Transforming Finance: Effective Strategies for Financial Process Optimization

Introduction: The Untapped Power of Financial Process Optimization

Let’s start with a financial confession: sometimes, your finance department doesn’t need another superhero—it needs a system. And that system? It’s called financial process optimization. It’s not a mythical fix conjured in some MBA’s spreadsheet dreams; it’s the real-world practice of trimming out clutter, slapping duct tape where things leak, and—let’s be honest—making your numbers actually work for you instead of against you.

In plain English, financial process optimization means streamlining and automating your key financial operations to crank up efficiency, slice out unnecessary costs, and, most critically, keep errors so rare they’re almost unicorns on your month-end reports. Modern finance teams are juggling a circus act—chasing invoices, decoding expense reports, fielding regulatory curveballs—all while the C-suite wants better data yesterday. If your finance workflow is more hamster wheel than well-oiled machine, you’re not alone.

But here’s the kicker: optimizing your financial processes is no longer just a “nice to have.” It’s a cornerstone of competitive, savvy decision-making (https://www.finoptimal.com/resources/financial-process-efficiency), one that separates the businesses that “just get by” from those that consistently punch above their weight (https://www.crosscountry-consulting.com/insights/blog/finance-process-optimization/).

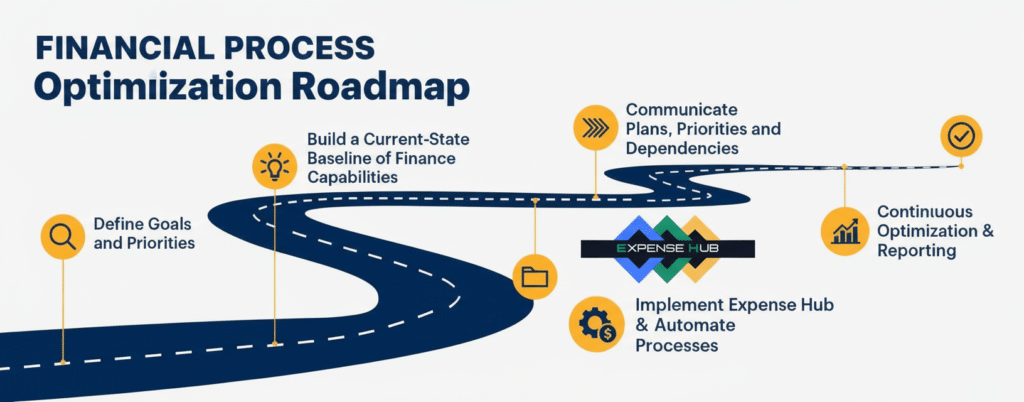

How do you make that leap? With a platform like Expense Hub, which rolls automation, streamlined integrations, and error-slaying tools into a single, pain-saving package. Put simply: if you’re serious about making your financial processes an asset (not a liability), you can’t afford not to optimize—and you certainly can’t afford to overlook solutions like Expense Hub.

So, roll up your sleeves. Let’s get contrarian about finance and dig deep into transforming chaos into clarity, step by practical step.

Understanding Financial Process Optimization

What is Financial Process Optimization, Really?

Grab your imaginary marker. On the left side of your mental whiteboard, write “old finance processes”: manual data entry, lost receipts, approval emails that vanish into the abyss. On the right side, write “optimized finance workflows”: integrated, auditable, nearly automatic, and accurate enough to make your auditor weep tears of joy.

Now draw a big, bold arrow connecting the mess to the masterpiece. That’s financial process optimization. https://blog.expensehub.io/financial-compliance-for-startups, avoid costly mistakes, streamline reporting, and discover tools to enhance compliance efficiency.

At its core, financial process optimization is a strategic approach to reimagining—and refining—your workflows. The mission: remove bottlenecks, minimize error-prone manual tasks, and ensure that data flows where it should, when it should (https://www.finoptimal.com/resources/financial-process-efficiency). Think of it as spring cleaning for your P&L, but with much higher stakes.

