Optimizing Finance Team Structures for a Successful Digital Transformation

Let’s clear something up before your eyes glaze over: finance team structure is not just corporate-speak that only the C-suite gets excited about. Nope, it’s the backstage magic that turns chaos into clarity, spiraling costs into savings, and “we’ll get back to you” into “we’re already done.” If your organization is running around trying to herd invoices, approvals, and budgets like stray cats, chances are your finance team structure needs more than a caffeine boost.

Now, picture this: in one hand, you’ve got transaction processing (the folks who keep the lights on, literally), FP&A (the bean counters who predict your next latte shortage), controllership (the guardians of all things compliance and order), treasury (money whisperers), and, if you’re really humming, shared services or centers of excellence (the special-ops forces of back-office efficiency). These pieces don’t naturally fall into place. Left unstructured, they compete for attention, duplicate effort, and create a paper trail longer than the Great Wall of China.

But when optimized? You slash cycle times, sharpen forecasts to a fine point, and build compliance into the bones of your operations — not just as window dressing. This post is your roadmap to building that kind of finance team structure, whether you’re riding a unicycle as a startup or steering a freight train as an enterprise, and—bonus—how digital transformation (with an ace up your sleeve, Expense Hub) multiplies your muscle.

Let’s talk about Expense Hub upfront, without the awkward product placement. This isn’t just another SaaS badge to slap on a dashboard. By centralizing all your finance data and automating the grind of expense reports, AP, and analytics, Expense Hub frees your team to spend more time on high-value work and less on chasing receipts down the company Slack rabbit hole. It does for finance what power tools do for Ikea furniture: less sweat, more “wow, that’s solid.”

Ready to question everything you think you know about finance teams and digital transformation? Let’s roll.

The Role of Finance Team Structure in Business Success

Why Finance Team Structure Is (Still) the Secret Sauce

Let’s start loud and clear: finance team structure is not about boxes on an org chart or gleaming corridors at HQ. It’s the difference between a kitchen where dishes keep piling up (hello, restaurant nightmares!) and a Michelin-level team working in sync — every move, every dish, planned out and executed with flair.

The Core Ingredients of an Effective Finance Team Structure

Let’s break it down as if you’re organizing a barbecue:

- Clear Role Definitions:

You wouldn’t hand the spatula to someone who confuses steak with tofu, right? It’s the same here:- Transaction Processing: Collectors of invoices, payers of bills. The beating heart of daily finance.

- FP&A (Financial Planning & Analysis): They forecast, budget, and answer big “what-ifs.” Read more about improving these processes in Improve Expense, Finance Process & Reporting.

- Controllership: The rule enforcers, making sure no one’s “creative accounting” lands you in hot water.

- Treasury: The folks who care where all your cash is hiding (and how to multiply it).

- Shared Services/Centers of Excellence: Your “special teams”—the ones who optimize, polish, and handle repetition at scale.

- Governance and Ownership:

Think cockpit controls: someone needs to own the process, know who’s flying what, and if the chart of accounts is playing nicely. No more, “I thought Wendy had it.” If everyone owns the process, no one does. Learn more about governance in Expense Policy Best Practices: Save Money and Simplify Management. - Shared Services vs. Decentralized Functions:

Picture this as dining out: shared services is your all-you-can-eat buffet — standard, reliable, efficient. Decentralized? It’s each chef running their own food truck. One’s efficient, the other’s innovative — but only if you pick the right method for your growth stage. - Talent Mix:

Mix up the bench. The best teams blend detail-loving transactional staff, data-wrangling analytics specialists, and the business partners who speak both numbers and “Sales.” For insights into talent mix optimization, visit Master Business Expenses: Track & Manage for Maximum Profit.

How Expense Hub Transforms the Playing Field

Here’s where the Expense Hub apron comes in. (I promise, no hard sell.) Centralized expense data, automated workflows, and rock-solid policy enforcement mean:

- No missing receipts, no mystery expenses.

- Real-time dashboards for everyone from AP clerks to Controllers.

- Automated reporting that actually tells you what you need to know.

