- Discover the Best Spendesk Alternatives in the UK for SMEs: Serious Savings, Legendary Support, Better Business

Discover the Best Spendesk Alternatives in the UK for SMEs: Serious Savings, Legendary Support, Better Business

Let’s play a quick game: “If your expense management tool makes life harder, is it still a tool, or is it just another problem with a login screen?”

Welcome to the expense management rodeo, UK style. Thousands of small and medium-sized enterprises are saddling up, only to fall straight off the Spendesk horse — bruised by high costs, let down by so-so support, and left hankering for features that actually work for them, not just for the Parisian product manager who doodled them on a café napkin.

If you’re reading this, you’re probably wondering if there’s a smarter, less “French bakery prices” way to manage your business spend. Maybe you’ve grappled with Spendesk’s modular pricing (at first blush, a crisp croissant – then, surprise: it’s packed with expensive add-ons and not nearly enough butter). Or you hit a wall with support — the sort where “local support” seems to mean “someone in another time zone googling UK laws.”

Either way, you’re not alone. UK SMEs from London startups to Manchester agencies are ditching legacy expense tools for solutions that actually fit. Expense Hub entered this mess — cheerfully, bravely — with a different take: “What if UK businesses could track every penny, simplify approvals, and actually talk to a support person with a Leicester accent? All without selling their director’s Range Rover?”

Today, we’ll open up the mystery box of the best Spendesk alternatives UK business owners can actually get excited about. We’ll show you what’s lacking, break down the numbers, and get practical. You’ll leave not just with knowledge, but with an actionable route to smarter spending. And yes, Expense Hub is right in the centre of this conversation – not as an ad, but as a modern solution that’s earned its reputation (and a growing fanbase peeking over the Spendesk fence).

Ready? Roll up your sleeves and let’s treat expense management like the high-stakes sport it is.

Understanding the Key Features of Spendesk

Spendesk’s Core Offerings: A Decent Pizza Base… But Where’s the Topping?

Let’s be fair. Spendesk didn’t take over finance departments by being useless. Its core ingredients are solid:

- Company cards (physical and virtual) with pre-set spending limits. Never again do you need to pass your personal card around like a secret handshake at the office pub.

- A mobile app that snaps receipts faster than you can say “VAT reclaim,” making paper chases a thing of the past.

- Expense tracking with real-time updates, quick approvals, and the minimum paperwork your accountant will tolerate.

Not a bad starter kit, right? But here’s the rub: innovation stopped just as you started needing more toppings:

- Modular pricing – Looks affordable from a distance, but every time you want a “premium” feature (like adding an extra user, or integrating with your existing accounting setup), the price tag grows faster than a teenager on protein shakes. [Proof: See Airwallex on Spendesk alternatives]https://airwallex.com/uk/blog/best-spendesk-alternatives.

- Basic invoice and PO management – Good enough for simple expenses, but if you’re handling multiple suppliers, currencies, or need granular workflows, you’ll feel the pinch.

- Inadequate multi-currency support – Spendesk claims to ride the global wave, but for most UK SMEs trading in GBP and EUR, support is limited and foreign exchange rates can nibble away at profits.

- Local support? Sort of. Clients report that help can be slow or… missing. UK-based queries occasionally get the “please hold, while we learn your country’s compliance laws” treatment. Who has time for that? [Tipalti’s Spendesk assessment backs this up]https://tipalti.com/en-uk/resources/learn/spendesk-alternatives/.

It’s like getting a pizza base and calling it lunch. Technically, yes. Satisfying? Not quite — especially when, as an SME, you need the works and the right price.

Where Spendesk Misses the Mark for UK SMEs

Let’s put numbers to feelings. Imagine your business with 10 staff needing expense cards, basic approvals, and integration with Xero. With Spendesk, modular pricing means you pay not just for cards, but for add-ons, integrations, and sometimes support tiers. It’s like buying a car, then paying extra for wheels and the steering wheel.

As companies scale, the cracks widen. Supplier management is limited, workflows may feel clunky, and when things get tricky (say, multi-entity setup), the tool starts to groan. If you’ve ever shouted at a SaaS dashboard and heard nothing but your own echo, you know the feeling. [For more on software integration and enhancements, visit our guide on accounting software integration]https://blog.expensehub.io/accounting-software-integration-secret-weapon.

