- HMRC Compliant Expense Software: The Surprising Secret to Effortless Expense Management in 2026

- Understanding HMRC Compliance: Why It’s a Big Deal (and How Software Turns Headaches into High-Fives)

- Why Businesses Need HMRC Compliant Expense Software

- Understanding HMRC Expense Rules for Businesses: The “Brief” (But Useful) Version

- The Importance of an Expense Audit Trail HMRC: Preventing Painful Paper Chases (and Penalties)

- Expense Compliance UK: Key Challenges and Creative Solutions

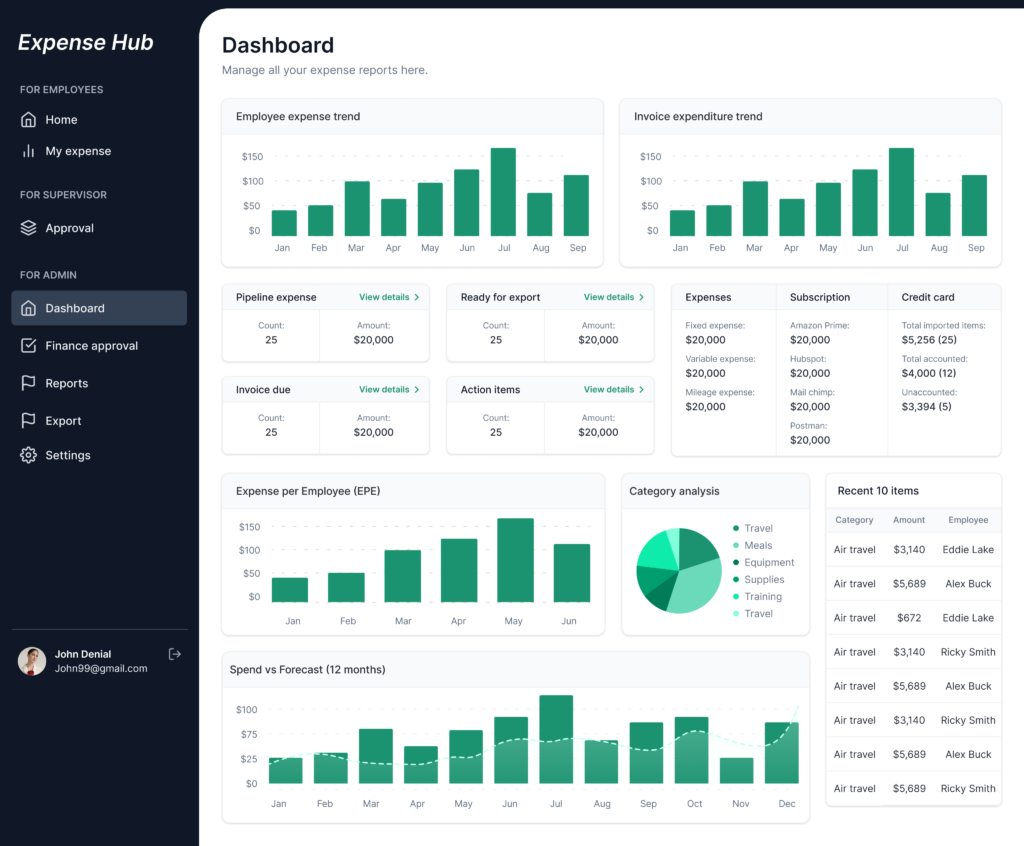

- Features of Expense Hub That Ensure HMRC Compliance (Not Just Hype—Actual Features)

- Case Study: How a Real-World SME Used Expense Hub to Make Compliance a Breeze

- The Smart Choice for Expense Compliance

- Ready to Master Your Expenses—Without Breaking a Sweat?

HMRC Compliant Expense Software: The Surprising Secret to Effortless Expense Management in 2026

Understanding HMRC Compliance: Why It’s a Big Deal (and How Software Turns Headaches into High-Fives)

Let’s face it: nothing says “Friday fun” quite like curling up with a cuppa and poring over the HMRC’s expense rules. (Just kidding—unless you’re an accountant or a glutton for bureaucratic punishment.) But here’s the hard truth—getting HMRC compliance right can spell the difference between a thriving UK business…and one haemorrhaging money into the black hole of fines and admin chaos.

