Expense Policy Best Practices for Small Businesses: Stop Leaking Money and Gain Control

Why Effective Expense Policies Aren’t Optional for Small Businesses (But Most Treat Them Like an Afterthought)

Let’s get real for a second. Running a small business without an expense policy is like playing Monopoly — except everyone’s making up the rules, and only one guy seems to be collecting $200 every time he passes “Go.” That’s not a game you want to play with your cash flow.

Expense policies aren’t there just because “that’s what grown-up companies do.” They’re your front-line defense against unnecessary spend, compliance headaches, and the kind of out-of-the-blue expenses that have you asking, “Who approved this $500 office chair for the work-from-home intern?” (Spoiler: no one knows.)

But when you do nail down expense policy best practices, here’s what happens:

- Costs stop running wild.

- Employee reimbursements get lightning fast — cue the grateful Slack DMs.

- Financial health improves, because you finally have clarity over your outflows.

It’s not magic. It’s a matter of streamlined expense management. And these days, you don’t need an army of accountants or a file cabinet the size of a fridge. Enter https://blog.expensehub.io/unlocking-efficiency-expense-management-software—the tech solution that’s digitizing, automating, and simplifying expense processes for real-world, boots-on-the-ground small businesses. We’ll show you exactly how—in practical, story-driven detail.

Ready? Because your bank account sure is.

Understanding Expense Policies: What They Are (and Why Your Team Shouldn’t Hate Yours)

Expense policies are the playbook for every spend in your company. Imagine handing out corporate credit cards with absolutely zero rules. Chaos, right? That’s why you need this document.

What’s Inside a Smart Expense Policy?

Think of an expense policy as a well-written recipe:

- Ingredients (Allowable Expenses): What employees can buy (hotel for a work trip—yes; dolphin-shaped pool floaty—probably not).

- Measurement (Limits): The max anyone can spend (because “sky’s the limit” is not fiscally responsible).

- Instructions (Procedures): How to submit expenses and get repaid (do you want receipts taped to napkins, or uploaded via app?).

- Timing (Deadlines): When claims must be filed so payroll isn’t chasing ghosts.

A strong expense policy puts everyone on the same page (and yes, people actually read it if you keep it clear and concise). No more “but Jim said I could expense my artisanal green juice cleanse…”

Why Policies Flat-Out Matter

Without structure, you open yourself up to:

- Freeloaders testing your generosity (“Oh, company policy says nothing about first-class upgrades!”)

- Payroll purgatory (the steely silence after you ask for missing receipts).

- A “Wild West” budget where last month’s spend bears zero resemblance to this month’s.

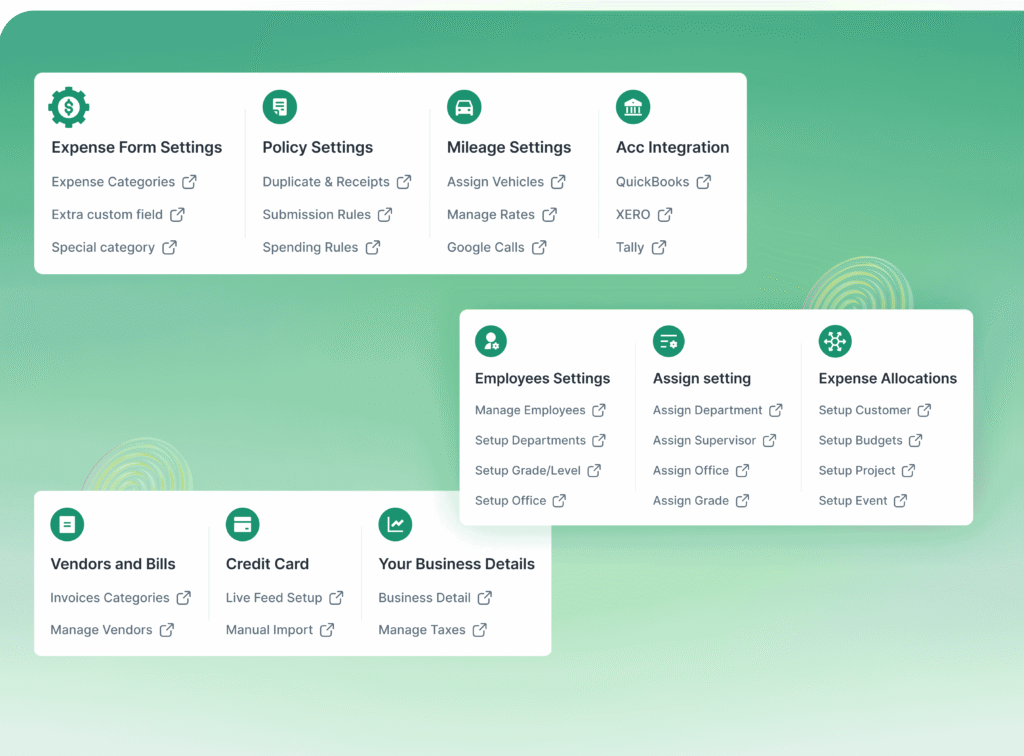

Expense Hub helps you dodge these disasters with ready-made policy templates and communication tools that take that PDF rulebook and make it accessible, relevant, and—wait for it—actually understood. Plus, Expense Hub’s built-in reminders ensure people remember to read and follow the darn thing.