Imagine your finance “back kitchen” moving in orchestrated harmony instead of “left hand doesn’t know what the right is expensing.” With streamlined workflows and clear data in Expense Hub, operational roles are lighter, auditors grumble less, and your number ninjas finally have time for analysis, not just drama. Check out more on automation’s role in finance at The Role of Automation in the Modern Financial Analyst Toolkit.

Linking Team Structure to Business Goals

Now for a heretical truth: your finance team structure isn’t about tradition or org chart aesthetics. It’s about moving your company closer — faster — to the stuff investors care about: scale, profits, and market domination.

Think of the structure as your Formula 1 pit crew. If your team is aligned to business strategy — say you’re scaling globally or chasing a killer EBITDA margin — your finance team should morph to match those ambitions. Need to move fast on a potential M&A deal? Your structure shouldn’t bottleneck approvals or info-flow. Want tighter forecast accuracy to wow the board? That’s FP&A’s time to shine, but only if they’re unburdened from process chaos.

Napkin math time: Imagine trimming just one day per month from your financial close cycle. Over 12 months, not only do you save serious manpower (Expense Hub customers report 30+ hours/month reclaimed), you also get financial insight 12 days sooner per year. That’s an edge your competitors will envy. Dive deeper into aligning finance strategies with business goals in our guide, How to Align Financial Strategies with Business Goals.

Hiring a CFO for Your Startup: The Hidden Growth Accelerator

When (and Why) “Hiring a CFO for Startup” Isn’t Optional Anymore

If you’re thinking hiring a CFO for startup sounds too “grownup” for your scrappy stage, think again. Waiting until your hair’s on fire is not a growth strategy. For insights into startup expense management, read Expense Management for Startups: Essential Guide to Financial Growth.

The Signs It’s Time for a CFO

How do you know you’re ready? Let’s turn on the “CFO Bat-Signal”:

- Revenue’s Soaring: You’re crashing through $5–$10 million ARR (or prepping for that leap), and closing the books is starting to resemble a group science project — messy and confusing.

- Cap Table Complication: Convertible notes, safe rounds, options pools growing like kudzu. (Good luck explaining this to your friendly neighborhood venture capitalist without professional help.)

- International Waters: Operating across borders? Suddenly, you’re swimming with tax sharks and FX piranhas.

- Rapid Headcount Growth: Payroll is a spreadsheet nightmare, and compliance is threatening to eat your weekends.

- Growing Governance Pressure: Investors, regulators, or your own board now want real numbers, not hand-waving.

Fractional vs. Full-Time: Pick Your Flavor

If you’re not swimming in VC money, a fractional (part-time) CFO can get you real expertise without mortgaging your runway. They’re like expert chefs invited over for Thanksgiving: no payroll bloat, just results. When you outgrow that — say, after scaling, M&A rumblings, or public plans — bring the full-timer in-house.

How Expense Hub Makes a CFO’s Life (and Yours) 10x Easier

A CFO’s secret weapon? Visibility. Instead of rifling through endless spreadsheets or pinging department heads for missing data, Expense Hub provides:

- Real-time spend analytics.

- Effortless approvals.

- Dashboards that put clarity on autopilot.

Instead of your CFO spending 60% of their time on “where did the money go?” detective work, they get to focus on how to grow the pot (and keep you out of jail).

The Impact of a CFO on Startup Growth

What happens when you plug a strategic CFO into your engine? You stop flying by gut feel and start running toward your Series B with a clear-eyed, risk-averting navigator.

- Fundraising:

Investors want numbers, not narratives. CFOs create the bridge — and the trust. - Capital Allocation:

Every dollar now has a mission, not just a home. - Investor Reporting:

Timely, credible, and “no surprises” financials win you allies, not skepticism. - Risk Management:

You spot landmines before they explode — like cash flow crunches or regulatory pitfalls.

Case in point: Real startups that paired CFO hires with tools like Expense Hub saw their cash runway visibility increase from “maybe six months?” to “15 months, and here’s the chart to prove it.” Suddenly, you’re negotiating VC terms from a position of strength. Curious how this looks in action? Read Scaling Your Startup: Financial Strategies for Growth, and check out what veteran leaders say about The Importance of a CFO in Startups.