If you’re a business owner in the UK, you know the HMRC doesn’t just want your numbers—they want your numbers neat, categorised, digitised, and ready for a digital dance called Making Tax Digital (MTD). Miss a step, and suddenly there’s a polite envelope from our friends at the tax office inviting you to pay a “little” penalty—or even to explain yourself in person (less fun than it sounds). https://www.mobilexpense.com/en/blog/expense-management-solution-uk.

Why Is HMRC Compliance So Hard?

Here’s why: the rules are complex enough to send even the Queen’s corgis running for cover. You’ve got allowable expenses, disallowable expenses, business travel (was that dinner really for work?), client entertainment (do cocktails count?), VAT tracking, mileage logs…and don’t get me started on digital record-keeping. Businesses—even the best-run—struggle, especially when managing travel and entertainment expenses. https://www.expensein.com/blog/business-expenses/best-expense-tracking-software-for-uk-finance-teams-what-to-look-for-why-it-matters.

One slip, one missing receipt, one incorrectly filed VAT claim, and the consequences range from “mildly annoying” to “oops, there goes our profit margin.” And for small and mid-sized businesses? These mistakes cut deeper than an accountant’s sense of humour.

This is where the magic phrase HMRC compliant expense software enters the chat. Great platforms like Expense Hub aren’t just digital spreadsheets in new clothes. They’re compliance bodyguards—automating, double-checking, and integrating your expense records faster than you can say “Section 336 ITEPA 2003.” (If that reference made your eyelid twitch, don’t worry, you’re my type of reader.)

The Secret Sauce: Software that Does the Hard Work

Modern expense platforms aren’t just digital ledgers. The best—Expense Hub leading the charge—link seamlessly with Sage, Xero, and QuickBooks for smooth data flows, VAT tracking, and MTD compliance. Your expense claims and records—once a messy mountain of receipts and spreadsheets—become a streamlined, digital fortress. And most importantly? The software is built for HMRC rules, not retrofitted after the fact. https://www.mobilexpense.com/en/blog/expense-management-solution-uk.

But why is “HMRC compliant expense software” the answer instead of yet another spreadsheet? Let’s break it down, Michalowicz-style: with stories, napkin math, and a pinch of British wit.

Discover more about HMRC compliant expense software in our Ultimate Guide.

Why Businesses Need HMRC Compliant Expense Software

The Compliance Burden: Why the Old Ways Don’t Work

Ever spent a Saturday hunched over expense receipts from three months ago, trying to figure out if that £17 lunch was client entertainment, subsistence, or just you escaping the office? You’re not alone. Manually decoding HMRC rules, keeping tabs on VAT, and sorting expenses by tax code is like herding cats—only less predictable.

Let’s do some napkin math: Suppose your company processes 200 expenses monthly. If manual entry and rules-checking takes even 3 minutes per expense, that’s 10 hours per month lost to soul-sapping admin. Not to mention the inevitable mistakes—a missed VAT code here, an invoice left uncaptured there.

Enter Automation: OCR, Workflows, and Smarter Than-Human Memory

This is where Expense Hub flexes its innovation muscles. Picture this: an expense lands, a receipt is snapped (or dumped into your email), and—thanks to https://www.expensein.com/blog/business-expenses/best-expense-tracking-software-for-uk-finance-teams-what-to-look-for-why-it-matters—the details are tugged out, tax codes are cross-checked with actual HMRC rules, and workflows kick off without a single human having to ask, “Wait, is this VAT applicable?”

Expense Hub’s automated workflows track everything, flag exceptions according to HMRC guidelines, and route correctly—no need for a tax-law degree. Results? You’re not just faster; you’re compliant without the guesswork, the headaches, or the “but we’ve always done it this way” inertia. https://www.mobilexpense.com/en/blog/expense-management-solution-uk.

The role automation plays is significant; learn more about it here.

Penalties: The Traps Lurking for the DIYer

Let’s talk about the uninvited dinner guest: HMRC fines. Not keeping solid expense records isn’t just a minor oversight—it can get costly, fast. Penalty for incorrect VAT return due to poor records? Up to 30% of the tax due. Forgot to submit MTD updates digitally? Cue an HMRC nudge (and sometimes not-so-gentle escalation) https://quickbooks.intuit.com/uk/tax-software/.

Expense Hub isn’t just about hospitality—its policy controls and digital audit trails are like having a vigilant (but polite) tax advisor chained to every claim. Missed an important policy detail? The system won’t let it through. Need to audit expenses for a VAT inspection? The records are all there, timestamped, and neatly tied with a bow.