For a deeper dive, check out https://www.concur.com/blog/article/6-expense-reimbursement-policy-best-practices-and-why-you-need-them and see why this stuff is non-negotiable.

The Big 3: Expense Policy Best Practices Every Small Business Must Follow

If you’ve ever sat through a meeting about “spend alignment” and left more confused than when you started, you’re about to get all the clarity you need.

Clarity and Transparency: Say Goodbye to Grey Areas

Start by drawing a bright, neon-highlighted line between what’s in and what’s out. Define every reimbursable expense and set the rules for exclusions.

Let’s break this down with napkin math:

If you have 10 employees, and each submits just one “should I really be expensing this?” claim a month, you burn hours clarifying, correcting, and sometimes, fighting about it. Say each “clarification” takes 15 minutes—that’s 2.5 hours you’re spending on confusion, every month.

Expense Hub’s customizable templates allow you to spell out all the details, from what defines a “business meal” to caps on travel, so there’s zero ambiguity. No more emails with subject lines like, “Can I expense this?” The policy answers it, black and white.

Practical Steps to Achieve Clarity

- List specific allowable expenses (travel, meals, office supplies) and exclusions (personal grooming, Taylor Swift tickets).

- Outline submission requirements: must include receipts, date, and business purpose.

- Map out approval workflows: who must sign off and in what order.

Consistency is irresistible—think of it as your best defense against the “but I didn’t know” excuse.

Regular Policy Reviews and Updates: Because Your Business Isn’t Frozen in Time

Think your policy is “set it and forget it?” Think again. Regulations change. Your business grows. Suddenly, your team’s traveling internationally, and your policy mentions nothing about currency conversion.

Here’s where regular policy reviews come in. Schedule a quarterly check-in—seriously, put it on the calendar—and make it as much a part of your rhythm as payroll.

Expense Hub makes this actually doable. You can edit policies on the fly and push updates instantly to your entire team. No more “outdated PDF attachment” trauma.

Real-World Example

Company A didn’t update their expense limits for a decade. Now, employees are clamoring for higher meal caps—because $6 doesn’t buy a latte and a muffin anymore. Company B, using Expense Hub, adjusts limits with a few clicks and broadcasts updates—problem solved, compliance maintained.

Incorporating Employee Feedback: Policies People Believe In (Because They Helped Write Them)

Want actual buy-in? Ask your people what’s working—and what’s not.

“Hey, team, what slows you down on expense reports?” You’ll be shocked: maybe it’s not the rules, but glitchy submission systems or too-tight per diem rates.

Expense Hub is built for feedback loops. Employees can flag issues, suggest improvements, and you can respond publicly (“Thanks for the suggestion, Jordan! We’ve updated the policy to include Uber Pool!”).

This isn’t democracy gone wild—it’s about practical improvement and making rules that are respected because they’re realistic.

Example: When a small business let its team suggest restaurant price caps for client dinners, adherence shot up. Employees were less likely to fudge a too-low limit and stopped grumbling about ‘impossible rules.’

Want even more tactics? https://www.sage.com/en-us/blog/creating-an-effective-expense-policy/

Optimizing the Employee Expense Reimbursement Process: Don’t Make Folks Wait for Their Money

Slow reimbursements? That’s the #1 way to guarantee eye rolls and mutinies. Here’s where streamlined processes really shine.

Streamlining Submissions: Digital > Paper

Nobody wants to shuffle receipts like playing cards and hand them to finance. Paperless expense reporting is faster, error-resistant, and lets you approve claims while waiting for your coffee.

With Expense Hub, employees can:

- Snap a pic of their receipt.

- Fill a simple form via mobile or browser.

- Submit instantly—no hunting for scanner access at the airport lounge.

This isn’t just about speed. It cuts entry errors, eliminates lost paperwork, and—brace yourself—keeps your accountant’s blood pressure within normal range. Intrigued? See https://blog.expensehub.io/streamlining-business-expense-report-software for the nitty-gritty.

Speeding Up Approvals: Automation Is Your Friend

You don’t want expense approvals bottlenecked because Liz is out sick. An automated, multi-tiered workflow is the answer.

With Expense Hub:

- Claims route to the right manager, instantly.

- Automated reminders chase slowpokes, not you.

- Approvals can be made on the go, not just at a desk.

You slash turnaround from “whenever I get to it” to “done by lunch.”

Myth-Busting: Automation ≠ Less Control

You’re not ceding oversight. You’re just cutting the time wasted on manual checks. Expense Hub’s settings still let you flag high-dollar expenses or weird patterns for manager review.

Ensuring Compliance and Accuracy: Don’t Just Trust—Verify

Let’s play “Spot the Needle in the Haystack.” If your process is all spreadsheets, that’s what finding policy violations feels like.