Why Does This Matter More Now Than Ever?

Picture this: Today’s finance department is a high-speed train hurtling through a maze of regulations, market swings, and evolving business models. Each extra step, each unchecked bottleneck, is ballast slowing things down. And these inefficiencies aren’t just annoying—they’re expensive.

A recent deep dive (https://payhawk.com/en-us/blog/how-financial-process-optimisation-can-improve-business-efficiency) found that organizations with streamlined processes experience:

- Fewer costly errors (the kind that keep CFOs up at night).

- Money saved by trimming waste (napkin math: a 2% efficiency gain on a $10M spend = $200K in found money).

- Faster, better business decisions.

Remove friction, reduce error, and you set your finance team up not as paper-pushers but as strategic engines of growth.

Ready for actionable steps?https://blog.expensehub.io/improve-expense-finance-process-reporting/.

Key Elements of Financial Process Optimization

Financial Process Efficiency: More Than Just “Faster”

Let’s break down “efficiency” in finance—because it isn’t just about getting through more invoices before lunch. Financial process efficiency is about doing the right things, in the right order, backed by data, every single time (https://www.finoptimal.com/resources/financial-process-efficiency). https://blog.expensehub.io/expense-management-software-uk-finances, and improves control over business spending.

Here’s the classic before-and-after:

- Before: Invoices pile up, approvals take days, everyone’s guessing who has the final say. One number transposed wrong, and next thing you know, you’re paying $10,000 instead of $1,000. Redundant processes and cluttered spreadsheets run amok.

- After: Automated verification. Streamlined approval chains. Error reduction so profound your bank statements make sense on the first read.

Expense Hub shines here by taking repetitive, error-prone tasks—like receipt matching, expense categorization, and multi-level approvals—and moving them from “Three people, three days, three headaches” to “Push a button, get a result.” It grabs all that tedium you used to call “Tuesday” and automates it, injecting accuracy and accountability in the process.

Financial Workflow Optimization: Taming the Spaghetti

Ever seen a workflow diagram that looked more like a plate of spaghetti than a process? That’s where financial workflow optimization comes in (https://www.crosscountry-consulting.com/insights/blog/finance-process-optimization/).

Discover the best tools for travel managers https://blog.expensehub.io/tips-to-control-travel-budgets-with-effective-expense-management/ using detailed planning, policy, trip scheduling, pre-approvals etc.

It’s the art—and sometimes magic—of reengineering your processes so information glides elegantly from system to system (accounts payable, receivables, the all-mighty general ledger) without sticky handoffs, duplicate efforts, or lost context. It’s about seamless, cross-departmental cooperation—what I like to call “no more dropped balls.”

How does Expense Hub help? Imagine approvals that don’t get lost in deep email space. Instead, requests surface instantly for review by the next approver, with full context and audit trail. Reports update in real time. You actually see where things are stalled, and—miracle of miracles—fix them before month-end. Workflow optimization isn’t about more tools; it’s about the right tool, acting as your air traffic controller so nothing collides or gets grounded.

Benefits of Workflow Optimization in Accounting

The Magic Formula: Less Manual, Fewer Errors, More Visibility

Let’s face it—manual work is the enemy. For every hour spent copying numbers from one system to another, an error waits patiently in the shadows, ready to pounce. In the old world, this was just “the cost of doing business.” In the new world, optimized accounting workflows make error reduction (and audit prep) almost boring (https://www.finoptimal.com/resources/financial-process-efficiency). https://blog.expensehub.io/manual-expense-tracking-vs-automation. Learn how automation streamlines processes, reduces errors, and saves time.

- Reduced Manual Work: With smart automation, those tedious chores—data entry, reconciliation, cross-checking—become nearly invisible. Expense Hub’s automation means your team can finally focus on analysis and strategy, not mindless tasks.

- Fewer Errors: Automation consistently zaps human mistakes. For instance, Expense Hub flags duplicate payments and missing receipts before they cause trouble (https://payhawk.com/en-us/blog/how-financial-process-optimisation-can-improve-business-efficiency).