The bottom line: Automation minimises human error, and policy control features ensure every expense lives up to the HMRC gold standard—without staff needing to become amateur tax specialists overnight.

For more detailed insight into expense policy, visit our Expense Policy Best Practices.

Understanding HMRC Expense Rules for Businesses: The “Brief” (But Useful) Version

What Does HMRC Want? (No, It’s Not Just Your Money)

The rules are precise, sometimes mind-bending, and frequently updated. Here’s your crib sheet for the big-ticket categories:

- Travel: Everything from mileage logs (with exact postcodes) to daily allowances, all logged, VAT-checked, and justified by purpose.

- Entertainment: Can’t expense “boozy dinners with old mates.” HMRC wants a clear difference: business-related or not? Expense Hub’s workflows nudge you for this at the point of entry.

- VAT: Claims are valid only with proper digital evidence and storage, linked to MTD for VAT/ITSA digital update requirements.

- Record-Keeping: Digital receipts, categorisation by HMRC tax code, quarterly and annual updates, and no gaps—ever. https://rentalbux.com/blogs/the-best-free-hmrc-approved-mtd-software-in-2025.

Analogies help: Think of HMRC as a picky librarian. She won’t fine you for taking out books (making expenses), but will if you return them with missing pages (lost receipts) or in the wrong section (incorrectly categorised).

How Software Like Expense Hub Turns Rules Into No-Brainers

Here’s where the software earns its fees: all those rules are hardwired into the process. Upload a photo—a receipt is matched to your claim, cross-referenced to current HMRC thresholds and rules, and flagged if there’s a “policy mismatch” (for the uninitiated, that usually means “Oops, you can’t claim that.”). Real-time alerts warn you of missing info before submission.

Still hungry for detail? Check out The Ultimate Guide to Business Expenses for a deeper dive into HMRC’s labyrinth.

The Importance of an Expense Audit Trail HMRC: Preventing Painful Paper Chases (and Penalties)

What the Heck Is an Audit Trail (And Why Should You Care)?

Imagine this: HMRC sends a letter. Auditors want to see three months’ expenses for your team. Are you sweating bullets or leaning back confidently? The difference? An impeccable audit trail—a digital chain showing who claimed what, which manager approved it, where the receipt lives, and when it was all submitted.

Think of an audit trail as your business’s receipts-to-results documentary—no missing frames, no “he said, she said.” It’s the first line of defense against both honest mistakes (lost receipts, forgotten details) and not-so-honest ones (duplicate claims—yes, they happen).

How Expense Hub Makes Your Audit Trail Bulletproof

Expense Hub automates this audit trail—no extra admin required. Each expense claim is:

- Time-stamped (so you know when it was done),

- Linked with receipts and VAT data,

- Tracked with GPS (for mileage verification),

- Logged with approver details.

It’s not just “easier”—it’s safer. You can even e-file claims directly to HMRC if required, minus the panic and paper cuts.

And here’s a cheeky bonus: Expense Hub’s built-in fraud detection is always watching for duplicates or odd patterns. It’s like having a forensic accountant on speed dial, ready to pounce on red flags before the taxman ever does. https://quickbooks.intuit.com/uk/tax-software/.

“Our month-end close used to be a guessing game. Now, if HMRC calls, I just run the audit report, and I’m all buttoned up. No drama.”

– Actual finance manager, post-Expense Hub implementation

Delve deeper into audit trails with our blog on Understanding Compliance in Expense Management.

Expense Compliance UK: Key Challenges and Creative Solutions

Why Most Businesses Struggle (And Yes, Spreadsheets Are Partly to Blame)

Let’s get real—most businesses don’t wake up thinking about expense compliance. They default to patchwork solutions: Excel here, a shoebox of receipts there, and a dash of optimism (“We’ll sort it out at year-end!”). This approach has three giant flaws:

- Manual Errors: Humans miss things—especially when tired or rushed. Spreadsheets don’t block a £50 “working lunch” that was actually last week’s pub quiz.

- MTD Woes: When HMRC updates their digital requirements, your trusty spreadsheet just shrugs. There’s no auto-update for MTD rules.

- Audit Trauma: Missing audit trails and VAT reconciliation invite sleepless nights and possible penalties.

According to the UK Small Business Compliance Guide, most SMEs lose hours monthly patching these holes—and if staff turn over, forget it. The “institutional memory” walks out with them.