No wonder savvy finance types across the UK are scouring Google for spendesk alternatives that actually work for them. [Our blog on expense management software for the UK can give you more insights]https://blog.expensehub.io/choosing-expense-management-software-UK.

Expense Hub’s Offering Compared to Spendesk

Expense Hub didn’t just see the cracks in Spendesk’s coverage; it smashed through the gaps and built a bridge out of them. If Spendesk is cafeteria pizza, Expense Hub went full-on wood-fired pizzeria: same basic ideas, executed with local flair, better value, and actual care for the customer experience.

Spendesk vs Expense Hub: Why the New Kid Is Winning Hearts (and Wallets)

Let’s get straight to it — spendesk vs expense hub isn’t a clash; it’s a passing of the torch.

- Cost-efficiency that makes accountants do a happy dance: Where Spendesk’s pricing creeps upwards with each added feature, Expense Hub bakes everything in from the start. No smoke-and-mirrors, no “contact us for quote” emails lost in the ether, just transparent, fair pricing that scales with your business.

- UK-specific support: Not just “someone speaks English,” but actual support teams based in the UK. You get answers in your time zone, from people who know what HMRC stands for (and don’t need a Wikipedia refresher).

- A user interface your granddad could master: No labyrinthine menus, no guesswork. Everyone, from part-time interns to battle-hardened FDs, can find what they need without a 20-minute tutorial. [See the role of a good user interface in enhancing financial processes]https://blog.expensehub.io/improve-expense-finance-process-reporting.

- Direct integration with UK bank feeds and invoice formats: Save time, avoid costly mistakes, and make your year-end a cakewalk.

- Support for growing businesses: Whether you have five staff shopping at Tesco or fifty handling supplier relationships, Expense Hub flexes with you.

It’s no wonder that SME bosses from Leeds to Bristol are championing Expense Hub as the best alternative — not as a sweetener to Spendesk, but as a true upgrade for UK business needs. [Learn more about Spend Management Strategy: Innovative Tips for Better Finances]https://blog.expensehub.io/mastering-spend-management-strategy.

The Best Spendesk Alternatives for SMEs in the UK

“Alternatives” doesn’t mean “poor cousin.” The right tool will shave hours off admin, reclaim lost receipts from the abyss, and maybe even spark a small cheer when tax season comes around.

Expense Hub: A Leading Spendesk Alternative

Let’s not mince words: Expense Hub is not just an alternative; for the UK market, it’s the best spendesk alternative for SMEs hands down, and here’s why:

The Real-World Power of Expense Hub

- Flexible pricing that fits SME wallets: You don’t have to be a spreadsheet ninja to know when you’re getting charged for fresh air. Expense Hub’s pricing is simple and transparent, letting you plan expenses without nasty surprises.

- UK-specific features — built from local business feedback: Think swift GBP processing, compliance checks for UK rules, and workflows made for busy British teams.

- Legendary support (actual humans, not chatbots): Imagine a support team that doesn’t make you swear at hold music. Expense Hub takes pride in answering queries in real English, helping you solve issues fast.

- Practical user experience: From uploading receipts to auditing card usage, everything’s as easy as pie — because business life should be easier, not more complicated.

But don’t take my word for it. UK business owners who’ve switched from Spendesk to Expense Hub consistently report faster onboarding, lower monthly costs, and support that actually solves problems on the first call. Want to see how? Here’s a deep dive into [How Expense Hub Supports UK SMEs]https://www.expensehub.io/blog/why-expense-hub-is-ideal-for-uk-smes.

Expense Hub in Action: A Story from the Trenches

Keen Media, a growing Brighton creative agency, was hemorrhaging both time and money. Their director described their Spendesk set-up as “like buying a Swiss Army knife and getting only three tools.” Expenses lagged, reconciliations stalled, and when an issue came up in March, they got a ticket response in May.