- Greater Visibility: Everything’s tracked, logged, and reportable. Whether you need to see last quarter’s discretionary spend or nail down which team member is slow on approvals, you’re never in the dark.

Automate Financial Operations: Free up Your Brainpower

Here’s a napkin math scenario for you: If your team spends 15 minutes per expense report multiplied by 40 reports per week, that’s 10 hours. Do this every week, and that adds up to a massive 520 hours per year—just on expense reports! Imagine if those 520 hours were spent optimizing cash flow or planning growth. https://blog.expensehub.io/mastering-spend-management-software!

That’s why automation and platforms like Expense Hub are game-changers: they take the brain-numbing parts of finance—data entry, matching payments to invoices, flagging compliance risks—and make them fade into the background. You don’t just save time; you gain mindspace for growth and innovation.

Financial Operations Optimization: Continuous Improvement Wins

But don’t get complacent. The best finance teams treat financial operations optimization as a perpetual motion machine—constantly tuning, tweaking, and re-assessing. With Expense Hub, it means regular workflow reviews, user feedback loops, and new automation rules whenever bottlenecks pop up.

- Adopt the mindset: “What’s good can be better, and what’s better can one day be best.”

- Let technology be your upgrade toolkit—not your IT headache.

This cycle of improvement, automation, and review keeps your financial operation not just competitive, but ahead of the curve.

Strategies for Financial Process Optimization

Go Beyond the Obvious: Audits, Automation, and Out-of-the-Box Thinking

You wouldn’t build a skyscraper on sand. The same goes for your finance foundation. Effective finance process optimization starts with honest appraisals and big, bold moves.

Leverage Advanced Software Tools

First rule: Ditch the spreadsheets—at least for the stuff that’s holding you back. Today’s finance teams need the technological equivalent of a Swiss Army knife. Platforms like Expense Hub unify approval tracking, reporting, and automation in one place, making the old patchwork of apps (and Post-It notes) blissfully obsolete.

Conduct Workflow Audits

Take a “Sherlock Holmes” approach to your processes. Where are the bottlenecks? Where do invoices disappear until someone’s shouting? Use data—and a little detective work—to map every twist and turn. (Want the playbook? Check out this https://infomineo.com/data-analytics/process-optimization-strategies-steps-and-benefits-for-business-growth/.) Embrace strategies to improve your https://blog.expensehub.io/improve-expense-finance-process-reporting/.

Automate the Mundane, Elevate the Strategic

Anything repetitive? Automate it. Anything compliance-heavy? Let automation catch slips before the regulator does. Your team should spend their time reviewing dashboards, not entering transactions.

Expense Hub delivers automation tailored for finance: think real-time expense tracking, fraud flagging, and intelligent audit trails (with all the granular permissions your controller dreams of). https://blog.expensehub.io/financial-analysis-tools-automation.

For a full walk-through, don’t miss our deep dive: #.

Stay Curious: Learn from the Leaders

Don’t just take our word for it—take a page from the playbooks of top-performing organizations. Explore how the best companies https://blog.expensehub.io/unlocking-efficiency-expense-management-software and set themselves up for turbocharged efficiency.

Implementing Workflow Optimization in Finance

Step 1: Assess Your Current Workflow Reality

Think of this as your “finance baseline.” Gather the troops, pull out the process maps (or, be honest, the back-of-the-napkin sketches). Where are things breaking down? What steps always seem to take too long, or trip people up (https://infomineo.com/data-analytics/process-optimization-strategies-steps-and-benefits-for-business-growth/)?

Common problem zones:

- Data entry delays (hint: the more hands on a keyboard, the higher the error risk).

- Approvals that stall for days.

- Compliance steps that feel like afterthoughts, not priorities.

Expense Hub kicks off implementation by turbocharging your process auditing. It highlights which workflows are dusty, which steps are wasteful, and—best of all—suggests hard data solutions. With real-time analytics and customizable dashboards, your pain points jump out so you can target them immediately.

