as rules shift. Exports reports to match digital record-keeping standards.

- Spendesk: UK frameworks “supported,” but no deep customization or ongoing legal updates.

- Expensify: Robust automation, but little UK legal nuance. You wind up copy-pasting between systems or doing “interpretative dance” for auditors.

Integration With Accounting Systems

- Expense Hub: Full API and direct feeds to Xero, Sage, and QuickBooks (and plenty more—learn more in this https://blog.expensehub.io/choosing-expense-management-software-UK guide).

- Spendesk/Expensify: Possible, but with more fiddling. Mapping issues, manual reconciliation, sometimes weeks until new UK accounting integration updates appear.

User Experience and Support

- Expense Hub: UK-based support, real humans, and thoughtful onboarding (including out-of-hours help during year-end crunch).

- Spendesk/Expensify: EU/US time zones; “submit a ticket and we’ll get back to you.” Not great when HMRC is waiting.

Expense Hub doesn’t just “match” the others — it outpaces them specifically where UK SMEs need it most. And in a 2024 landscape full of cloud, remote work, and relentless compliance, that edge isn’t luxury — it’s a lifeline.

The Process of Transition: Switching to Expense Hub

Breaking the Chains (Of Bad Expense Software)

Worried about switching costs, lost data, or confused teams? Don’t be. Expense Hub gets that UK SMEs don’t have spare bandwidth for drawn-out migrations. Here’s how a typical switch works — no migraine required.

Step-By-Step: The Expense Hub Onboarding Experience

Step 1: Consultation & Audit

Expense Hub’s UK onboarding specialists kick things off with a checkup—looking at your current tools, your compliance needs, and your pain points (yes, even the embarrassing ones).

Step 2: Seamless Data Migration

Old expenses, authorizations, user hierarchies—drag them in, and Expense Hub’s team makes sure nothing gets lost. Import wizards pull data from legacy tools, spreadsheets, and yes, even that old Dropbox folder.

Step 3: Custom Configuration

Expense policies are British by default: mileage rates, VAT rules, approval flows. Your business size, structure, and workflow? All factored in before anyone clicks “submit.”

Step 4: Training That Actually Sticks

Training is practical—not just PDFs, but live sessions, cheat sheets, and video walk-throughs for every team. No jargon. And ongoing support means stupid questions don’t feel stupid.

Step 5: Ongoing Support (UK Time, Please)

Hit a snag? Live chat is manned by UK-based experts, not “bots who’ll escalate you.” Whether it’s a weird VAT receipt or a month-end panic, help is just a click away.

“Easy” isn’t just a slogan — it’s why UK firms keep recommending Expense Hub to their mates.

Customer Success Stories and Testimonials

Numbers are nice, but you want proof from businesses like yours. Here are a couple of Expense Hub success stories that show what’s possible.

Transforming Chaos to Clarity: An Accountancy Firm’s Journey

Mark’s two-office practice in Leeds was a classic motley crew: field staff losing receipts, admin drowning in manual checks, annual panic every VAT period. After switching to Expense Hub:

- Manual claim processing time dropped by over 60%

- VAT recovery improved (yes, they got real money back—enough for a Brexit party)

- Mark’s team could finally focus on clients, not paperwork

“We used to say ‘Don’t spend if you can’t find the receipt later,’” Mark laughs. “Now? The system catches missing info before it ever reaches Sue in accounts. I’m finally NOT dreading quarterly filing.”

Scalability and Compliance: The SME That Grew Without Growing Pains

A growing ecommerce player with teams in London and Birmingham struggled to keep cross-region and international expense claims HMRC-proof. With Expense Hub:

- Digital trails for every claim (“Here’s who, when, and what — all in one click”)

- Audit preparation slashed from three days’ work to an afternoon

- Full team adopted mobile submissions, reducing late claims by 90%

Check out more transformation tales on the official Expense Hub success stories page.

Why Your Next Move Should Be Local — And Laser-Focused

Let’s wrap up where we started. UK expense management alternatives aren’t created equal. The game isn’t “find the shiniest tool nationally.” Instead, it’s about finding a partner who:

- Lives and breathes UK rules, from VAT to compliance

- Integrates right into Xero, Sage, or your own unique setup

- Offers real support for how you actually work — not how a US or EU company does

Expense Hub isn’t just another face in the expense crowd. It’s the toolkit designed for you, engineered to tackle the headaches that keep UK finance pros up at night.

Ready to Take Control of Your Finances? Here’s Your Next Step

Tired of wrestling receipts, unpicking VAT mysteries, or dreading compliance audits? You’re in