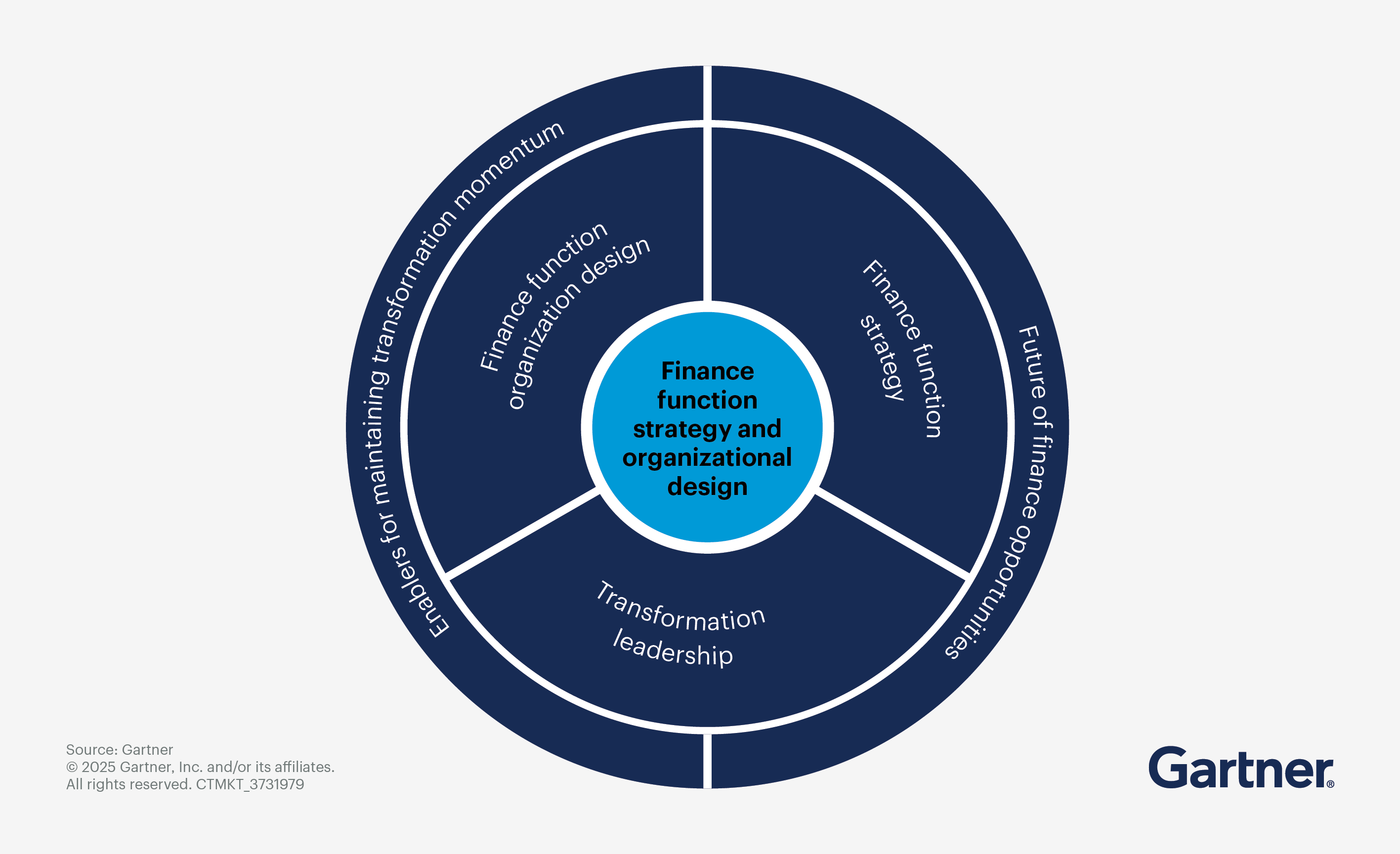

Embracing Finance Digital Transformation

Finance Digital Transformation: Why It’s More Than Buzzwords

Let’s do away with buzzword fatigue: finance digital transformation is about ditching Excel Olympics and manual circus acts for a future where automation and data actually work for you.