How Expense Hub Crushes These Challenges

Expense Hub tackles manual drudgery with automated bank feeds—no more “copy-pasting” statements. Its policy enforcement tools ensure claims are reviewed against your specific HMRC rules before approval, and its UK VAT/mileage calculators guarantee precision even for the fussiest submitter.

Want to grow without drowning in admin chaos? Expense Hub scales with you, integrating with the heavyweights (Xero, Sage, QuickBooks) and keeping records MTD-ready from Day 1. Businesses switching from spreadsheets or generic expense software have slashed completion times and passed HMRC audits with flying colours, see more in Expense Management Software: Why UK Businesses Need Expense Hub.

Still using Excel and scared to make the leap? There’s further hand-holding in How to Ensure Compliance with Business Expenses in the UK.

Features of Expense Hub That Ensure HMRC Compliance (Not Just Hype—Actual Features)

Automated Documentation and Record-Keeping: The Power of AI & OCR

Remember the old days of squinting at faded receipts, typing in the vendor and date? Welcome to the future. Expense Hub uses AI-powered OCR (Optical Character Recognition) technology to:

- Instantly scan, read, and digitise receipts,

- Auto-categorise by HMRC tax code,

- Store everything in secure, cloud-based records (no more lost paper).

Real talk: If you can snap a picture, you can keep perfect records. MTD standards are met as a byproduct—not an afterthought.

Real-Time HMRC Updates and Compliance Alerts: The Taxman on Your Side (Really!)

HMRC rulebooks aren’t printed on stone—they change. Expense Hub keeps its data sources synced to the latest updates. If HMRC tunes VAT rates or tweaks a policy? The software will nudge your finance team with real-time compliance alerts, deadline reminders, and policy breach warnings—before you fall foul of the system.

It’s proactive, not reactive. And if you value your weekends? This is how you keep them.

Curious about what makes great expense software stand out? Check out Top Features to Look for in Expense Management Software.

Case Study: How a Real-World SME Used Expense Hub to Make Compliance a Breeze

From Chaos to Clarity: The Acme Widgets Example

Let me introduce “Acme Widgets Ltd”—a UK-based SME with 45 staff spread across three locations. They’d been limping along with spreadsheets and Google Drive for receipts. Month-end was a scramble, and MTD deadlines loomed like storm clouds over Brighton Pier. Staff cringed at audits, the finance director’s inbox groaned under the weight of emailed PDFs, and VAT returns were a nail-biting, cross-referencing marathon.

Enter Expense Hub.

They onboarded in a single week. Suddenly:

- 80% of expense processing was automated. No more “what is this charge?” emails. Receipts were OCR’d, expenses categorised, VAT rates applied, and all matched in real time.

- MTD VAT submissions integrated with Xero, slashing the admin burden by half. Month-end chaos gave way to routine, predictable close-outs.

- Audit risk dropped: Expense audit trails could be produced in three clicks, and the team no longer feared random HMRC letters.

Results? Finance could focus on forecasting and strategy—not chasing receipts. Staff got reimbursed on time. The company sailed through VAT compliance checks unscathed, saving both time and the odd aspirin. Read more about success stories.

For a guide on mastering business expenses, see Master Business Expenses: Track & Manage for Maximum Profit.

The Smart Choice for Expense Compliance

Let’s cut through the noise: HMRC compliant expense software isn’t a luxury—it’s a business survival tool. The jungle of expense regulation grows thicker every year. Manual methods—or even “digital duct tape” solutions—simply don’t cut it.

Expense Hub flips the script. Automation, live compliance updates, and fool-proof audit trails mean you spend less time worrying about fines, and more time focusing on what matters: growing your business, nurturing your team, and occasionally taking a proper lunch.

You don’t have to cross your fingers at every audit or suffer “HMRC dread.” There’s a smarter way—and thousands of UK businesses are switching.

Ready to Master Your Expenses—Without Breaking a Sweat?

Stop letting compliance rule your business (or your work-life balance). Take Expense Hub for a test drive. Experience pain-free, HMRC-aligned expense management, built for real humans (not robots).

- Streamline your records.

- Slash admin hours.

- Put yourself firmly on the right side of the taxman.

Curious? See Expense Hub in action, or request your demo now.

For more on official HMRC guidelines, visit the UK Government’s Official Guide to HMRC Expense Rules.

—

Compliance made simple. Stress made optional. That’s Profit First, Mike-style—but for your expenses.