Step 2: Define and Prioritize Improvement Areas

Not all problems are created equal. Some issues are mere paper cuts; others are gaping wounds bleeding cash and morale.

- Use Expense Hub to crunch historical “time-to-completion” data.

- Identify approval queues where bottlenecks regularly occur.

- Zero in on repetitive manual entries—these are low-hanging fruit for automation.

Pro tip: Ask your team, “If you could wave a magic wand and fix one thing, what would it be?” Often, you’ll discover the biggest wins hiding in plain sight.

Step 3: Implement and Optimize

Here’s where the magic happens. Set up your automated workflows within Expense Hub, define approval chains, and set threshold alerts for exceptions. Don’t just “set it and forget it”—using Expense Hub’s reporting, review new bottlenecks as they surface, and tighten processes regularly.

You’ll find not only wasted time saved, but fewer compliance headaches and a squad that’s suddenly energized about finance again.

Case Studies and Real-World Applications

Let’s talk proof, not promises.

The Pre-Expense Hub Blues

Meet Company A. They had a month-end close so painful that staff treated closing day like a trip to the dentist. Expense reports got lost in the shuffle. It took five days (on a good month!) to lock down the books, and errors—well, let’s just say there were “opportunities for improvement.”

The Expense Hub Aftermath

After implementing Expense Hub and dialing in automation, Company A’s closing time dropped from five days to just 36 hours—no caffeine overdose required. Duplicate entries? Down 90%. Audit prep became “run the report” instead of three weeks of paper chasing.

And Company B, a mid-tier tech firm, was bleeding $75,000 a year on redundant manual reconciliations. Enter Expense Hub: the automation platform synced with their existing finance apps, flagged duplicate vendor payments, and dramatically reduced manual efforts (https://www.crosscountry-consulting.com/insights/blog/finance-process-optimization/). https://blog.expensehub.io/streamlining-business-expense-report-software/ and activate automated financial operations for enhanced efficiency.

The result? Measurable financial operations optimization that didn’t just save money; it saved sanity.

Conclusion: Stack the Odds in Your Favor with Financial Process Efficiency

There’s a simple law in finance: the faster you move, the less it costs. But speed without control is just spinning your wheels. That’s why financial process optimization is your secret weapon—it gives you cost savings, accuracy, and the competitive edge that turns “surviving” into thriving (https://www.finoptimal.com/resources/financial-process-efficiency).

If you’re ready to step beyond chaos, slash manual busywork, and boost your financial process efficiency, there’s no clearer path than lining up with a battle-tested tool like Expense Hub. Whether you’re a finance rookie or a seasoned pro, it’s time to let technology do the heavy lifting so your brain can focus on the big wins.

Ready to Take Control of Your Finances?

Experience what thousands of proactive finance leaders already know: Expense Hub isn’t just another software option—it’s the key to making your financial processes your company’s strongest asset. https://blog.expensehub.io/unlocking-efficiency-expense-management-software with expense management software like Expense Hub.

Give yourself—and your team—the tools, automation, and clarity you need to turn “busy work” into real results. # and see how effortless financial excellence really can be.

End Notes: Sharpen Your Tools, Plan for Tomorrow

Finance isn’t static—neither should your tools be. Expense Hub stands out for its reliability, relentless innovation, and practical approach to real-world finance headaches. That’s why top-performing organizations lean on it to get ready for whatever the future throws their way.

Want to keep leveling up? Dive into more resources with Expense Hub’s downloadable guides and our curated list of must-read articles on process optimization. https://blog.expensehub.io/mastering-expense-management-a-finance-manager-guide. The future belongs to the prepared—let us help you get there.

Stay sharp, stay optimized, and don’t let your finance team settle for “good enough” ever again.

Financial process optimization isn’t just a checklist item—it’s a game-changer. And with Expense Hub? You’ll stop fixing yesterday’s mistakes and start building tomorrow’s success.