Definition:

At its core, finance digital transformation is about trading in your paper-pushing habits and disconnected point solutions for integrated, cloud-based, data-rich, and automated processes. Think cloud ERPs, automated AP, one-click expense reports, AI-powered forecasting — technology that enables finance teams to do the work of ten with half the people (and a lot less overtime pizza). Explore more on digital transformation in finance in our A Beginner’s Guide to Finance Digital Transformation.

Why Now?

- Speed wins. If your competitor closes their books in five days and you take fifteen, you’re already out of gas by the next board call.

- Regulation isn’t sleeping. Compliance risks and data privacy grow messier every year.

- Remote and hybrid work. There’s no going back to desk-bound paper trails.

- Digital-first disruptors are sniffing out every inefficiency you cling to.

The fastest route to transformation? Expense Hub — because it doesn’t just automate expense capture and approvals, it centralizes spend data, enforces your policies, and gives you analytics to drive change. (One less midnight email from your auditor. You’re welcome.)

Steps to Achieving Digital Transformation in Finance

Let’s put on your project manager hat (the one that’s always slightly askew):

1. Assess Your Current State: The Finance “Health Check”

You can’t fix leaks without knowing where the pipes are. Map your current processes:

- Is AP still doing manual data entry?

- Do you hunt through emails for approvals?

- Where are you wasting time chasing paper (or .pdfs)?

- What key metrics are you measuring (or missing)?

Pro tip: Use Expense Hub to pull a report on approval cycle times or “expense report orphan rate.” If you can’t measure it, you can’t improve it.

2. Define Outcomes and KPIs

Be ruthless:

- Want a faster monthly close? Shoot for under 5 days.

- Want policy compliance? Try for less than 2% out-of-policy spend.

- Need FP&A accuracy? Eliminate budget surprises.

Track these with consistent dashboards and let Expense Hub’s real-time analytics do the heavy lifting.

3. Draw Your Roadmap (With Quick Wins)

Break it up:

- Quick wins: Automate expense capture. That’s what Expense Hub delivers in spades.

- Medium projects: Migrate AP and AR. There are plug-and-play integrations that don’t require a weekend locked in the server room.

- Long-term: Modernize FP&A, bring in EPM platforms. (Expense Hub can export the right data for easy integration.)

4. Pick the Right Tech & Partners

Look for:

- Cloud-first: No more “only works on Janice’s desktop.”

- API integrations: Play nice with your HR, ERP, and card systems.

- Automation: If it feels like magic but runs on logic, you’re on the right track.

Expense Hub checks all of the above: easy API connections, super-friendly user experience, and a workflow engine built for teams who hate manual work.

5. Change Management and Upskilling

Tech is useless without adoption. Get buy-in with:

- Role-based training (teach by what people do).

- Clear documentation.

- “Why this matters” sessions — with numbers! (Did you know Expense Hub users cut expense approval time by 65%? That’s tangible.)

6. Iterate, Measure, Improve

Transformation isn’t a sprint. Use real-time metrics—Expense Hub’s dashboards are gold here—to keep moving the needle, month after month.

Want a more granular guide? Don’t miss A Beginner’s Guide to Finance Digital Transformation.

Tools for Enhancing Operational Efficiency

Month-End Close Checklist: The CFO’s Nightly Toothbrush

If you’re not using a solid month-end close checklist each month, your future self is already planning an audit-induced vacation. The checklist is your finance sleep aid—tick the boxes, rest easy, repeat.

Must-Have Items on Your Month-End Close Checklist

Here’s what your new finance bedtime routine should look like:

- Reconcile subledgers:

Match up AP, AR, and payroll to the general ledger. Nothing falls through the cracks. - Review and post accruals:

Make sure all revenue and costs are landed in the right period — no “oops, forgot!” in Q2. - Validate intercompany reconciliations:

Especially for multi-entity firms — intercompany loans shouldn’t become ghost stories. - Run variance analyses:

Are you actually hitting those budgets, or is there a wild card expense lurking? - Archive supporting docs:

If it’s not saved, it didn’t happen (according to your auditor).