After a short (actually enjoyable) onboarding with Expense Hub, not only did admin hours drop by 70% according to their office manager, but the finance team had full spending visibility — and support actually called them to check on their migration! That’s not myth — that’s what a real best spendesk alternative for SMEs looks like in practice.

Other Notable Spendesk Alternatives for UK Businesses

Full disclosure: Expense Hub isn’t the only kid at the party, just the best-dressed one. Let’s give credit where it’s due and run a quick lap around the field:

Pleo

- What shines: Company cards (physical and virtual) with neat cashback, instant receipt scan, easy reimbursement. Snappy onboarding, and a pretty tiered monthly plan.

- Who loves it: Startups and SMEs that want to ditch paper expenses fast. Users rave about the app’s “just works” feel. (See the love-fest on [Pleo’s Spendesk alternative page]https://www.pleo.io/en/spendesk-alternative).

- What to watch: Some report slowdowns when scaling beyond small teams, or missing deeper reporting tools.

Payhawk

- What shines: Combines expense cards, AP, and ERP integrations for serious finance teams. Great for multi-department businesses — scale without friction, bulk import users, and enjoy a caretaker onboarding.

- Who loves it: CFOs who want spend control across rapidly expanding teams. More at [Payhawk’s comparison]https://payhawk.com/blog/best-spendesk-alternatives.

- What to watch: Pricing can stack up per user, and interface complexity isn’t always loved by non-finance staff.

Soldo

- What shines: Prepaid cards in GBP/USD/EUR, tight focus on employee expenditures, works well if you have heavy spend across lots of users.

- Who loves it: Businesses needing controlled, decentralized spend. (See the [Airwallex rundown]https://www.airwallex.com/uk/blog/best-spendesk-alternatives).

- What to watch: High-volume users benefit most, but smaller outfits may find limited flexibility.

Ramp

- What shines: Free (yes, really) tier for basics, piles of pre-built integrations, and claims to save 20,000+ hours per year for customers through heavy automation.

- Who loves it: Ambitious businesses streamlining sprawling finance processes. [Check comparative reviews]https://ramp.com/blog/top-spendesk-alternatives.

- What to watch: US-first, with UK support growing but not yet best-in-class.

Airwallex

- What shines: Globe-trotters delight — world-class multi-currency, FX management, and all-in-one platform for international payments.

- Who loves it: SMEs trading globally, needing a finance tool that doesn’t flinch at border crossings. [See Airwallex’s comparison]https://airwallex.com/uk/blog/best-spendesk-alternatives.

- What to watch: International strengths sometimes come at the cost of deep UK specialization.

All told, these spendesk alternatives UK businesses now have to choose from are leaps ahead of the old days of paper forms and rogue Excel sheets. Yet for most British SMEs who want reliable support, all-in pricing, and no-nonsense features, Expense Hub still stands out from the crowd. [Learn more about top mileage tracking apps that are complementary to expense tools]https://blog.expensehub.io/how-to-choose-mileage-tracker-app.

Comparing Expense Hub and Spendesk: Head-to-Head

Let’s roll up the sleeves and serve what accountants crave: feature-by-feature, pound-for-pound spendesk vs expense hub comparisons.

Features Faceoff: Expense Hub vs. Spendesk

Expense Management, Cards, and Approval Workflows

- Cards: Both offer physical and virtual cards. Spendesk’s real-time controls are solid; Expense Hub matches, but with one-click GBP management tailored for UK banks. [Check out improved strategies for managing business expenses across different platforms]https://blog.expensehub.io/improve-expense-finance-process-reporting.

- Receipt capture: Both have mobile apps, but Expense Hub’s OCR is built on actual UK invoice layouts, shaving down human error on expense claims.