Instead, layer in regular audits and real-time tracking. Expense Hub provides:

- Live dashboards of all expenses (see the big—and small—picture).

- Flags for out-of-policy claims or late submissions.

- Audit trails that make tax time painless.

It’s like having a compliance cop who never sleeps, for a fraction of the cost.

Real-world twist: A startup used automated tracking and slashed reimbursement errors by 40% in six months. Their secret weapon? Instant alerts for duplicate or suspicious claims—built into Expense Hub.

And remember, ensuring compliance in expense policies isn’t just about catching fraud. It means less time arguing about what’s allowed, and more time scaling your actual business. For more on compliance, you can check https://blog.expensehub.io/understanding-compliance-in-expense-management.

How to Create an Expense Policy from Scratch: From Blank Page to Bulletproof (No Legalese Required)

Ever tried writing an expense policy from scratch, only to stare at the blinking cursor for 45 minutes and then give up? Let’s change that.

Step One: Conducting a Needs Assessment

Before you copy some big corporation’s policy, figure out what actually works for your business. Start with these questions:

- Which expenses crop up most often?

- Are your people mostly on the road, or at their desks?

- How high do limits need to be so people aren’t spending out of pocket?

- Which categories need the tightest controls?

Napkin math time: If you find travel averages $200 per employee per month, but supplies average only $15, maybe don’t set the same review rigor for both.

Expense Hub does the heavy lifting here with analytics tools: instantly pull historical data, spot trends, and see where money’s going. No more guesswork—just solid, data-powered policy design. Consider https://blog.expensehub.io/expense-management-for-startups-guide for more details.

Step Two: Drafting and Communication

This is where most companies blow it by writing policies nobody understands.

Drafting the Policy

- Use plain English. (“No first-class flights.” Not, “Airfare shall be capped at the lowest reasonable applicable fare class.”)

- Include practical examples—a little story: “If you’re at a conference, meals will be reimbursed up to $50/day. Anything above? That’s on you (no, you can’t claim dinner for your buddy).”

- Spell out what’s required for submittals—photos of receipts work, as do scanned PDFs.

Communicating the Policy

Don’t just send an all-staff email and call it done. Use multiple channels. This is where Expense Hub shines: push notifications, in-app messages, and a central library where employees can always find the latest version.

Blockquote Inspiration:

“Policies everyone knows are policies everyone follows.”

For extra wisdom, look up http://externalsite.com; it’s a goldmine for anyone left scratching their head at step one.

Reducing Expense Fraud: The Real-World Shield Against Costly Surprises

Ready for a stat that’ll shock you? The ACFE says businesses lose 5% of revenue every year to fraud, with expense fraud at the top of the small biz list. And most of it’s so basic—fake receipts, double claims, split transactions.

Implementing Oversight Mechanisms: Trust But Verify

Here’s the deal: Most fraudsters aren’t criminal masterminds—they’re opportunists. A missing check, a broken workflow, and suddenly you’re paying for a “working lunch” at Disney World.

Expense Hub’s oversight features = smarter defense:

- Real-time monitoring: All claims checked against policy as they’re submitted.

- Automated alerts: If someone submits overlapping receipts or suspicious amounts, you’ll know now, not next quarter.

Keep your system tight, and fraudsters stick out like a sore thumb.

Training and Awareness: Equip Your People, Don’t Just Lecture Them

Most expense mistakes aren’t malicious—they’re just people not knowing the rules. That’s where training comes in.

Training for expense reporting accuracy isn’t a one-off. Use Expense Hub’s onboarding modules to walk new hires through expense reporting. Drop “policy refresher” reminders quarterly.

- Explain real consequences of falsifying reports (and don’t just say “disciplinary action”—be real).

- Provide clear examples: “This is legit. This isn’t. Any questions?”

When your team knows the boundaries—and the why behind them—you’re protected.

Discover more about how to tackle fraud with https://blog.expensehub.io/avoid-fraud-expense-management-tool.

Recap and Your Next Step: Ready to Reinvent How You Manage Expenses?

Let’s put a bow on it.

Expense policy best practices are like guardrails for your business’s financial health. When you establish clear expectations, keep policies current, invite input, and use tech tools that ditch the paperwork, you sidestep fraud, speed up reimbursements, and keep costs predictable.

Still chasing receipts? Tired of playing detective with expense claims?

Expense Hub lets you:

- Create flexible, understandable policies—fast.

- Update and communicate changes instantly.

- Streamline every last step from submission to audit.

- Reduce expense fraud with oversight and training features built right into the flow.

Want to see it in action? https://blog.expensehub.io/maximizing-travel-expense-management-tool or sign up for a hands-on demo webinar. Bring your messiest claims, your biggest “can this be expensed?” debates, and your thirst for a better way.

Because, as every smart CEO knows, the money you save is just as important as the money you make. And in the small business world? That’s the difference between sweating payroll and celebrating profit.

Take back control, drive compliance, and turn expense chaos into clarity—one great policy at a time. Expense Hub is here to help you lead the charge into a streamlined, fraud-free future.

Ready to reboot your approach? The path is just a click away.