Here’s what this looks like inside Expense Hub:

[Screenshot: Expense Hub – Automated Receipts Capture and Checklist Dashboard]

Caption: “Expense Hub’s checklist dashboard tracks every reconciliation and adjustment task in one place. No more missing items come audit time.”

Expense Hub automates half of this by:

- Categorizing and matching expenses to ledgers,

- Centralizing receipts (dropbox who?),

- Creating an audit trail that makes even tax season bearable. Learn more about these techniques in Advanced Financial Reporting Techniques & Insights for Business Growth.

Download our Month-End Close Checklist PDF for a plug-and-play solution.

Accounts Payable Automation Benefits: Why You Want Robots on Your Side

Let’s say it loud: accounts payable automation benefits aren’t just shiny words for the AI hype squad — they put real dollars and sanity back in your operation.

Here’s the Deal:

- Faster Invoice Processing:

Invoices processed in days, not weeks. (Some Expense Hub customers cut cycles by 70%—no joke!) - Fewer Errors and Less Fraud:

Automated policy enforcement and three-way match. No more “creative” vendor entries slipping by. - Cost Savings:

Every manual touchpoint costs money. Automation means fewer FTEs and faster processing (that’s money you can see in the P&L). - Stronger Supplier Relationships:

Pay on time, take advantage of early-pay discounts, and watch your vendor NPS rise. - Cash Forecasting Clarity:

Real-time visibility into outstanding liabilities means you don’t get caught with your financial pants down.

Expense Hub delivers all of the above by:

- Automating invoice capture (no more PDF print-stack).

- Matching and coding to GL painlessly.

- Real-time dashboards for all your AP and cash management needs. Discover more on this topic in Accounts Payable Automation Benefits: Why You Want Robots on Your Side.

Want more backstory? Here’s our deeper dive: Benefits of Accounts Payable Automation.

[Screenshot: Expense Hub – AP Automation Analytics View]

Caption: “Expense Hub’s AP automation module shows real-time invoice status and payment forecasts.”

Real-World Sidekick:

One Expense Hub customer eliminated 80% of manual AP entry after three months. Not only did errors drop, but their finance headcount for AP stayed flat even as transaction volume doubled. That’s the kind of “do more with less” magic your CEO dreams about.

Achieving Comprehensive Finance Team Excellence

Let’s recap—because finance loves a good summary:

- A modern finance team structure empowers operational excellence and strategic vision. Skimp on structure, and you’re building your empire on quicksand.

- Hiring a CFO for startup companies is an accelerator pedal, not a brake. Don’t wait until you’re drowning — pull in the expertise the moment growth outpaces your Excel skills.

- Finance digital transformation is not just for the Big 4 or the Fortune 500. Leveraging automation and real-time analytics is now table stakes in every industry.

- Tools like a month-end close checklist and accounts payable automation aren’t nice-to-haves — they’re your immunity shot against risk and burnout.

And through it all, Expense Hub is your leverage. It centralizes your spend, automates the grind, and frees your team for work that actually drives your business forward. No heroics, just better results on autopilot.

Ready to Transform the Way Your Finance Team Works?

You’ve got the blueprint, the checklists, and the proof that digital transformation is not just possible, but profitable — especially when powered by the right tools. Isn’t it time you let your finance team trade chaos for clarity, late nights for predictive insight, and manual drudgery for strategic growth?

Explore Expense Hub today — see how finance leaders automate, optimize, and win back control, one smart process at a time. Request your custom demo today or dig into our finance resources to get inspired.

P.S.: Want plug-and-play? Download our free Month-End Close Checklist and watch your finance headaches shrink, overnight.

[Downloadable Asset: Month-End Close Checklist PDF]

Get the step-by-step guide that top-performing teams use to close faster and smarter. (Link captures leads.)

References & Next Reads:

– How to Align Financial Strategies with Business Goals

– Scaling Your Startup: Financial Strategies for Growth

– A Beginner’s Guide to Finance Digital Transformation

– The Importance of a CFO in Startups

– Accounts Payable Best Practices by Deloitte

Expense Hub: making finance teams heroes, one automated process at a time.