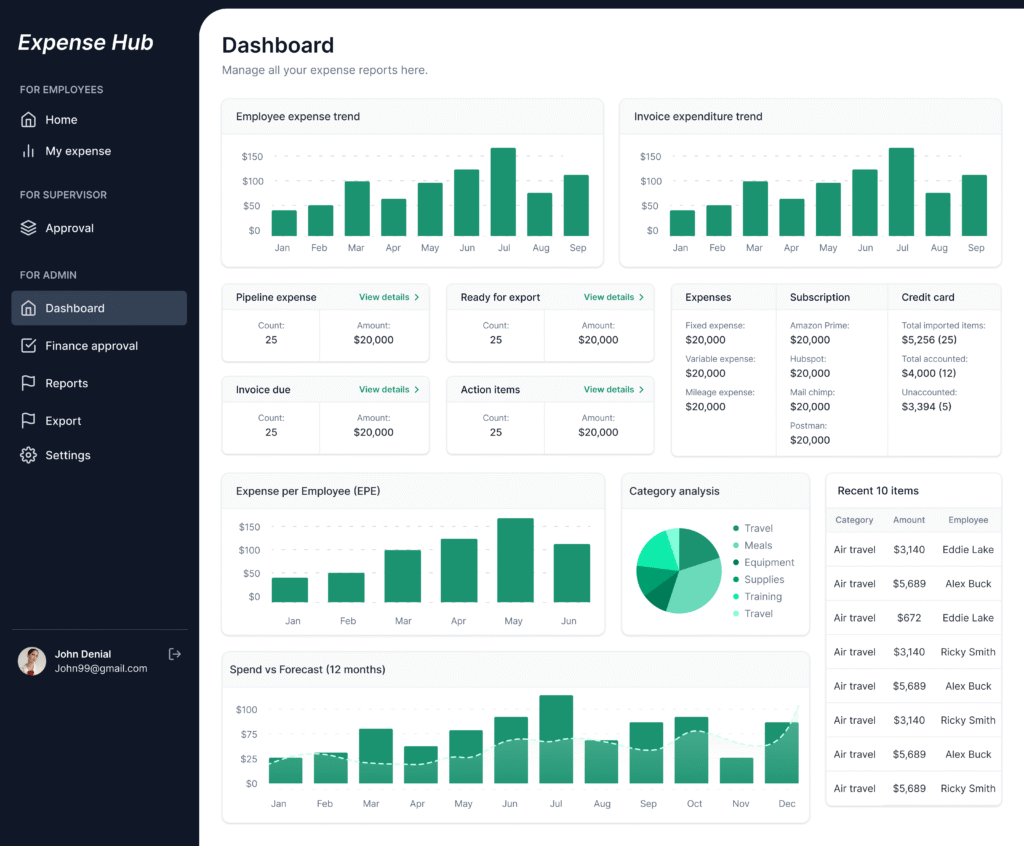

- Expense visibility: Expense Hub offers dashboard-level reporting that tracks by project or team — no fiddling with exports, no extra charges. [Discover how improved reporting features can boost business growth]https://blog.expensehub.io/advanced-financial-reporting-techniques-insights-business-growth.

- Approvals: More customizable with Expense Hub. Want a unique flow for travel, and another for tech? No problem.

- Supplier management: Spendesk’s offering is thin, while Expense Hub puts supplier onboarding and payment management up front — vital if you’re paying more than the occasional freelance designer.

Reporting and Compliance

Expense Hub outpaces Spendesk in integrating with UK accounting standards: think MTD compliance, direct Xero and Sage links, and reporting exports HMRC actually likes. Spendesk can feel EU-first, forcing workarounds.

For the nitty-gritty breakdown, see our [In-Depth Comparison of Expense Tracking Software]https://www.expensehub.io/blog/expense-tracking-software-comparison for the data behind these claims.

Price and Value: Cheaper Spendesk Alternative UK Businesses Actually Want

Let’s talk napkin math — the Mike Michalowicz special.

Suppose you’re a 20-person agency:

- Spendesk: Modular plan. Want cards? Tick. Want integrations? Tick. Want support in English, Monday through Friday? Another tick. Starting at £8/user/month (bare bones) and soon climbing over £300 per month (source: [Airwallex report]https://airwallex.com/uk/blog/best-spendesk-alternatives).

- Expense Hub: Flat rates, typically 20-30% less at scale. No add-ons lurking in the shadows. Even at £200/month, you get support, integrations, and all the core features baked in.

And unlike the “contact us for quote” routine, hello actual, visible price tags! See how [Expense Hub helps scale UK SMEs affordably]https://www.expensehub.io/blog/why-expense-hub-is-ideal-for-uk-smes.

The Bottom Line: Spend Less, Get More

Every expense software claims it saves money, but Expense Hub delivers it — straightforward, without Excel headaches or unwelcome “renewal surprises.” The real ROI comes from time saved, admin work outsourced to the platform, and having support ready when things go sideways (because, let’s face it, sometimes things do).

Real User Experiences and Testimonials: Proof from UK SMEs

“Yeah, but does it really work?” Let’s put some skin in the game — real SME stories, warts-and-all.

Changing Course: When UK SMEs Move from Spendesk to Expense Hub

Case 1: Whiston Engineering Ltd, East Midlands

Their finance chief told us, “Our Spendesk rep vanished after onboarding. When invoices didn’t sync, we were left guessing. Switching to Expense Hub? We got migration help, local onboarding, and support on WhatsApp. It’s like having a finance cousin who actually likes you.”

Within two months, Whiston slashed admin hours by 60%, cut expense approval times from 3 days to same-day, and made sense of their monthly management accounts for the first time in a year. [For insights on such user transformations, see our guide on expense management tool adoption]https://blog.expensehub.io/mastering-expense-management-tool-adoption.

Case 2: The Digital Hive, Manchester

Growing staff, growing pains. “Expense Hub let us add new cardholders and suppliers without submitting a ‘support ticket’ for every single tweak. Pricing was clear, and when we hit our first quarter milestone, they sent brownies. I can’t say Spendesk ever sent baked goods!”

Industry Feedback: How Do Other Alternatives Stack Up?

It’s not just Expense Hub making life easier. Pleo, for example, cracks 94% satisfaction for ease of use on G2, and Ramp users rave about their free plan saving “thousands in lost invoices.” ([See Pleo’s user feedback]https://www.pleo.io/en/spendesk-alternative; also compare with [Ramp reviews]https://ramp.com/blog/top-spendesk-alternatives).

But the golden thread across testimonials? UK SMEs switching from Spendesk want clearer pricing, faster response times, and better controls. Expense Hub, with its laser-focus on UK rules and versatile reporting, consistently gets flagged for solving exactly those pain points. Check the [latest user stories]https://www.expensehub.io/testimonials for the receipts (pun absolutely intended).

Why Choose Expense Hub Over Spendesk?

Let’s recap — in plain English, minus the jargon:

- Local support that never sleeps on UK business hours.

- Transparent, fair pricing – no “optional” features you can’t live without.

- Features built for the real quirks of British SMEs, not just generic templates.

- User satisfaction that isn’t just “fine” — it borders on actual joy.

- Faster onboarding, so you’re spending less time with customer success and more with customers.

And if you’re tired of wrestling five tools to add up to one solution, Expense Hub absorbs card management, approvals, supplier onboarding, and expense tracking in one friendly dashboard.

Spendesk got UK SMEs in the door; Expense Hub lets them stay, grow, breathe, and finally focus on their actual business. [For a comprehensive look at zero-based budgeting strategies in managing company finances, visit our guide]https://blog.expensehub.io/effective-zero-based-budgeting-strategies.

Here’s Your Next Step: Give Yourself the Gift of Sanity

Reading about the cheaper spendesk alternative UK isn’t half as satisfying as actually seeing the hours (and pounds) come rolling back into your business. Expense Hub is built for growing British SMEs — by people who’ve worn the same boots, tapped the same receipts, and cursed the same hidden fees. [To understand how automation can supercharge your finances, learn about the role of automation in financial analyst toolkits]https://blog.expensehub.io/the-role-of-automation-in-the-modern-financial-analyst-toolkit.

Why not see for yourself? [Sign up for a free, zero-risk trial right now]https://www.expensehub.io/sign-up and experience Expense Hub’s difference in your next claim, your next supplier audit, or your next Friday afternoon (when you’d rather be in the pub than sorting expense nightmares).

Ditch the drama, save the pounds, and give local support a try. Let’s turn expense management from a chore into your sneakiest growth hack yet.

Expense Hub: For UK businesses who’d rather outsmart the expense game than outspend it. Ready to see the difference? Start your free trial here.